Introduction

Comprehending and unleashing the intricate affinities amongst variables within the expansive realm of statistics is integral.

Every part from data-driven decision-making to scientific discoveries to predictive modeling is determined by our potential to disentangle the hidden connections and patterns inside advanced datasets. Amongst numerous statistical requirements supporting this pursuit, covariance and correlation are essential, rendering insights into the independencies between variables.

Covariance and correlation are incessantly occurring variables in statistical evaluation, but individuals typically misunderstand or use them interchangeably. The delicate nuances differentiating these two requirements can profoundly influence our interpretation and utilization of statistical relationships.

Due to this fact, understanding the true nature of Covariance and correlation is paramount for any knowledge fanatic or skilled striving to unveil the complete potential of their knowledge.

This blog- covariance vs correlation- will focus on the variations between these two statistical ideas and demystify their relationship.

Additionally, gasoline your knowledge science profession by upgrading your expertise with Analytics Vidhya’s Study Swift for Knowledge Science course.

Covariance

It’s a statistical time period demonstrating a scientific affiliation between two random variables, the place the change within the different mirrors the change in a single variable.

Definition and Calculation of Covariance

Covariance implies whether or not the 2 variables are instantly or inversely proportional.

The covariance system determines knowledge factors in a dataset from their common worth. As an example, you’ll be able to compute the Covariance between two random variables, X and Y, utilizing the next system:

Within the above process,

Decoding Covariance Values

Covariance values point out the magnitude and path (optimistic or destructive) of the connection between variables. The covariance values vary from -∞ to +∞. The optimistic worth implies a optimistic relationship, whereas the destructive worth represents a destructive relationship.

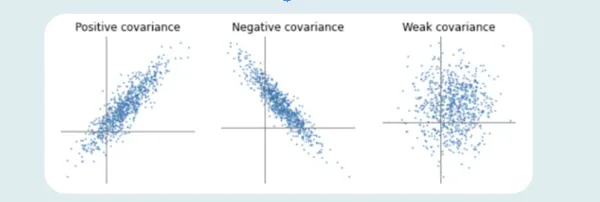

Constructive, Adverse, and Zero Covariance

The upper the quantity, the extra reliant the connection between the variables. Let’s comprehend every variance sort individually:

Constructive Covariance

If the connection between the 2 variables is a optimistic covariance, they’re progressing in the identical path. It represents a direct relationship between the variables. Therefore, the variables will behave equally.

The connection between the variables shall be optimistic Covariance provided that the values of 1 variable (smaller or extra vital) are equal to the significance of one other variable.

Adverse Covariance

A destructive quantity represents destructive Covariance between two random variables. It implies that the variables will share an inverse relationship. In destructive Covariance, the variables transfer in the wrong way.

In distinction to the optimistic Covariance, the better of 1 variable correspond to the smaller worth of one other variable and vice versa.

Zero Covariance

Zero Covariance signifies no relationship between two variables.

Significance of Covariance in Assessing Linear Relationship

Covariance is important in figuring out the linear relationship between variables. It suggests the path (destructive or optimistic) and magnitude of the connection between variables.

A better covariance worth signifies a robust linear relationship between the variables, whereas a zero covariance suggests no ties.

Limitations and Issues of Covariance

The scales of measurements affect the Covariance and are extremely affected by outliers. Covariance is restricted to measuring solely the linear relationships and doesn’t apprehend the path or energy.

Furthermore, evaluating covariances throughout numerous datasets demand warning on account of totally different variable ranges.

Correlation

Not like Covariance, correlation tells us the path and energy of the connection between a number of variables. Correlation assesses the extent to which two or extra random variables progress in sequence.

Definition and Calculation of Correlation Coefficient

Correlation is a statistical idea figuring out the connection efficiency of two numerical variables. Whereas deducing the relation between variables, we conclude the change in a single variable that impacts a distinction in one other.

When a similar motion of one other variable reciprocates the development of 1 variable in some method or one other all through the research of two variables, the variables are correlated.

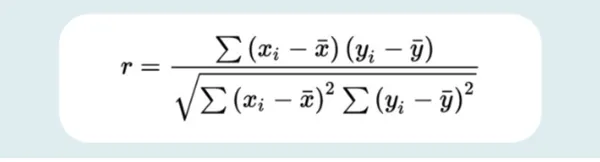

The system for calculating the correlation coefficient is as follows:

The place,

Decoding Correlation Values

There are three sorts of correlation primarily based on numerous values. Adverse correlation, optimistic correlation, and no or zero correlation.

Constructive, Adverse, and Zero Correlation

If the variables are instantly proportional to at least one one other, the 2 variables are stated to carry a optimistic correlation. This means that if one variable’s worth rises, the opposite’s worth will exceed. A super optimistic correlation possesses a worth of 1.

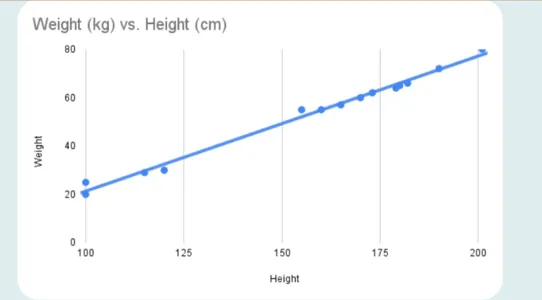

Right here’s what a optimistic correlation seems to be like:

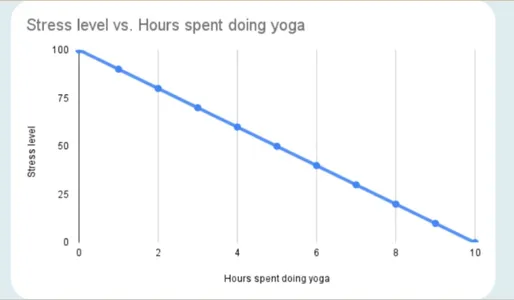

In a destructive correlation, one variable’s worth will increase whereas the second’s worth decreases. An ideal destructive correlation has a worth of -1.

The destructive correlation seems as follows:

Identical to within the case of Covariance, a zero correlation means no relation between the variables. Due to this fact, whether or not one variable will increase or decreases received’t have an effect on the opposite variable.

Power and Course of Correlation

Correlation assesses the path and energy of a linear relationship between a number of variables. The correlation coefficient varies from -1 to 1, with values close to -1 or 1 implying a excessive affiliation (destructive or optimistic, respectively) and values close to 0 suggesting a weak or no correlation.

Pearson Correlation Coefficient and Its Properties

The Pearson correlation coefficient (r) measures the linear connection between two variables. The properties of the Pearson correlation coefficient embrace the next:

- Power: The coefficient’s absolute worth signifies the connection’s energy. The nearer the worth of the coefficient is to 1, the stronger the correlation between variables. Nevertheless, a worth nearer to 0 represents a weaker affiliation.

- Course: The coefficient’s signal denotes the path of the connection. If the worth is optimistic, there’s a optimistic correlation between the 2 variables, which implies that if one variable rises, the opposite may also rise. If the worth is destructive, there’s a destructive correlation, which means that when one variable will increase, the opposite will fall.

- Vary: The coefficient’s content material varies from -1 to 1. The proper linear relationship is represented by a number of -1, the absence of a linear relationship is represented by 0, and a great linear relationship is denoted by a worth of 1.

- Independence: The Pearson correlation coefficient quantifies how linearly dependent two variables are however doesn’t suggest causality. There isn’t a assure {that a} sturdy correlation signifies a cause-and-effect connection.

- Linearity: The Pearson correlation coefficient solely assesses linear relationships between variables. The coefficient could possibly be inadequate to explain non-linear connections absolutely.

- Sensitivity to Outliers: Outliers within the knowledge would possibly affect the correlation coefficient’s worth, thereby boosting or deflating its dimension.

If you would like hands-on expertise engaged on Knowledge Science initiatives, discover a complete program by Analytics Vidhya on Prime Knowledge Science Tasks for Analysts and Knowledge Scientists.

Different Forms of Correlation Coefficients

Different correlation coefficients are:

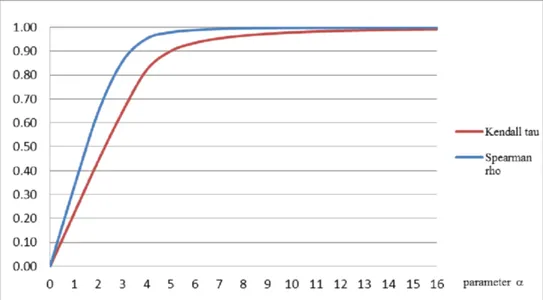

- Spearman’s Rank Correlation: It’s a nonparametric indicator of rank correlation or the statistical dependency between the ranks of two variables. It evaluates how successfully a monotonic perform can seize the connection between two variables.

- Kendall Rank Correlation: A statistic determines the ordinal relationship between two measured values. It represents the similarity of the info orderings when ordered by every amount, which is a measure of rank correlation.

A picture of an anti-symmetric household of copulas’ Spearman rank correlation and Kendall’s tau are inherently odd parameter features.

Benefits and Disadvantages of Covariance

Following are the benefits and downsides of Covariance:

Benefits

- Straightforward to Calculate: Calculating covariance doesn’t require any assumptions of the underlying knowledge distribution. Therefore, it’s straightforward to calculate covariance with the system given above.

- Apprehends Relationship: Covariance gauges the extent of linear affiliation between variables, furnishing details about the connection’s magnitude and path (optimistic or destructive).

- Useful in Portfolio Evaluation: Covariance is often employed in portfolio evaluation to judge the diversification benefits of integrating totally different property.

Disadvantages

- Restricted to Linear Relationships: Covariance solely gauges linear relationships between variables and doesn’t seize non-linear associations.

- Doesn’t Provide Relationship Magnitude: Covariance doesn’t supply a standardized estimation of the depth or energy of the connection between variables.

- Scale Dependency: Covariance is affected by the variables’ measurement scales, making evaluating covariances throughout numerous datasets or variables with distinct items difficult.

Benefits and Disadvantages of Correlation

The benefits and downsides of correlation are as follows:

Benefits

- Figuring out Non-Linear Relationships: Whereas correlation primarily estimates linear relationships, it could actually additionally exhibit the presence of non-linear connections, particularly when utilizing various correlation requirements like Spearman’s rank correlation coefficient.

- Standardized Criterion: Correlation coefficients, such because the Pearson correlation coefficient, are standardized, various from -1 to 1. This enables for straightforward comparability and interpretation of the path and energy of relationships throughout totally different datasets.

- Robustness to Outliers: Correlation coefficients are sometimes much less delicate to outliers than Covariance, delivering a stronger normal of the affiliation between variables.

- Scale Independencies: Correlation will not be affected by the measurement scales, making it handy for evaluating affinities between variables with distinct items or scales.

Disadvantages

- Pushed by Excessive Values: Excessive values can nonetheless have an effect on the correlation coefficient, despite the fact that it’s much less vulnerable to outliers than Covariance.

- Knowledge Necessities: Correlation assumes that the info is distributed in line with a bivariate regular distribution, which can not at all times be correct.

- Restricted to Bivariate Evaluation: As a result of correlation solely examines the connection between two variables concurrently, it could actually solely seize easy multivariate correlations.

Similarities between Covariance and Correlation

Covariance vs correlation certain has a number of variations, however they’ve similarities too. Among the similarities are as follows:

Indicators of the Relationship between Variables

Correlation and Covariance each gauge simply the linear relationship between variables. This means that if the correlation coefficient is zero, so will the Covariance. Even the change in location doesn’t have an effect on the correlation and covariance requirements.

The Measure of Linear Affiliation

Each Covariance and correlation are measures used to evaluate the connection between variables. They provide readability on how variables are linked to at least one one other.

Calculations Utilizing the Similar Variables

The calculation of Covariance and correlation each require the identical set of variables. They want

Covariance and correlation calculations contain the identical set of variables. They require paired observations of the variables of curiosity to find out their relationship.

Nevertheless, if it’s about selecting between Covariance and correlation to reckon the connection between variables, specialists at all times desire correlation over Covariance as a result of the change in scale doesn’t have an effect on correlation.

Variations between Covariance and Correlation

Whereas each of them are statistical phrases, Covariance and correlation differ from one another on numerous grounds.

Interpretation and Scale of Values

The change in scale modifications the worth of Covariance. A better quantity in Covariance means larger dependency. Decoding Covariance is troublesome.

Quite the opposite, the correlation worth stays unaffected by the change in scale. The correlation coefficients vary from -1 to 1, which permits for a extra easy interpretation, in contrast to Covariance.

Relationship to the Models of Measurement

The variables’ measurement items have an effect on Covariance, making evaluating covariance values throughout numerous datasets or variables with totally different items difficult.

Then again, correlation coefficients don’t have any items and don’t depend on the items of measurement, permitting comparisons between variables with numerous items.

Standardization and Comparability Throughout Datasets

Since Covariance doesn’t have standardization, evaluating covariances throughout numerous datasets is difficult. Whereas correlation coefficients are standardized. Due to this fact, evaluating it instantly throughout variables, datasets, or contexts is straightforward.

Robustness to Outliers

Outlier massively impacts the worth of Covariance. Therefore, it’s delicate to the presence of outliers. Quite the opposite, correlation coefficients supply a extra sturdy normal of the connection between variables, as correlation coefficients are much less vulnerable to outliers.

Utilization in Totally different Contexts and Purposes

Covariance has functions within the following:

- Biology — Molecular and Genetics to gauge particular DNAs.

- Estimating the invested quantity on totally different property in monetary markets.

- Amassing knowledge procured from oceanographic/astronomical research to conclude.

- Analyzing a dataset with logical implications of the principal factor.

- Learning indicators obtained in numerous kinds.

Then again, the correlation has the next functions:

- Employed in sample recognition

- Measures the connection between poverty and inhabitants

- Analyzes temperature rise throughout summer time v/s water consumption amongst relations

- Estimates the time vs. cash a buyer has spent on an internet e-commerce web site

- Compares the previous climate forecast experiences to the present yr.

To summarize the variations, right here’s a desk you will need to look by:

| Distinction Grounds | Covariance | Correlation |

| That means | Covariance means two variables instantly or inversely rely on each other. | Two variables are stated to be in correlation if the change in a single impacts the opposite variable. |

| Values | Lie between -infinity to +infinity | Values lie between -1 to 1 |

| Unit | It’s a product of the unit of variables | It’s a unit-free measure |

| Change in Scale | Even minor modifications in scale have an effect on Covariance | There received’t be any change in correlation due to the dimensions |

| Measure of | Correlation | The scaled model of Covariance |

| Utility | Market Analysis, Portfolio Evaluation, and Danger Help | Medical Analysis, Knowledge Evaluation, and Forecasting |

Use Circumstances and Examples

Given beneath are some sensible functions and examples of Covariance vs Correlation:

Sensible Situations The place Covariance is Helpful

There are three sensible situations the place Covariance proves useful:

- Market Analysis: Covariance is employed in market analysis for analyzing the hyperlink between variables, resembling gross sales income and promoting expenditure, to understand the affect of selling endeavors on enterprise outcomes.

- Danger Evaluation: Covariance helps in threat administration and threat evaluation. As an example, in insurance coverage, Covariance will help determine the affiliation between distinct variables (resembling claims frequency, well being circumstances, and age) to evaluate potential losses and set acceptable premiums.

- Portfolio Evaluation: Covariance has a profound software in finance for evaluating the connection between totally different asset returns inside a portfolio. A optimistic covariance implies that the property will transfer in the identical path, whereas a destructive one signifies that they are going to go in reverse instructions. Such data is useful in portfolio diversification for managing threat.

Sensible Situations The place Correlation is Helpful

Some sensible instances of correlation embrace forecasting, knowledge evaluation, and medical analysis.

- Forecasting: Correlations help forecasters in figuring out the diploma to which they’ll predict one variable primarily based on the values of one other variable. For instance, correlation in gross sales forecasting will be useful in foretelling future gross sales primarily based on earlier gross sales data.

- Evaluation of Knowledge: Knowledge lovers use correlation popularly to quantify and determine relationships between variables. As an example, in social sciences, correlation will help decide the hyperlink between variables like training degree or earnings or between productiveness and job satisfaction.

- Medical Analysis: In medical analysis, correlations assist discover associations between variables, just like the correlation between lung most cancers and smoking or the correlation between the danger of cardiovascular illnesses and the BMI (physique mass index).

Actual-World Examples and Purposes of Covariance and Correlation

Whereas the functions of Covariance and correlation have been described above, some real-world examples of the identical are as follows:

Covariances are used extensively in finance and present-day portfolio principle. As an example, the Covariance between safety and the market are utilized within the calculation for one of many mannequin’s key variables, beta, within the capital asset pricing mannequin (CAPM), which determines the anticipated return on an asset.

Within the CAPM, beta quantifies an asset’s volatility, or systematic threat, in comparison with the entire market; it’s a useful metric that makes use of Covariance to find out an investor’s threat publicity specific to at least one funding.

Examples of Correlation embrace the time spent operating vs. the physique fats. The extra time an individual spends jogging, the much less physique fats they’ve. In different phrases, a destructive relationship exists between variable operating time and variable physique fats. Physique fats lowers as operating time rises.

One other occasion consists of physique weight vs. peak. The connection between a person’s dimension and weight is normally upbeat. In different phrases, those that are taller are inclined to weigh extra.

Factors to Think about Whereas Selecting Between Covariance and Correlation

Earlier than concluding or selecting Covariance or correlation, you will need to preserve the next into consideration:

1. Issues for the Analysis Query or Goal

Focus in your necessities. No matter you select should go together with the precise goal or analysis query. In case you purpose to estimate the path and energy of the linear affiliation between variables, then deciding on the correlation shall be clever. Nevertheless, should you want to measure the extent of a relationship with none interpretation, go for Covariance.

2. Nature of the Variables and Underlying Assumptions

The following level to think about is the character of the variables you’re analyzing and the assumptions for every measure. The Correlation has no unit; it’s unitless and embraces a linear affiliation between variables. Nevertheless, Covariance focuses on the essential items and is delicate to the dimensions.

3. Availability of Knowledge and Measurement Scale

Don’t forget to evaluate the variable’s measurement scale and the obtainable knowledge. Whereas Covariance calls for paired observations of the variables, the correlation wants the same and bivariate normality assumption.

4. Significance of Standardized Interpretation or Comparability

You will need to analyze the necessity for comparability or standardized interpretation throughout numerous variables or units of knowledge. If the comparability is important, the standardized vary of correlation varies from -1 to 1, permitting for easy comparability and interpretation.

5. Applicability within the Particular Evaluation or Area

You will need to select a selected evaluation or area of analysis. Whereas Covariance is relevant in market analysis, threat evaluation, and finance, correlation is employed in forecasting, knowledge evaluation, and social sciences.

Conclusion

Understanding the variations between Covariance and correlation is important. Covariance measures the diploma of linear relationship, whereas correlation affords a standardized measurement that additionally considers the path and energy of the connection.

Covariance vs correlation has a number of grounds for differentiation, resembling standardization, interpretation, scale, sensitivity to outliers, and functions in numerous phrases. Whereas they differ considerably, they do share some similarities as nicely. They’re indicators of the connection between variables and measures of linear affiliation.

Selecting an acceptable measure is essential. It must be primarily based on particular necessities and the context of the evaluation. Covariance is helpful in market analysis, threat evaluation, portfolio evaluation, and extra. In distinction, correlation is useful in medical analysis, forecasting, knowledge evaluation, and different areas.

Why not do it with specialists if you wish to speed up your profession? Discover Analytics Vidhya’s Knowledge Science Hacks, Suggestions, and Methods course to sharpen your knowledge science expertise and seize a rewarding profession as an information scientist.

Ceaselessly Requested Questions

A. A optimistic covariance implies that two variables are shifting in the identical path. It signifies a direct hyperlink between the variables. It means if the worth of 1 variable is extra glorious, the worth of one other variable may also be related.

A. The destructive Covariance means that the variables will share an inverse relationship. In destructive Covariance, the variables progress in the wrong way. This additionally implies that if one worth has an above-average worth, the opposite could have a below-average worth.

A. The correlation coefficient of 1 means a great optimistic linear relationship between the variables. It means that if one variable will increase, one other one may also enhance.

A. A correlation coefficient of 0 suggests no linear affiliation between the variables. It implies that even when one variable modifications, one other will stay unaffected.

A. Covariance and correlation matrices supply insights into the relationships between numerous variables in an information set.