Micromax Informatics as soon as had a agency grip on the native cell phone market in India, for a time passing stalwarts like Samsung, icons like Apple and plenty of extra to be the most important handset maker of all of them. However a mixture of stronger (and cheaper) competitors, coupled with the fast tempo of expertise growth and the ongoing market slowdown, have left it spinning.

Whereas some consider that it nonetheless has some life in it but as a cellular model, sources and filings level to one thing else: it’s eyeing as much as step into mobility, particularly into the realm of electrical automobiles.

However that change in gears can be coming with a variety of bumps. TechCrunch understands that the New Delhi-based firm has axed dozens of jobs each at its headquarters in Gurugram in addition to department workplaces throughout the nation, slicing into its ranks in gross sales, product, testing, R&D and logistics, and the remainder of the enterprise. A number of prime executives together with the corporate’s chief enterprise officer and chief product officer have additionally resigned within the final some months. Its most up-to-date smartphone mannequin launched as far again April 2022.

Micromax declined to remark concerning the job cuts and different particulars of this story.

To the general public, for now, the corporate stays a cell phone firm, though many cracks are displaying. Stories on social media present the corporate’s reluctance to deal with client complaints. Distributors and retailers are having a tough time with their stock as a result of there’s little demand for Micromax telephones from customers. And fundamental searches on the Micromax model on Google from 2008 — its first yr in cellular — lay naked the overall decline in chatter concerning the firm. There have additionally been stories about how the corporate is gearing up, amongst different equally struggling older manufacturers, to redouble its efforts to recuperate.

“[The] market may be very aggressive now, targeted across the prime 5 or 6 manufacturers,” stated Navkendar Singh, affiliate vice chairman at market analysis agency IDC. Micromax, having dropped from its place on the prime of that listing, is nearly as good as forgotten.

The EV transfer would come within the type of a brand new model and focus, a minimum of initially, on two-wheel electrical automobiles, in keeping with three people who just lately left the corporate.

A shift to city mobility from cell phones wouldn’t be the primary time that Micromax reinvented itself.

Based in 2000 by Vikas Jain, Rahul Sharma, Sumit Kumar Arora and Rajesh Agarwal, Micromax first began life as a small IT agency, making its first transfer into telephones solely in 2008.

The preliminary journey of the corporate relied on low-cost characteristic telephones. Reasonably priced Android smartphones and tablets entered the body a while after, dovetailing with a rising client class in India that needed the most recent devices, however didn’t have the cash to purchase a Samsung, Nokia or BlackBerry gadget — not to mention an iPhone.

The corporate selected a worth disruption technique to swiftly dethrone Samsung from its management place within the Indian smartphone market, making it one of many trailblazers within the first wave of low-cost, sub-$200 smartphones. Using its provide chain in China, Micromax launched a spread of cheap smartphones and tablets that attracted the lots, tapping immediately into their aspirational inclinations: some fashions immediately mimicked Apple’s iconic iPhone designs.

In 2014, Micromax poached Samsung’s nation head for cellular and digital imaging Vineet Taneja and appointed him the CEO. By 2015, it was promoting thousands and thousands of cell phones a month and producing round a few billions of {dollars} in revenues in a yr. The expansion in its enterprise helped the corporate associate with huge tech firms like Google and Microsoft to launch smartphones primarily based on their respective cellular working methods.

The primary market issues began in 2014, when Xiaomi and different Chinese language distributors began to get significantly extra targeted on India, disrupting Micromax in the identical means that Micromax had disrupted Samsung earlier than it: with extremely inexpensive, Chinese language-made fashions throughout totally different worth segments.

Having been a trailblazer by manufacturing a few of its fashions in India, Micromax additionally labored carefully with Chinese language suppliers like Tinno Cell to carry newer traces of low-cost smartphones to the market.

It wasn’t sufficient, although, and by 2016, Taneja was out.

“China-based distributors managed to get high quality units, excessive specs and the most recent expertise at inexpensive costs with enormous advertising and marketing and channel spends,” Singh stated. “Indian distributors have been simply not capable of compete in any of those levers — product, advertising and marketing, channel, and so on. In consequence, they misplaced the market to manufacturers like Xiaomi, Vivo, Oppo and Samsung.”

Micromax was challenged additionally attributable to a state-level transfer. The Indian authorities, in September 2014, launched its flagship ‘Make in India’ program, schemes to incentivize world producers to localize manufacturing within the nation. Newer market entrants, taking the home manufacturing route with its tax breaks and different incentives, began to roll out even cheaper handsets.

The third huge blow got here in September 2016, when billionaire Mukesh Ambani’s Reliance Industries launched Jio, its 4G community. Testing on the community was closed to a choose group of manufacturers. And Micromax — with no 4G-ready handsets given its concentrate on the low finish of the market — was not one in all them.

“Micromax didn’t anticipate the motion from 3G to 4G so rapidly,” stated Ajay Sharma, former enterprise head at Micromax. Different Indian distributors have been additionally impacted, he added.

The troubles with gross sales additionally began to flare up tensions between founders and executives, which in flip impacted Micromax’s makes an attempt to boost capital.

In keeping with the information out there on PitchBook, the corporate raised a complete of $98.02 million. The latest post-money valuation is famous as $745.57 million, though that dates from 2010. Former buyers embrace Peak XV Companions (previously Sequoia Capital India & SEA), Sandstone Capital and TA Associates. The final audit report filed with the Indian regulator exhibits that Wagner, an affiliate of TA Associates, offered its complete remaining fairness stake to Placid Holdings in January 2020, and that the corporate purchased these shares again from Placid Holdings in March 2022.

The corporate had been in talks to boost a whopping $1.2 billion from Alibaba. However the deal by no means closed reportedly attributable to disagreements between Micromax and Alibaba over future technique for the enterprise.

All of this was being performed out amid the ambitions of Micromax’s founders and administration. The corporate could have gained its reputation as an Indian vendor, but it surely didn’t need to stay restricted to India.

The corporate entered Russia, South Africa and the Center East: it employed former India gross sales director of Analysis in Movement (BlackBerry) Amit Mathur as the pinnacle of its worldwide enterprise and created a separate provide line to cater to the demand within the world markets. The corporate additionally tapped Australian actor Hugh Jackman as its model ambassador.

Micromax roped Australian actor Hugh Jackman as its model ambassador Picture Credit score: Prashanth Vishwanathan/Bloomberg through Getty Pictures

In Russia, the place the corporate grew to become the third largest handset vendor a few years after debuting in 2014, Micromax adopted within the footsteps of Fly Mobiles, which was additionally working within the Russian market, in keeping with a former firm govt. Fly Mobiles was initially primarily based within the U.Okay., however a majority stake in its India and SAARC enterprise was acquired by Indian firm SAR Group in 2011.

Inside one yr of kicking off its world operations, Micromax began creating separate provide traces devoted to its abroad markets. This helped the corporate management its quantity and provide totally different fashions catering to the demand for particular markets. Micromax additionally began producing income from its world operations.

Nonetheless, Micromax’s world market presence started to say no after its enterprise in India skilled a downturn.

“The income have been to not the extent that we might maintain and transfer to the subsequent stage so far as the branding is anxious. We have been doing it clearly, however we wanted assist from India,” the previous govt stated.

With margins shrinking on the firm, in February 2017, Mathur left and was not changed. Micromax finally sundown its world enterprise operations.

Some former executives consider that Micromax’s founders might have dealt with the scenario higher if that they had given a free hand to others approaching board.

That was even though the founders have been engaged on separate companies concurrently. Sharma co-founded an EV startup referred to as Revolt Motors in 2019 (offered to New Delhi-based RattanIndia Enterprises in January). Jain additionally has accessories-focused startup Play Design Labs, which produces wearables and audio units.

An angel investor and two-time startup founder who works carefully with Micromax stated the founders’ resolution to run Micromax alongside different companies suggests an absence of belief and confidence in their very own enterprise.

“I personally felt that when all of your vitality and hearth are there with one explicit model after which daily you need it to develop, then no person can cease it,” echoed a top-level govt who left the corporate earlier this yr. “In case you are not with the ability to dedicate that point, how will a company survive?”

The 4 founders are stated to have totally different qualities that helped the corporate compete in opposition to world manufacturers in India and worldwide markets. Whereas Jain is sweet at constructing relationships, Sharma is stronger at model constructing and advertising and marketing, Arora at dealing with the technical facet, and Agarwal at managing finance, say sources.

“The great half is that they [complement] one another,” a former govt who labored carefully with the founders for over 4 years stated.

Micromax co-founder Rahul Sharma Picture Credit score: Pradeep Gaur/Mint

Residence crew fumble

In 2020, Micromax tried a comeback in smartphones in India. However as a substitute of launching new options, it targeted on stoking anti-China sentiment, within the wake of a skirmish between Indian and Chinese language military troopers in June.

It ploughed $61 million into the plan with a mantra of “extra R&D” to tackle Chinese language smartphone distributors. Micromax launched two new smartphone fashions in 2020 below its ‘In’ sequence to mark its return available in the market. To compete immediately with Chinese language fashions, each telephones have been priced within the sub-$150 phase. The corporate later expanded the lineup to 5 fashions.

However the entire endeavor was a flop. And a former Micromax govt stated that even when anti-China sentiment was a part of the technique, the timing was all mistaken: the launch occurred in early November — over 4 months after the skirmish.

“By that point, the iron had turn into chilly. It, in reality, had a damaging influence as a result of the Chinese language distributors began saying, ‘we’re extra Indian than Indians,’” the manager stated, referring to Xiaomi’s declare that it made 99.5% of its telephones in India.

Then in 2021, Micromax lastly teased the launch of its first 5G smartphone. Two years on, that telephone has but to materialize.

Additional afield, Micromax was additionally seeking to associate with some carriers within the U.S. to enter North America, in keeping with an individual accustomed to the plans. That, too, by no means occurred.

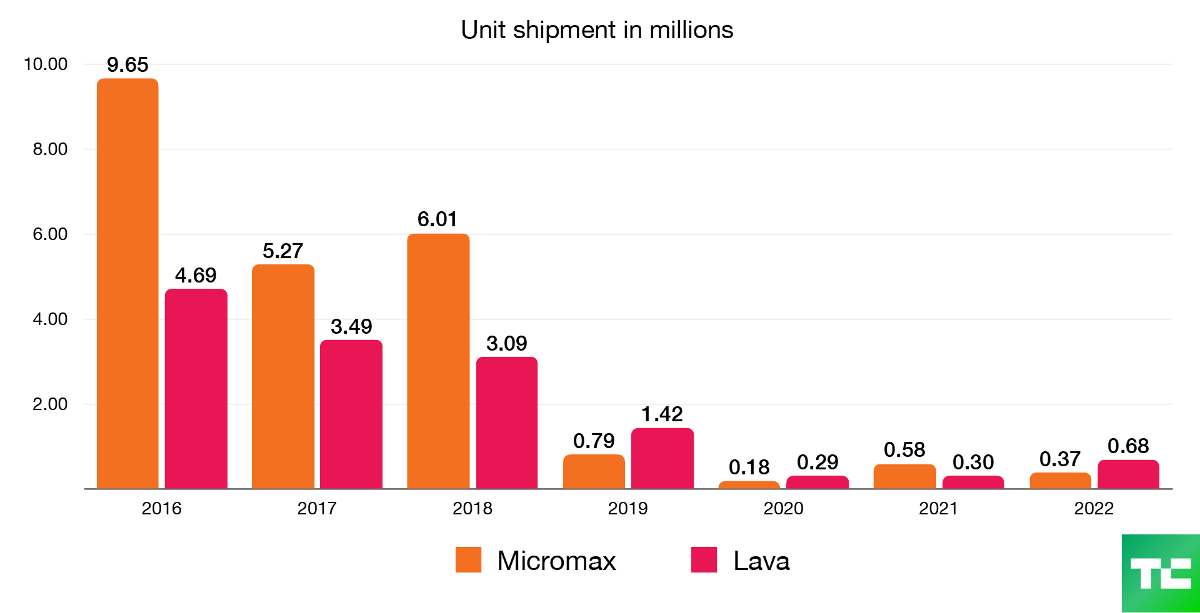

As a substitute, it continued to see revenues decline. Micromax’s whole income dropped drastically to a mere $94.26 million in 2022, in comparison with $1.33 billion in 2016. Smartphone shipments fared no higher, dropping to only 370,000 in 2022 from 9.65 million in 2016, in keeping with IDC information.

Micromax was not alone in its struggles to compete in opposition to Chinese language distributors in India. Lava Worldwide, Karbonn Mobiles and Spice Mobility additionally all threw their hats into the ring. Lava, with a concentrate on 5G, has seen some development in latest months; however Karbonn Mobiles and Spice Mobility, the 2 firms that labored with Google — alongside Micromax — to launch its first Android One program in India, have left the smartphone market.

Micromax and Lava smartphone shipments, in keeping with IDC Picture Credit score: Bryce Durbin / TechCrunch

Some have fared higher. Knowledge shared by market analyst agency Counterpoint additionally exhibits that whereas Micromax noticed an 80% year-on-year decline in its general shipments in 2022, Lava’s smartphone shipments grew 85% year-on-year. The corporate additionally just lately launched its mid-range 5G telephone referred to as Agni 2 to tackle related choices from Xiaomi and Samsung. Micromax, in distinction, has had no new fashions within the pipeline, in keeping with individuals who labored at prime positions within the firm till March.

Shuffles and layoffs

Whereas trying a turnaround, Micromax has additionally cycled by a lot of different govt strikes within the final a number of months, together with hiring after which dropping each Luke Prakash Andrew as its chief enterprise officer and chief product officer Sunil Loon.

Co-founder Rahul Sharma, who had been the important thing face of the corporate for the final a number of years, resigned from his managing director’s place in April 2021. The board appointed Vikas Jain, one of many different co-founders, as the brand new managing director, a three-year function that may expire April 2024. Sharma stayed on as a non-executive director, per regulatory filings.

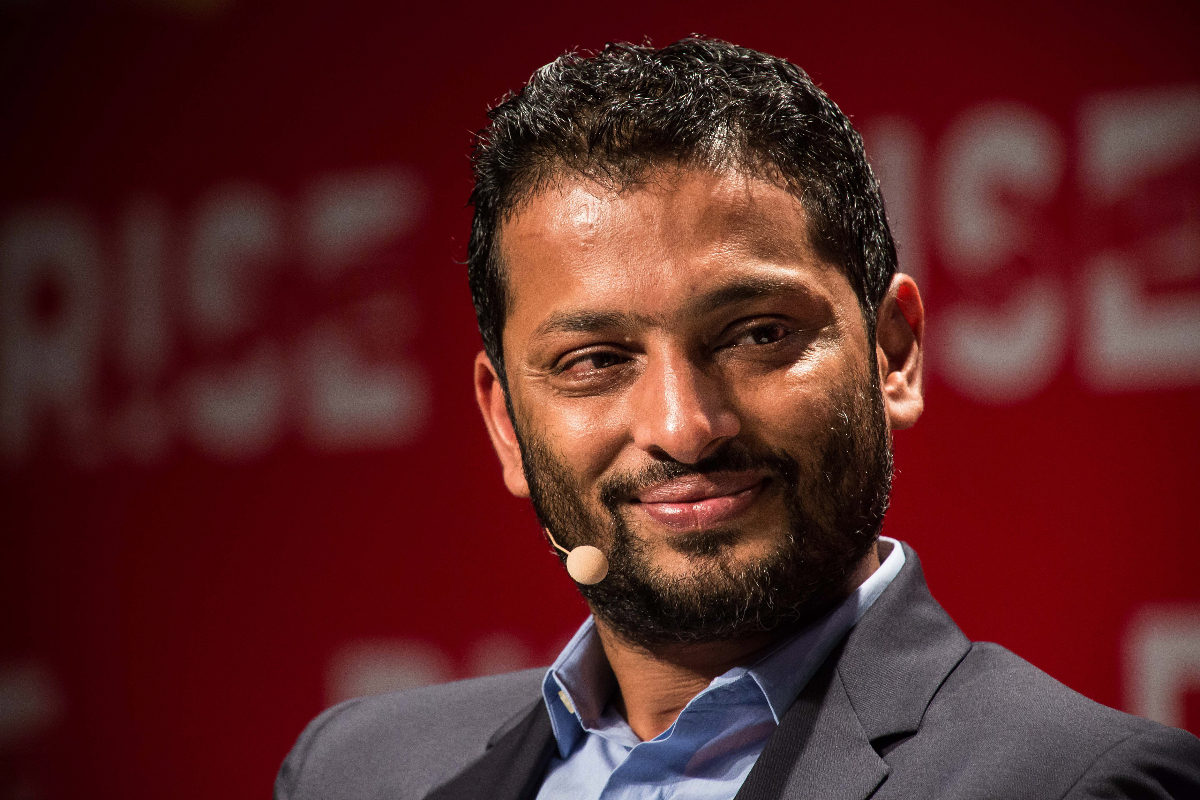

Vikas Jain, co-founder of Micromax Informatics Picture Credit score: Billy H.C. Kwok/Bloomberg through Getty Pictures

Individuals accustomed to the matter stated Sharma stepped down due to the botched comeback plan.

“Someplace down the road, [the founders] realized that they didn’t have any new issues clearly to construct up the size or Micromax once more,” a supply informed TechCrunch.

Sharma was additionally behind the 2014 ill-fated launch of YU Televentures, a three way partnership between now-discontinued working system maker Cyanogen and Micromax that aimed to tackle Xiaomi and its sub-brand Redmi within the nation.

And the corporate has additionally inevitably had wider layoffs.

Earlier this yr, Micromax’s executives contacted a few of its staff and requested them to search for new jobs as their present roles have been not required. Near 100 jobs — notably within the gross sales and providers groups — have been lowered as part of the cost-cutting measures, an govt who additionally left the corporate in March informed TechCrunch.

The corporate additionally began winding down its gross sales crew in varied states in the previous couple of months, remaining solely in just a few states the place it had some distributors, the manager stated.

The minimize within the gross sales crew has made it tough to shift inventory to retailers, which has in flip led Micromax to make use of the extra restricted, decrease margin cash-and-carry channel, the place retailers don’t get an choice to return any inventory left. (Usually, distributors give retailers a timeframe to return the stock they can not promote.) This has in flip additionally soured relationships between the model and its retail channel. Micromax’s present auditor — SR Batliboi and Associates — additionally resigned in June, after practically 9 years of working with the corporate, over not getting their demanded charge, per a latest regulatory submitting.

Transferring forward?

The discount in employees and switching to a brand new auditor could cut back prices, but it surely additionally begs the query of how Micromax will handle its subsequent enterprise.

Two sources stated that Micromax has began renovating one in all its workplaces in Gurugram to kick off its work on the brand new undertaking exploring the EV market, however few staff stay at Micromax to workers the enterprise transition.

However the transition has already been months within the making. In February this yr, Micromax founders Jain, Rajesh Agarwal and Sumeet Kumar included an organization named Micromax Mobility, per regulatory filings.

Though Sharma additionally had a small stint within the EV market with Revolt Motors, his identify is just not hooked up to the brand new enterprise’s filings.

A supply stated that Micromax administrators began discussions and ready documentation for the mobility enterprise earlier this yr. The corporate didn’t temporary most of its top-level administration concerning the transfer.

Jain declined an interview, and he additionally declined to reply an inventory of questions shared over e mail associated to latest the job cuts, plans with the EV enterprise and way forward for the corporate within the smartphone market.

TechCrunch additionally tried to contact Micromax’s media relations a number of occasions, with no success.

Micromax’s failure within the smartphone market sends a stark warning to different handset makers that need to compete on worth alone. Even when it may draw a line below its personal misadventures, it stays to be seen if the corporate could make the shift to the EV market, which is already crowded.

In order Micromax strikes out of the frying pan that’s India’s cell phone market, that doesn’t preserve it out of the hearth. People who would possibly pose a risk embrace Ola Electrical, Ather Power, and conventional car gamers reminiscent of Bajaj and Hero Electrical.