A brand new report from CONTEXT highlights combined outcomes for Q1 2023 throughout the 3D printing business, with consideration being drawn to mergers and acquisitions (M&A) amidst inflation and growing demand for high-end programs. Corporations are vying to determine the world’s first $1B+ 3D printing firm, with development in product shipments various throughout sectors. Regardless of the fluctuation in unit cargo development, system revenues have risen attributable to inflationary worth will increase and a shift in demand in direction of higher-end steel programs.

Three of the world’s largest 3D printing firms, Stratasys, 3D Programs, and Desktop Metallic, have been within the highlight, with Stratasys on the heart of M&A actions. Stratasys was set to merge with Desktop Metallic till newer occasions this week known as this plan of action into query. CONTEXT states, “continued gives from 3D Programs, and from nascent participant Nano Dimension, depart the business guessing.

World shipments of latest additive manufacturing programs within the Industrial and Skilled worth lessons have declined year-on-year (YoY) by −15% and −30% respectively in Q1 2023. Nonetheless, the Midrange, Private, and Equipment & Interest classes have seen an increase in shipments by 18%, 34%, and 29% YoY respectively. Regardless of the decline in some classes, revenues from system shipments have elevated, resulting in an total whole system income development of 15% on the earlier yr.

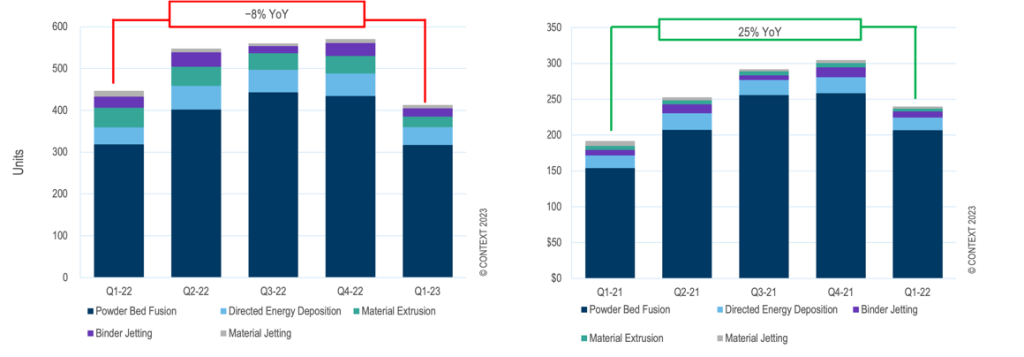

The YoY fall in international shipments of Industrial 3D printers, which account for 54% of whole system revenues, is primarily attributable to weaker gross sales of polymer programs. Nonetheless, this didn’t have an effect on revenues, which noticed an 11% YoY rise pushed by rising demand for higher-efficiency steel machines. The most important phase, vat photopolymerization, noticed the sharpest drop in gross sales, with a decline of 33% throughout most geographies.

Industrial steel 3D printers have carried out higher, with revenues rising 25% YoY in Q1 2023 regardless of a lower in unit gross sales by 8%. Powder mattress fusion (PBF) printers accounted for 77% of steel system shipments, with revenues for Industrial PBF programs rising by 34%. This development was pushed by firms like Velo3D and SLM Options, which supply sought-after multi-laser, giant build-volume machines.

The 18% YoY development in unit shipments of Midrange 3D printers was pushed by new merchandise and powerful home demand in China. Formlabs’ polymer PBF Fuse line and UnionTech’s vat photopolymer DLP choices had been vital contributors to this development. Nonetheless, shipments of Skilled 3D printers dropped considerably in Q1 2023, down by 30% YoY, though revenues fell solely by 15% YoY because the weighted pricing rose 21% to $7,271.

Regardless of glorious gross sales of lower-end, consumer-centric Private and Equipment & Interest printers in Q1 2023, full-year development expectations for the class stay subdued. That is attributed extra to improved supply-chain logistics than to new demand. Nonetheless, Bambu Lab has seen improbable demand, permitting them to maneuver from crowdfunding into mainstream commercialization, securing the quantity two international market share place within the quarter. Creality is ranked at primary.

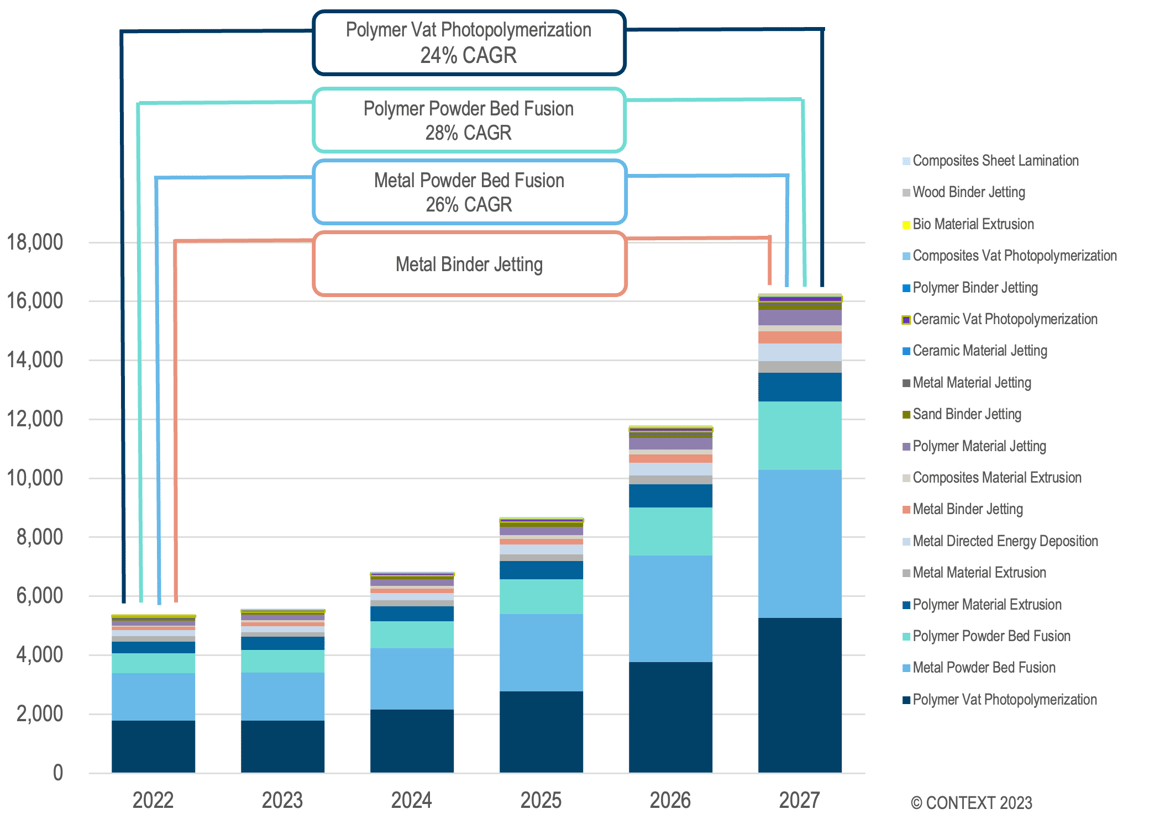

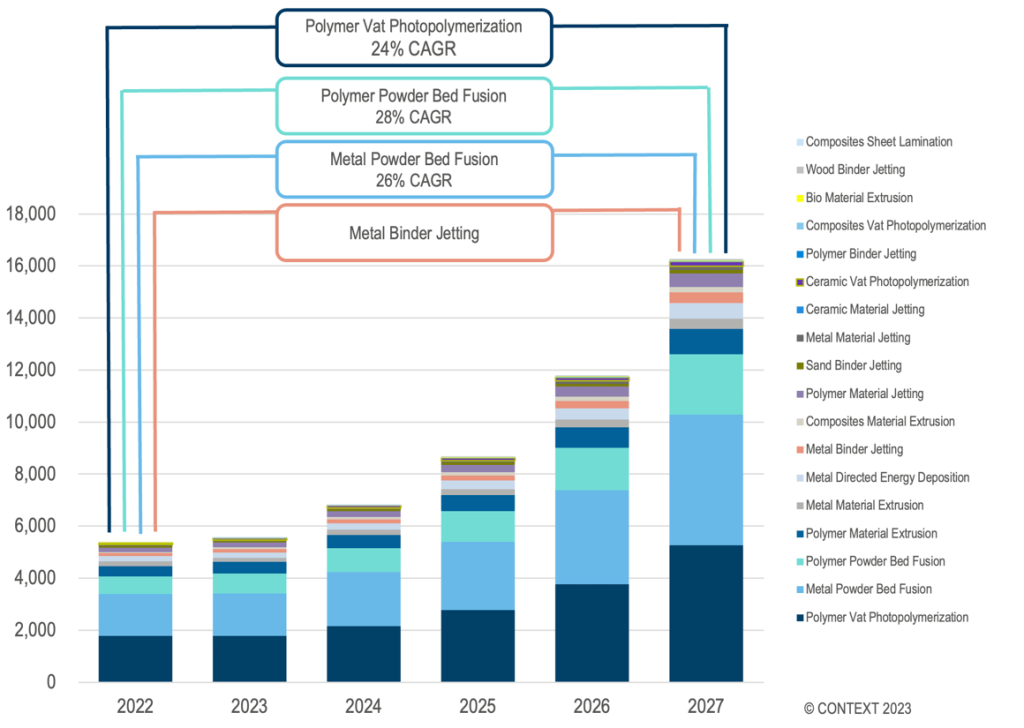

Trying forward, whereas a lot of the business’s consideration has been on Western firm consolidation, distributors like China’s Farsoon have continued the development within the Asia–Pacific area of going public through conventional IPOs. The prospects for 3D printing stay shiny, with demand rising and accelerating. The business continues to excel in prototyping, with ample room for development in mass customisation, low-volume manufacturing of difficult elements, and quantity mass manufacturing. Applied sciences resembling vat photopolymerization, PBF, and binder jetting are poised to fulfill these mass manufacturing wants, with steel PBF main the Industrial market and on monitor to see a 5-year cargo CAGR of +26%.

What does the way forward for 3D printing for the subsequent ten years maintain?

What engineering challenges will should be tackled within the additive manufacturing sector within the coming decade?

To remain updated with the most recent 3D printing information, don’t neglect to subscribe to the 3D Printing Business e-newsletter or observe us on Twitter, or like our web page on Fb.

When you’re right here, why not subscribe to our Youtube channel? That includes dialogue, debriefs, video shorts, and webinar replays.

Are you searching for a job within the additive manufacturing business? Go to 3D Printing Jobs for a number of roles within the business.

Featured picture exhibits Industrial Unit Cargo Forecast by ASTM Course of and Materials through CONTEXT.