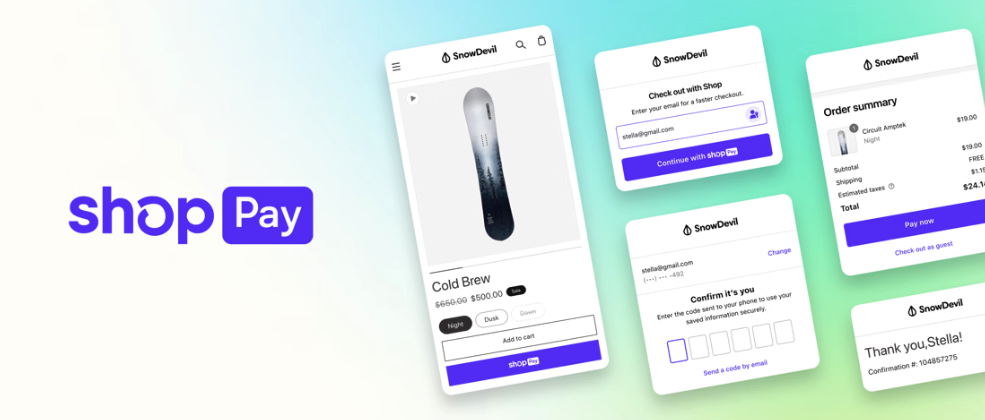

Store Pay is a function that helps save time throughout checkout by permitting prospects to save lots of their electronic mail deal with, bank card data, and transport and billing data in order that they don’t need to re-enter it the subsequent time they make a purchase order.

That is being made doable via the corporate’s Commerce Elements by Shopify, which launched earlier this yr. It offers retailers not on Shopify entry to Shopify elements like Shopify Funds, ShopifyQL, and Liquid, which is a low-code language for creating storefronts.

Based on Shopify, Store Pay boosts conversion by as much as 50% in comparison with visitor checkout, which is 10% greater than different accelerated checkout choices.

“Enterprises that don’t benefit from Store Pay are self-sabotaging. They’re leaving cash on the desk,” stated Kaz Nejatian, VP of product and chief working officer of Shopify. “That is crucial optionality in a hyper aggressive retail atmosphere. In an financial system the place massive manufacturers are competing extra fiercely than ever to accumulate prospects, they should decide and select what they should increase the top-line, with out the compromise of a whole platform overhaul.”

Along with the Store Pay information, the corporate additionally revealed it’s bettering its integration with Adyen, which is a web-based fee firm. Adyen permits Shopify storefronts to simply accept quite a lot of funds, together with bank cards; digital wallets like Apple Pay and Google Pay; and worldwide fee strategies equivalent to iDEAL within the Netherlands (the place Adyen relies) and Cartes Bancaires in France.