The CFO is the lynchpin of any SaaS enterprise. Armed with the appropriate perception, they’ll form choices and construct methods that drive development and energy success. However first, they have to ask the appropriate questions.

On the coronary heart of each nice SaaS enterprise, you’re virtually assured to discover a educated CFO. Their in-depth understanding and correct forecasts assist different finance capabilities, product improvement, cost managers and the C-suite make the appropriate choices, on the proper time, to safe sustainable development.

It’s a demanding position that entails numerous obligations together with:

- discovering funding to fund development, kick-start tasks and develop merchandise

- forecasting and managing budgets to remain aggressive and worthwhile

- defining and monitoring the metrics that preserve the enterprise on observe

- shaping income methods, pricing fashions and operational efficiencies and outsourcing fashions

- coping with continuously evolving monetary and regulatory compliance.

No shock that CFOs can really feel overwhelmed.

To deal with such an enormous operational burden, CFOs should have the proper assets, capabilities and assist to do the job. As with most fashionable capabilities, information is essential to securing this.

With out the appropriate data, information and metrics, CFOs will battle to handle their firm’s fiscal well being, to scale and direct development. However to assist them focus their efforts and get the solutions they want; they have to first ask the appropriate questions.

Listed below are 7 high line questions that may assist SaaS CFOs win:

1. How is our SaaS enterprise actually performing?

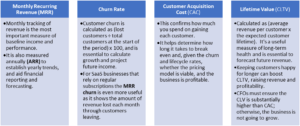

Accountable to the board and stakeholders for monetary efficiency, CFOs should be capable of measure success. For SaaS companies that depend on recurring income this entails trying past revenue and prices to buyer satisfaction and retention. Probably the most helpful metrics for measuring SaaS efficiency are:

2. How can we successfully handle money move in a SaaS enterprise?

Like all companies, SaaS corporations face a continuing battle managing money move. For these which might be venture-capital funded, reaching the stage the place they’re money move constructive is essential to unlocking additional capital for development. To stop liquidity points and keep away from nasty surprises, it’s essential to plan, forecast and continuously monitor revenue and expenditure.

To optimize money move, SaaS CFOs should handle subscriptions and billing effectively. Sluggish handbook processes and reporting points can delay funds, and too many dangerous money owed could cause your cashflow to crash. Shifting to mechanically recurring funds and pre-authorized direct debit assortment is healthier than counting on simply invoices and card funds which customers could overlook to pay. Discovering new clients is pricey and raises prices, so decreasing churn and enhancing buyer retention must also be a precedence for SaaS cashflow administration.

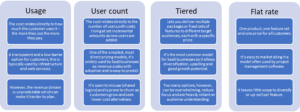

3. What’s the finest pricing mannequin for our SaaS product?

Greater than acquisition and retention, product pricing impacts your backside line – a single determine enhance can create double digit uplift in your income. Understanding what your product is value is as essential as its options and performance. Subscription costs with ongoing buyer funds and sophisticated product packages imply it is advisable to put extra effort into getting pricing proper.

The mannequin you select will rely in your technique – whether or not it’s competitor, worth or function pushed, in addition to your product choices, your viewers/markets and the significance of sustaining a constant income stream.

The 4 commonest SaaS pricing fashions are:

4. How can we forecast income and bills precisely?

Forecasting is the muse to SaaS success. It impacts choices round pricing, advertising and marketing, resourcing and cashflow, and determines growth methods, means to draw finance and funding. It additionally permits SaaS companies to consider threat, and guarantee they’re extra resilient to market change and disruption.

Having clear and correct efficiency information and frequently monitoring exterior in addition to inner tendencies are important to the standard of income and value forecasting. AI powered, predictive analytics, can assist you to extra precisely analyze historic information and market tendencies and create higher extra well timed and knowledgeable income and value forecasts. It could possibly additionally assist to trace efficiency in opposition to forecasts, in lots of circumstances in real-time.

To assist cope with market unpredictability, it’s value together with ‘what if’ state of affairs planning in your forecasts. For instance, the best target-case primarily based on aggressive gross sales assumptions, a conservative base-case utilizing the typical historic tendencies, and a worse-case, if exterior components outdoors your management impacted the enterprise.

5. How can we handle the monetary influence of buyer churn?

Churn is the share fee at which your clients cancel their recurring income subscriptions. Churned clients symbolize misplaced income and development. It’s less expensive to maintain an current buyer than to accumulate a brand new one so churn may also influence profitability. In accordance with some research, it takes twelve months on common for a SaaS enterprise to break-even with the bills for a single buyer – so early churn is actually dangerous for enterprise. It’s additionally why excessive churn charges could be a warning signal for potential buyers.

There are two kinds of churn:

- Voluntary churn, when the consumer chooses to go away, due to poor onboarding, dangerous consumer expertise or buyer assist, failure of answer to ship worth and aggressive strain of a greater deal.

- Involuntary churn when it’s not a aware selection. As an illustration when the shopper’s cost technique has expired, or a cost has been inadvertently declined.

It’s essential to grasp the place and why churn is occurring so you possibly can implement efficient methods to counter it.

Whereas buyer critiques, close-out suggestions and surveys are an essential supply of perception, information is usually unfold throughout a number of capabilities and groups, which may make causes for churn laborious to determine shortly. Having instruments that assist collect information and consolidate information right into a single supply of reality – from what product, what plan, and what options had been getting used, the timelines and speak to paths of each buyer – can assist spot particular tendencies and set off sooner remedial motion. As an illustration utilizing cost declines to set off communications or dunning flows that immediate the consumer to replace their cost technique earlier than the subscription is cancelled.

6. What are the tax implications and issues particular to SaaS corporations?

SaaS companies have distinctive and sophisticated tax issues particularly when promoting digital items cross-border or inter-state. Producing income from inbound gross sales into jurisdictions outdoors your property jurisdiction could have penalties for oblique and direct taxes in addition to payroll tax for distant workers. For instance, from a US gross sales tax perspective, the financial nexus imposes the duty to gather taxes from you digital gross sales, that means that a share must be utilized to the whole worth of merchandise bought, primarily based on the placement of the consumer. Tax planning methods and finest observe are important to make sure compliance, stop monetary publicity and threat. To develop these, it’s essential to have entry to the related gross sales, buying and selling and HR information to have the ability to precisely decide tax standing. You could additionally keep frequently knowledgeable of any adjustments to native and worldwide laws and the way this impacts the enterprise. There are lots of sources on the market that may assist together with eCommerce Taxation guides from 2Checkout – for the and the.

7. How can we optimize our SaaS firm’s monetary operations?

Each perform, from monitoring and measuring to planning and financing, entails complicated processes and is closely reliant on a number of information sources. With the ability to mechanically combination, assimilate and analyze this utilizing AI instruments can scale back effort and time and enhance accuracy and perception. It additionally offers CFOs with higher data to make extra knowledgeable choices, set higher targets and extra exact forecasts.

On the similar time, cost suppliers can present a raft of easy-to-use monetary administration instruments and reporting interfaces that may observe transactions and supply real-time revenue-related metrics in addition to making certain higher safety and simpler compliance.

Getting the solutions you want could rely upon enterprise maturity.

For CFOs in established companies, acquiring the solutions to the above could also be comparatively simple as most of the metrics required will likely be comparatively constant and simple to quantify primarily based on historic tendencies and information.

In case your SaaS enterprise is simply beginning out, they could be a lot more durable to estimate, and extra prone to fluctuate because the enterprise evolves. Benchmarking rivals’ buyer churn charges and lifelong values and making certain your improvement and advertising and marketing prices assist you to keep worthwhile at this similar degree of retention, can assist preserve you on observe.

In each circumstances, CFOs may also faucet into the experience of their monetary administration and funds companions to ascertain reasonable targets in opposition to trade norms. With the appropriate solutions, they’ll be sure they make the most effective choices, from whether or not to outsource, the sort and dimension of useful resource they should obtain their targets and the instruments required to assist their enterprise to develop.