Welcome again to The Interchange! If you need this in your inbox, enroll right here. We’re again after a quick hiatus, with numerous fintech information, together with Robinhood’s newest acquisition, Plaid’s latest product and a ChatGPT-powered AI software that goals that can assist you get monetary savings on payments.

Robinhood’s motives

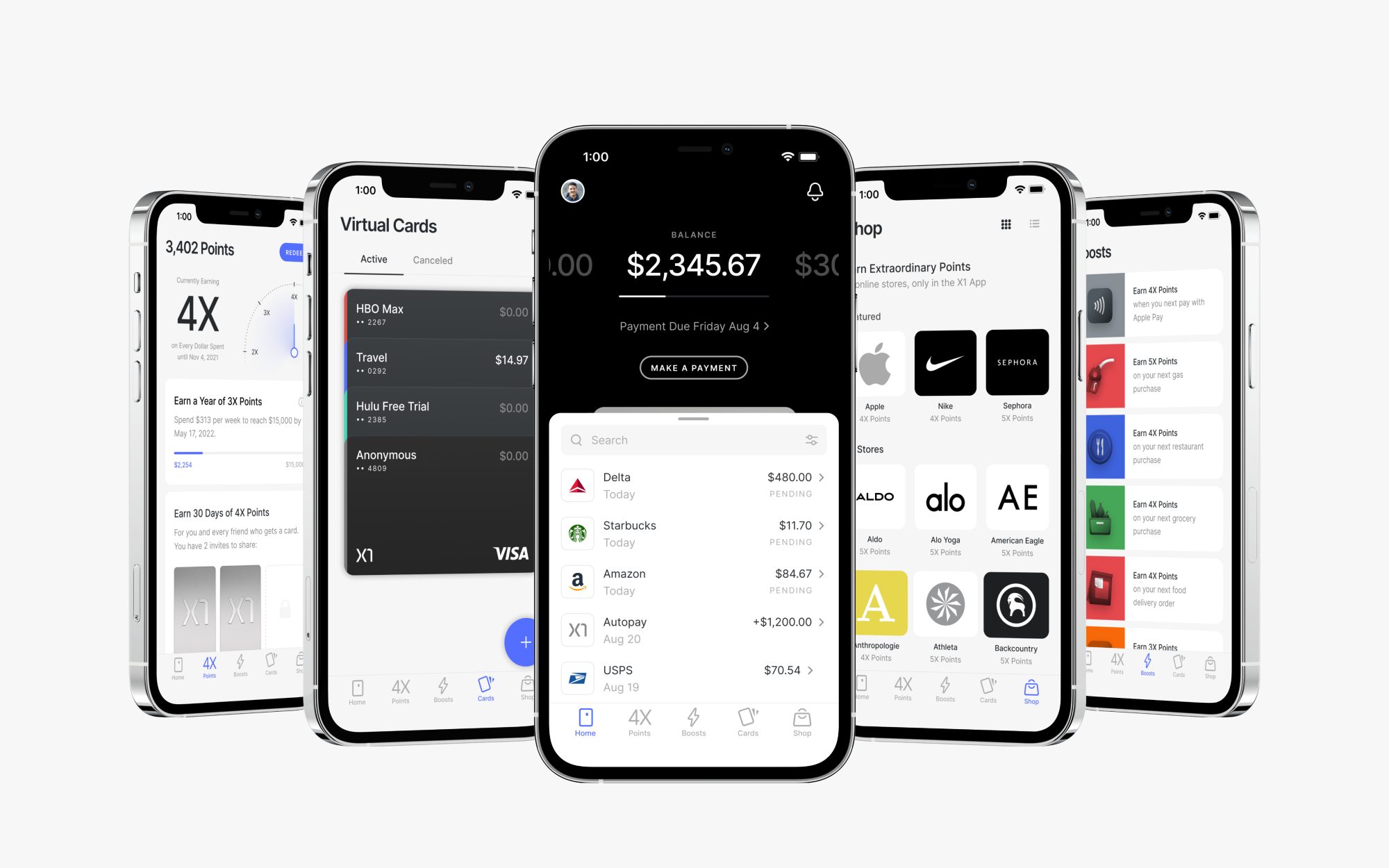

When Robinhood introduced on June 22 that it was buying bank card startup X1 for $95 million, it brought on all kinds of chatter within the fintech world.

Why would Robinhood wish to purchase a bank card startup? Did it get a superb deal, contemplating that X1 has raised solely $62 million over its lifetime? Did its traders get a superb deal or only a return on their funding? Why X1 particularly over the numerous different bank card startups on the market?

Let’s discuss that final level first.

Once we talked to X1 in December on the time of its final fundraise, founder and CEO Deepak Rao instructed us the corporate was launching a brand new buying and selling platform that might give its cardholders the power to purchase shares through the use of earned reward factors. He even singled out Robinhood as an organization he hoped to compete with, telling TechCrunch: “Through the use of bank card factors to purchase inventory as an alternative of money or their financial savings, we really feel this can be a secure method for a lot of customers to start out investing. There is no such thing as a actual draw back as their investing is technically free.”

Aha.

May that be what drew Robinhood to X1??

On this week’s Fairness podcast, we chatted about that risk, with co-host Alex Wilhelm noting that one must earn a number of rewards earlier than with the ability to purchase many shares. He additionally identified that Robinhood maybe had some cash to burn, in addition to the corporate declaring that it was on the lookout for one thing new as a method of “broadening [its] product choices” and “deepening” its relationship with current clients.

In the event you’ve been following Robinhood’s efficiency over the previous 12 months, a need to diversify its enterprise might be not a shock. We famous that not solely has Robinhood’s crypto buying and selling slowed, but additionally the corporate has seen vital consumer attrition. So an X1 acquisition will get Robinhood into the bank card area and an extra income stream.

Nonetheless, one observer famous that whereas X1’s fundamental premise of providing credit score based mostly on revenue slightly than credit score rating was modern, because it first shaped in 2020 it has not likely since delivered something — apart from the brand new inventory characteristic — that stands out available in the market.

Fintech analyst Alex Johnson shared an identical sentiment, tweeting: “The model alignment is powerful. Each corporations have a sure unearned machismo about them. Aside from that although, I don’t get this for Robinhood. X1 doesn’t have a number of clients (did it ever even totally launch?) and none of its options are revolutionary.”

It’s true that X1 could not have had a number of clients, particularly compared to an enormous like Robinhood, however the firm claimed to be on a progress trajectory, with Rao telling us final December that the corporate noticed $3 million a month in income final October, giving it an annual income price of $36 million.

Not everyone seems to be down on the deal, although. Higher Tomorrow Ventures’ Sheel Mohnot tweeted that whereas X1 could not have a number of clients, Robinhood does. He added: “[T]his looks like a superb acquisition to me, cheaper to cross-sell than to promote to new clients.”

— Mary Ann and Christine

Picture Credit: X1

Weekly Information

Fintech startup Plaid obtained its begin as an organization that connects client financial institution accounts to monetary purposes however has since been steadily increasing its choices to supply extra of a full-stack onboarding expertise. And on June 22, Plaid introduced much more new product releases that moved the corporate into an entire new path whereas additionally serving to to diversify its income streams. On the prime of that lies Beacon, which it’s describing as a “collaborative anti-fraud community enabling monetary establishments and fintech corporations to share vital fraud intelligence through API throughout Plaid.” Extra right here.

Navan (previously TripActions) presents each a company card and a subscription to its software program. In a twist, the corporate introduced on June 12 the launch of a brand new product referred to as Navan Join, which it describes as a patented card-link know-how that provides companies a strategy to provide automated expense administration and reconciliation with out having to vary their company card supplier. For the preliminary launch, Navan has partnered with Mastercard and Visa, with plans to announce extra community tie-ups within the close to future. Extra right here.

Spend administration startup Brex was named to Time’s 100 Most Influential Corporations listing. Because it made the popularity, Time wrote: “Co-CEO Henrique Dubugras says consider Brex as a ‘spend platform.’ The corporate launched its company cost card for startups 5 years in the past, and has since grown right into a fintech conqueror. Valued at $12.3 billion in 2022, it has made 10 acquisitions, and after Silicon Valley Financial institution’s collapse, it obtained $2 billion in deposits and opened 4,000 new accounts. Final 12 months Brex launched Empower, software program that hyperlinks Brex playing cards and accounts to a customized expense-administration service. The corporate providers startups, serving to new companies get off the bottom, in addition to enterprise purchasers, together with DoorDash, Certainly, Coinbase, SeatGeek, and Lemonade.”

Brubank, an Argentina-based digital financial institution based by former Citibank government Juan Bruchou, shared with TechCrunch that since launching in 2019, it has introduced in practically 3 million purchasers, making Brubank “the biggest Spanish-speaking digital financial institution in Latin America, with a 50% exercise price,” in keeping with the corporate. It additionally has been sustaining backside line profitability for the previous 12 months.

At the least two corporations are poised for a bank card launch this summer time: Snowfoll, one in every of three startups that pitched at TC Early Stage Boston in April, will launch a bank card in July that’s tailor-made to customers within the U.S. and India to allow them to extra simply transmit money cross-border. The corporate stated customers within the U.S. are eligible for limits as excessive as $30,000, and the cardboard reduces the necessity for having separate financial institution accounts within the U.S. and India. As well as, the method is instantaneous and cost-free. In the meantime, Step, the monetary platform tailor-made to teenagers, their households and younger adults, opened up a waitlist for its newest card, Step Black Card. Cardholders shall be eligible for perks, together with incomes 5% on financial savings balances as much as $1 million and as much as 8x the factors on purchases. Learn TechCrunch protection on Step right here and right here.

Different headlines

This ChatGPT-powered AI software will help you haggle to economize on payments

PayEm integrates spend administration and procurement platform with American Categorical

Stripe launches funds for bookings in Google Calendar

Transactions: Residents selects embedded funds supplier Wisetack

Amsterdam’s fintech unicorn Adyen companions with Shopify to strengthen its commerce capabilities

Visa launches fintech accelerator in Africa

TTV Capital continues buildout with hiring of ex-World Funds CFO

Funding and M&A

Seen on TechCrunch

Volt, an open banking fintech for funds and extra, raises $60M at a $350M+ valuation

Heard Applied sciences grabs one other $15M to develop therapist accounting instruments

Nasdaq to accumulate monetary providers software program firm Adenza from Thoma Bravo for $10.5B

With Equifax in its sights, TransUnion invests $24M in revenue verification platform Truework

Finfra lets Indonesian companies add embedded finance to their platform

And elsewhere

Dallas-based Yendo raises $24M in Sequence A funding

Fintech agency Rho in talks to purchase startup previously often called Social gathering Spherical

Automotive-insurance agency Root will get takeover bid (Curiously, the corporate’s inventory obtained an enormous increase when the information got here out, spiking from a gap value of $5.92 per share to shut at $12.62 that day.)

Neo-lender Gulp Knowledge secures $25m, bringing data-backed loans to startups

Alternativ raises $10 million as digitally native RIAs decide up steam

Fortis expands to Canada, provides charge assortment characteristic, acquires SmartPay

Be a part of us at TechCrunch Disrupt 2023 in San Francisco this September as we discover the impression of fintech on our world in the present day. New this 12 months, we may have an entire day devoted to all issues fintech, that includes a few of in the present day’s main fintech figures. Save as much as $600 if you purchase your go now by August 11, and save 15% on prime of that with promo code INTERCHANGE. Study extra.

Be a part of us at TechCrunch Disrupt 2023 in San Francisco this September as we discover the impression of fintech on our world in the present day. New this 12 months, we may have an entire day devoted to all issues fintech, that includes a few of in the present day’s main fintech figures. Save as much as $600 if you purchase your go now by August 11, and save 15% on prime of that with promo code INTERCHANGE. Study extra.

Picture Credit: Bryce Durbin