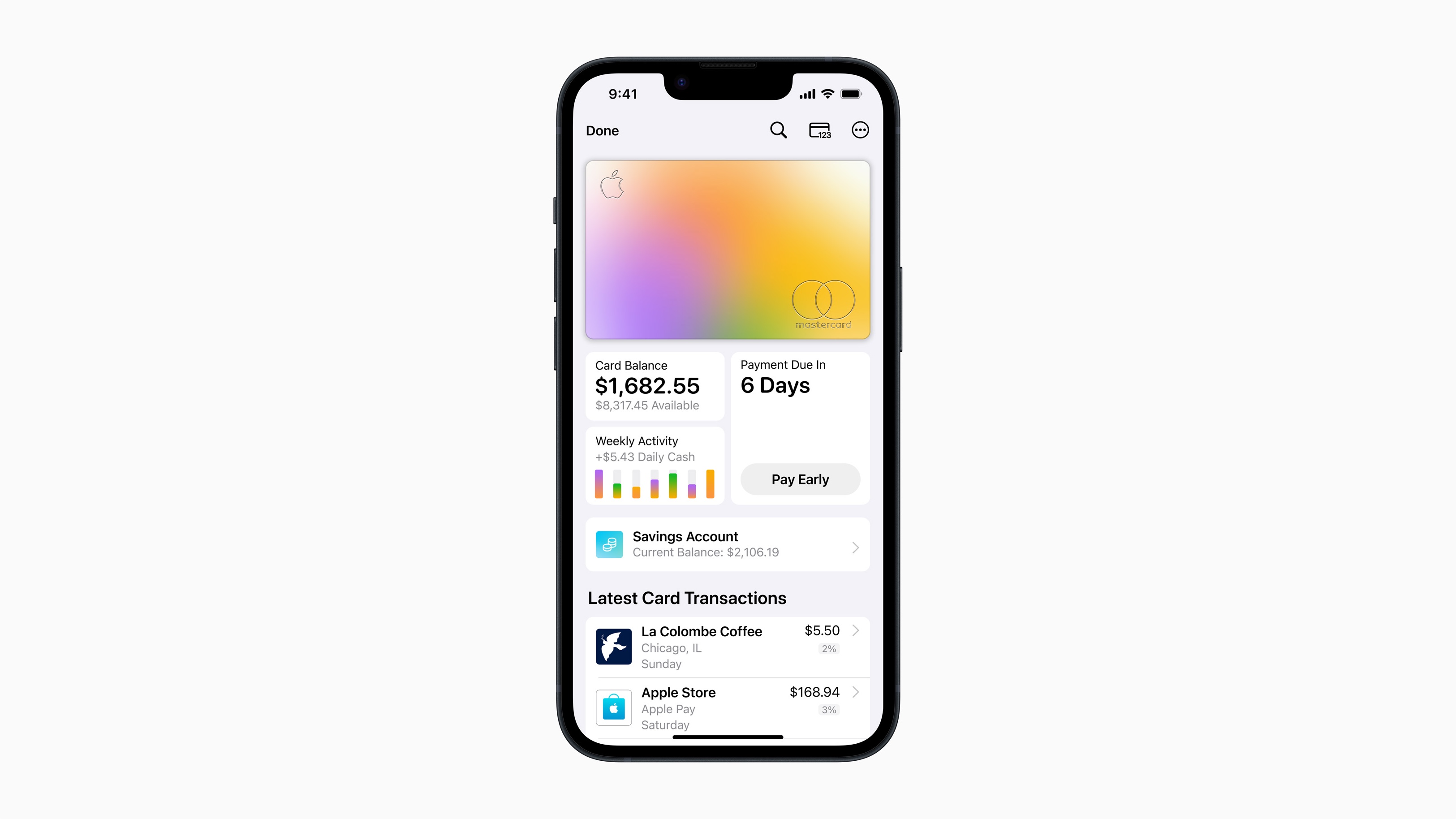

Apple’s new Financial savings account has been out for a few weeks now and, like several new Apple product, I’ve been utilizing it because it grew to become obtainable. After a few weeks with the account and seeing the way it interacts with the Apple Card, Each day Money, and the Apple Money account, I can say that Apple is on to one thing right here.

Nevertheless, when you don’t have an Apple Card, you possibly can’t use the Financial savings account but. So, until you have already got one — or plan to get one — this account isn’t going to be for you. That mentioned, there’s so much to think about when Apple Financial savings such because the rate of interest, deposit necessities, and charges.

Fortunately, similar to Apple Card, these are all areas the place Apple’s new Financial savings account shines compared to plenty of conventional banks.

Earlier than masking Apple, Joe labored for the corporate in Apple Retail. He additionally has greater than a decade of expertise within the expertise, monetary, and compliance industries, serving as a Private Banker, Retail Supervisor, and Software program Assist Supervisor. His earlier expertise gave him years of perception into monetary applied sciences and the proliferation of fintech. Along with being a person of Apple Card, Apple Financial savings, Apple Money, and Apple Pay Later, Joe has additionally examined out a number of different monetary merchandise starting from checking to funding accounts.

Apple Financial savings has probably the greatest rates of interest available on the market

Let’s face it. An important factor a few financial savings account is the rate of interest. There’s not a lot else that issues. The cash is supposed to sit down and develop over an prolonged time frame. If the rate of interest sucks, it’s not a superb financial savings account. Fortunately, Apple Financial savings has probably the greatest rates of interest available on the market proper now.

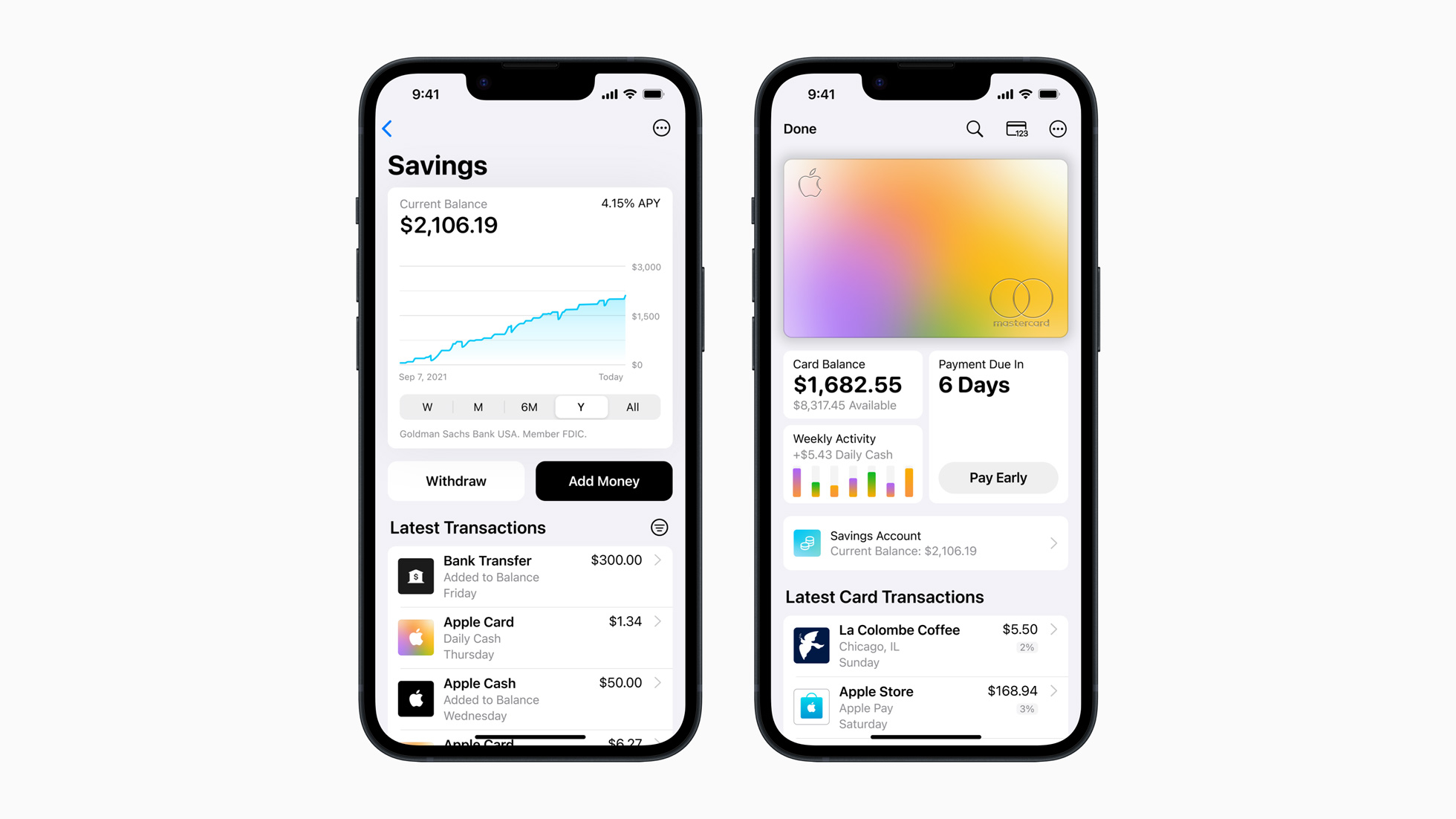

At launch, Apple Financial savings presents a 4.15% APY. That blows away many of the conventional banks which proceed to supply rates of interest as little as lower than one %. Even a number of the on-line choices from Citi, Uncover, and Capital One, which I used to be anticipating to see increased charges for, didn’t attain the extent of rate of interest supplied by Apple Financial savings.

There are some banks which can be at present beating Apple’s fee, nevertheless. I personally use Betterment for nearly every little thing now and, as of the writing of this text, their rate of interest for his or her financial savings account is 4.35%. It’s not an enormous distinction compared to Apple’s providing, however these sorts of presents are on the market when you look exhausting sufficient.

Apple Financial savings presents a strong rate of interest with out the deposit necessities

Regardless of another banks providing a better rate of interest than Apple Financial savings, you need to be careful — plenty of the time, that increased fee is barely obtainable when you deposit and keep a sure steadiness.

Banks love interest-gating their financial savings accounts. For instance, once I was researching this piece, I discovered a web-based financial institution that was providing a 4.75% APY. Nevertheless, once I took a more in-depth look, I spotted that you just needed to deposit and keep a $5000 steadiness in an effort to get that “particular” fee.

A few of the greatest rates of interest for financial savings accounts will generally include these deposit necessities in an effort to be eligible for the speed. It’s a crappy apply that, fortunately, Apple Financial savings doesn’t take part in.

That is one other good factor about Apple Financial savings. There may be completely no deposit requirement to open up an account. There isn’t any deposit quantity that it is advisable to keep in an effort to maintain the account in “good standing.” And there’s no deposit quantity that you just want in an effort to qualify for the 4.15% rate of interest.

That mentioned, there’s a deposit restrict. Apple Financial savings won’t allow you to maintain a steadiness of greater than $250,000 within the account. For many, that’s not going to be a giant deal. Protecting greater than $250,000 in financial savings and never in investments appears like one thing that will set monetary specialists’ hair on hearth.

Apple Financial savings, like Apple Card, has no charges

When Apple introduced Apple Card, one of many issues that the corporate actually honed in on was that, along with providing respectable rewards and an important expertise within the Pockets app, it could have zero charges. That meant no international transaction charges, no late charges, and many others. The corporate took the identical method with Apple Financial savings.

Sadly, conventional banks earn plenty of their cash from charges. Whereas most use checking accounts to prey on prospects by charging overdraft charges, some banks will even discover methods to cost charges on financial savings accounts.

Some do that by implementing deposit necessities. In the event you don’t keep the required steadiness, the financial institution will cost you a payment which, mockingly, makes it even more durable to keep up your steadiness. This will entice prospects in an countless loop of a steadiness under the requirement leading to charges which leads to a steadiness under the requirement and so forth and so forth.

Some banks will even permit prospects to attach their financial savings accounts to their checking accounts. Nevertheless, if a buyer overdrafts of their checking account and the financial savings account doesn’t have sufficient to cowl it, that may additionally lead to charges. It’s a very crappy apply that’s predatory on prospects with decrease balances.

Fortunately, Apple Financial savings has no charges. There isn’t any deposit requirement to open the account nor a steadiness requirement, so there aren’t any charges that Apple will cost The corporate does observe that an exterior financial institution may cost you and that the cost may replicate in your account, however that Apple nor Goldman Sachs, who oversees the account, will cost prospects any form of payment.

That’s an important win for patrons who’re beginning financial savings or simply don’t need to cope with remembering deposit necessities.

Transfers are on the spot — if they’re to Apple Money

One of many irritating issues about our present monetary system is how sluggish it nonetheless is to switch cash between accounts. Whereas delayed availability is predicted if you end up transferring funds between establishments, I nonetheless even see delays when transferring cash between accounts throughout the similar establishment.

Apple Financial savings undoubtedly has a leg up right here. The corporate says that transfers between your Apple Money and Apple Financial savings account will typically be instantaneous, which means that transferred funds between accounts ought to normally be obtainable instantly.

That sounds boring, however that is the form of infrastructure that extra experimental foreign money like crypto goes after. It’s nice to see a non-crypto account provide the identical profit — so long as you might be transferring inside Apple’s accounts, after all.

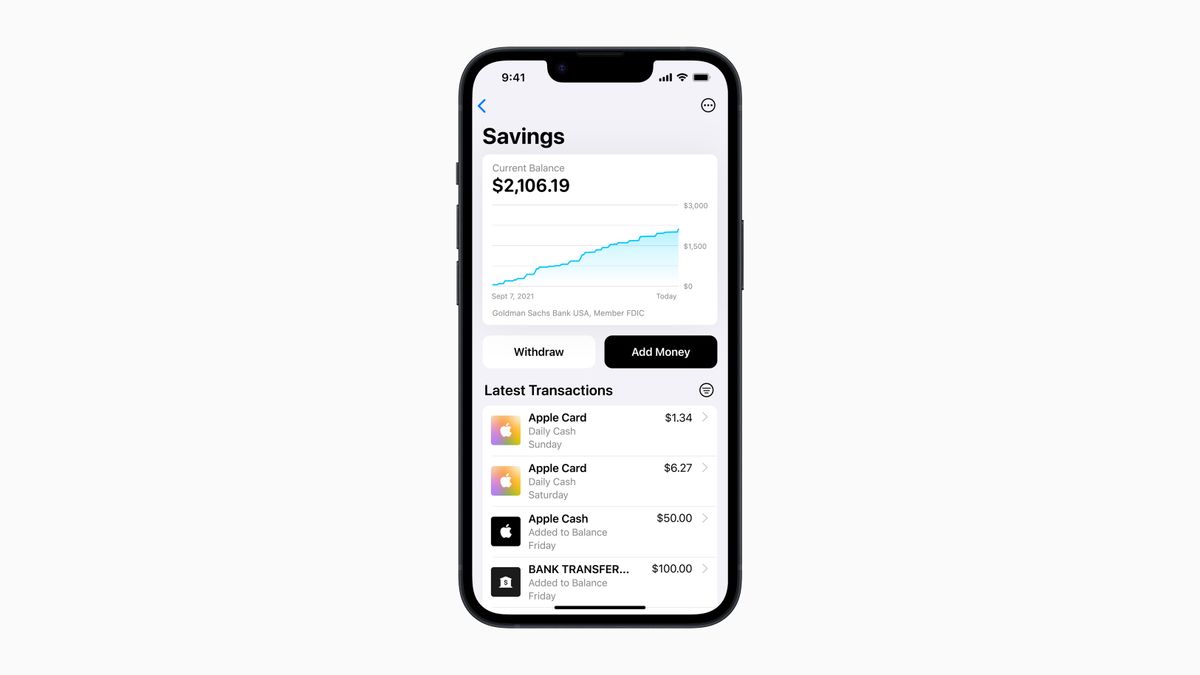

Talking of on the spot transfers, having earned Each day Money out of your Apple Card switch proper into your Apple Financial savings account is a good function. I’ve traditionally handled Each day Money like monopoly cash so having it skip into financial savings will certainly assist me be extra accountable with it.

One factor to notice is that Apple, like many different monetary establishments, does implement switch limits. The corporate says that customers cannot switch greater than $10,000 at a time and greater than $20,000 in a five-day interval between Apple Financial savings and Apple Money. Whereas some could discover that annoying, that’s a fairly frequent requirement and one you might be unlikely to have the ability to sidestep anyplace else.

What else do you want?

With an important rate of interest, no deposit necessities, and wicked-fast transfers to and from Apple Money, what else do you want in a financial savings account?

Properly, one of many issues I’d like to ultimately see is the flexibility to place your financial savings into buckets. For instance, have some financial savings in an emergency fund bucket, extra in a trip bucket, and so forth. I’d additionally like to see Financial savings supplied with out the necessity to have an Apple Card.

Nevertheless, I’ve a rising feeling we’ll see Apple make such strikes if, or extra doubtless when, the corporate rolls out its rumored checking account.