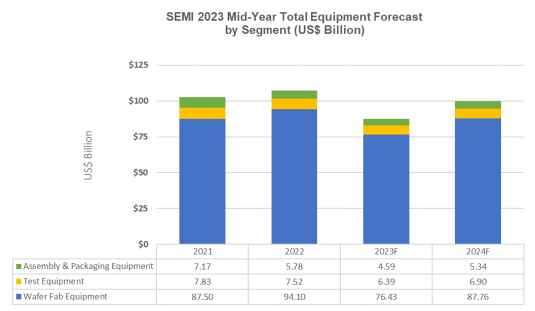

World gross sales of whole semiconductor manufacturing tools by authentic tools producers subsequent yr are forecast to bounce again from a projected contraction of 18.6% to $87.4 billion in 2023 following the {industry} report of $107.4 billion in 2022, SEMI introduced right now in its Mid-Yr Complete Semiconductor Gear Forecast – OEM Perspective at SEMICON West 2023. The anticipated 2024 restoration – to $100 billion – will probably be pushed by each the front-end and back-end segments.

“Regardless of present headwinds, the semiconductor tools market is about to see a robust rebound in 2024 after an adjustment in 2023 following a historic multi-year run,” stated Ajit Manocha, SEMI president and CEO. “Projections for strong long-term development pushed by high-performance computing and ubiquitous connectivity stay intact.”

Semiconductor Gear Gross sales by Phase

Gross sales of wafer fab tools, which incorporates wafer processing, fab services and masks/reticle tools, are projected to lower 18.8% to $76.4 billion in 2023 – greater than the 16.8% decline predicted by SEMI within the 2022 year-end forecast. The wafer fab tools phase is projected to account for the majority of the restoration to $100 billion in 2024, producing $87.8 billion in gross sales, a 14.8% improve.

The 2022 decline in back-end tools phase gross sales is anticipated to proceed in 2023 as a consequence of difficult macroeconomic circumstances and softening semiconductor demand. Semiconductor check tools market gross sales are projected to contract by 15% to $6.4 billion in 2023, whereas meeting and packaging tools gross sales are anticipated to drop by 20.5% to $4.6 billion in the identical yr. Nonetheless, the check tools and meeting and packaging tools segments are anticipated to broaden by 7.9% and 16.4%, respectively, in 2024.

Semiconductor Gear Gross sales by Utility

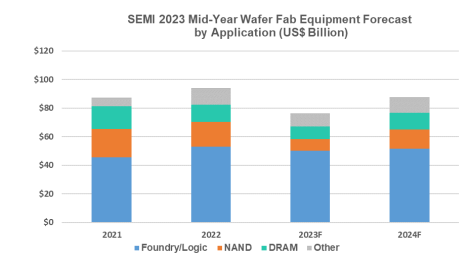

Gear gross sales for foundry and logic functions, accounting for greater than half of whole wafer fab tools receipts, are anticipated to drop 6% year-over-year to $50.1 billion in 2023, reflecting softer end-market circumstances. Demand for modern foundry and logic in 2023 is anticipated to stay steady, with a slight softening balanced out by an increase in spending on mature nodes. Foundry and logic investments are projected to extend 3% in 2024.

DRAM tools gross sales are anticipated to fall 28% to $8.8 billion in 2023 as a consequence of persevering with weak client and enterprise demand for reminiscence and storage however rebound 31% to $11.6 billion in 2024. NAND tools gross sales are projected to lower 51% to $8.4 billion in 2023 and surge 59% to $13.3 billion in 2024.

Semiconductor Gear Gross sales by Area

China, Taiwan and Korea are anticipated to stay the highest three locations for tools spending in 2023 and 2024. Whereas Taiwan is forecast to regain the lead in 2023, China is projected to return to the highest place in 2024. Gear spending for many areas tracked is anticipated to fall in 2023 earlier than returning to development in 2024.

The next outcomes replicate market measurement by phase and utility in billions of U.S. {dollars}:

Supply: SEMI July 2023, Gear Market Knowledge Subscription

* Complete tools consists of new wafer fab, check, and meeting and packaging. Complete tools excludes wafer manufacturing tools. Totals could not add as a consequence of rounding.

The SEMI forecast is predicated on collective enter from high tools suppliers, the SEMI Worldwide Semiconductor Gear Market Statistics (WWSEMS) knowledge assortment program and the industry-recognized SEMI World Fab Forecast database.

The Gear Market Knowledge Subscription (EMDS) from SEMI gives complete market knowledge for the worldwide semiconductor tools market. A subscription consists of three reviews:

- Month-to-month SEMI North American Billings Report, an early perspective of apparatus market tendencies

- Month-to-month Worldwide Semiconductor Gear Market Statistics(WWSEMS), an in depth report of semiconductor tools billings for seven areas and greater than 22 market segments

Bi-annual Complete Semiconductor Gear Forecast – OEM Perspective, an outlook for the semiconductor tools market