Inflation and rising demand for high-end steel additive manufacturing methods helped to spice up industrial 3D printer revenues this previous quarter as unit gross sales fell throughout the globe, in line with the most recent report from market intelligence firm CONTEXT.

Shipments diverse throughout completely different machine courses and industries, whereas inflationary value will increase propped up revenues throughout the gamut, leading to an total whole system income development of 15% on the earlier yr.

Whereas the economic machine phase (these costing upwards of 100,000 USD) noticed shipments fall by -15% (YoY), the class held a 54% majority of the {industry}’s total system income, and noticed revenues rise by 11% (YoY) on account of larger demand for steel 3D printing {hardware}. Powder mattress fusion methods made up 77% of commercial steel shipments, which CONTEXT connects to the demand for extra productive and bigger methods from the likes of Velo3D and SLM Options, and helped to push revenues for industrial PBF methods up by +34%. Different prime performers on this phase included EOS, Eplus3D and GE Additive.

On the different finish of the economic phase, vat photopolymerization machines noticed the sharpest drop with a -33% lower in shipments. UnionTech, which has dominated this phase in earlier quarters when it comes to shipments, reported weak gross sales for its higher-end vat photopolymer methods, and 3D Techniques skilled a drop in gross sales to sure dental markets as client slumped on account of inflationary challenges.

Within the midrange class (printers priced between 20,000–100,000 USD), an 18% (YoY) rise in shipments was spurred on by demand for brand new merchandise resembling Formlabs decrease value SLS know-how. In keeping with CONTEXT’s findings, polymer PBF machines accounted for 17% of all shipments on this class in Q1 2023, in comparison with simply 2% a yr in the past. The second driver on this class was robust home demand throughout a number of end-markets in China for UnionTech’s vat photopolymer DLP choices. CONTEXT additionally famous that rising prices, on account of inflation, have brought on printers that might have in any other case fallen right into a cheaper price class to creep up into the midrange value vary, boosting gross sales right here additional.

Machines within the skilled phase (2,500–20,000 USD) skilled a drop of -30% in shipments however a 21% rise in weighted pricing noticed revenues dip by solely -15% (YoY). The pattern had an impression on the highest 5 distributors on this class aside from UltiMaker, the brand new desktop 3D printing model which emerged after the mix of each Ultimaker and MakerBot companies. This price-class has been dominated by Materials Extrusion and Vat Photopolymerization machines however these applied sciences additionally noticed dips in shipments by -33% and -18% respectively.

Within the decrease value private and equipment & passion classes (<2,500 USD), gross sales had been constructive however helped by improved supply-chain logistics and different elements slightly than elevated demand. Creality continued to steer this phase however newcomer Bambu Lab accelerated to second place after transferring from kickstarter to commercialisation.

“Whereas a lot of the {industry}’s consideration has not too long ago been focussed on Western firm consolidation, distributors like China’s Farsoon have continued the pattern within the Asia–Pacific area of going public by means of extra conventional IPOs”, added Chris Connery, CONTEXT’s head of world evaluation, referring to ongoing M&A exercise dominating the additive manufacturing dialog. “Whereas mergers, acquisitions and public listings usually dominate headlines, such actions don’t sometimes drive demand or market development within the close to time period. Separate from the potential {industry} consolidation, the prospects for 3D printing stay shiny, with demand rising and accelerating, particularly as many corporations are managing to maintain supply-chain challenges and reshoring initiatives at top-of-mind whereas the inside-the-industry machinations play out round them.”

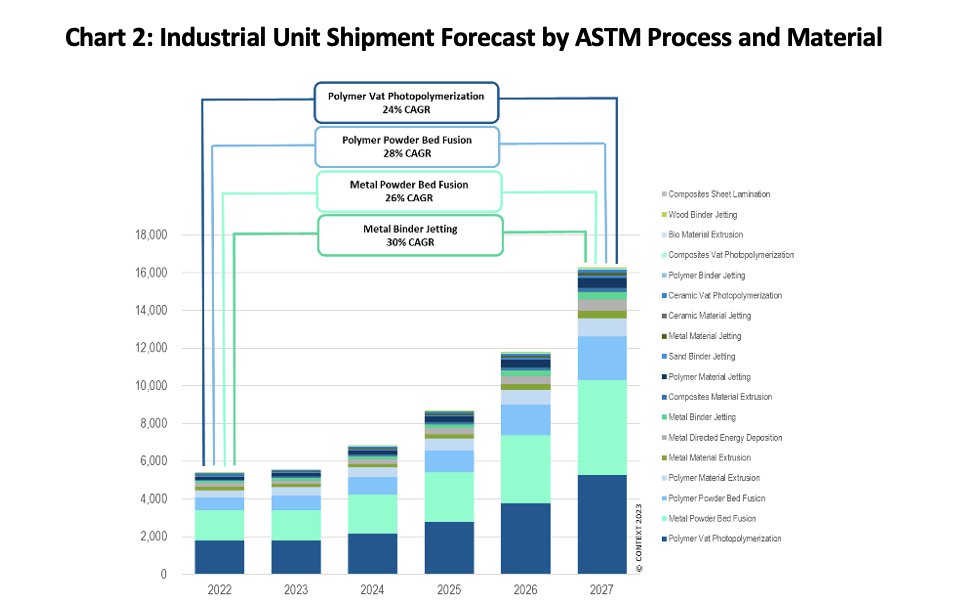

Wanting forward, CONTEXT says steel PBF is on monitor to see a 5-year cargo CAGR of +26%. In the meantime, though forecasts predict that steel binder jetting will stay behind PBF, the projected CAGR by way of to 2027 for this know-how is +30%.