These days, name recording is turning into vital cellphone system function for contemporary enterprises to trace agent efficiency and assess service high quality. In some industries just like the finance sector, it’s even obligatory to file each consumer name.

These days, name recording is turning into vital cellphone system function for contemporary enterprises to trace agent efficiency and assess service high quality. In some industries just like the finance sector, it’s even obligatory to file each consumer name.

Given this context and the truth that bank card funds are being accepted over the cellphone greater than ever earlier than, it’s vital for companies to keep up regulatory compliance whereas recording calls between workers and prospects. One of the vital widespread rules is the Cost Card Trade Knowledge Safety Commonplace (PCI DSS).

On this article, we’ll clarify what PCI DSS is and what you need to do to remain compliant with out affecting customer support.

PCI DSS: What it’s and Why it Issues

What’s PCI DSS?

Cost Card Trade Knowledge Safety Commonplace (PCI DSS) is a set of safety requirements established by the PCI Safety Requirements Council to make sure the safety of delicate cardholder information and mitigate the chance of bank card fraud. The regulation applies to any group that handles fee card transactions, no matter measurement or business.

The PCI Safety Requirements Council was fashioned within the yr of 2006 by main bank card manufacturers together with American Specific and Mastercard with the mission of enhancing international fee account information safety.

Why is PCI DSS Compliance Essential?

Compliance with PCI DSS is obligatory for companies that course of, retailer, or transmit fee card info.

Based on the regulation, the three-digit CVV variety of bank cards shouldn’t be recorded or outlined in name information. If a buyer reads out his card particulars to your agent and people particulars are captured within the name recording, you could be in breach of PCI DSS rules and face penalties.

By adhering to PCI DSS, companies can show their dedication to safeguarding cardholder information and stopping potential bank card fraud, therefore sustaining buyer belief.

Document Calls With out Risking Compliance with Yeastar

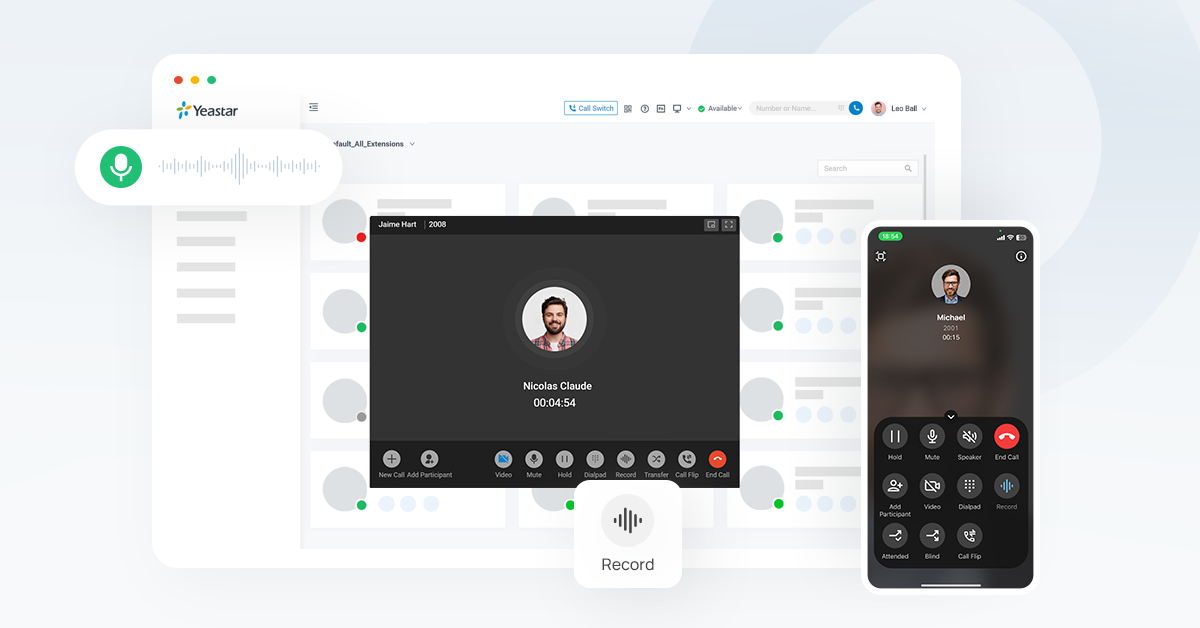

Yeastar supplies corporations with an easy-to-use answer to remain compliant with PCI DSS whereas recording buyer calls.

With the Yeastar P-Sequence Telephone System, extension customers and name heart brokers can manually pause the recording as prospects learn out delicate cardholder information like CVV numbers and resume afterward. This implies no bank card information is not going to be recorded in any respect and brokers can nonetheless keep on the cellphone to proceed the service. Additionally, the pause-and-resume operation will be shortly carried out both by urgent the button on Yeastar’s name window or dialing a pre-configured function code.

Because of Yeastar’s pause-and-resume methodology, system directors don’t should disable the Name Recording function completely with a purpose to keep compliant, whereas heart supervisors can nonetheless benefit from the recording for agent coaching and repair high quality evaluation.

The right way to Set Up?

System directors can grant permissions to start out/pause/resume name recordings for particular customers within the Administration Portal of the Yeastar P-Sequence Telephone System. For extra info, please discuss with our Administration Information: Cloud Version | Software program Version | Equipment Version.

Companies that Place Excessive Values on PCI DSS Compliance

Companies that prioritize PCI compliance can depend on Yeastar to successfully steadiness glorious customer support with sustaining buyer belief by way of the potential to pause and resume name recording.

- Finance: Contemplating the massive quantity of bank card information processed over telephones every day, monetary establishments comparable to banks, funding companies, and insurers place excessive values on PCI compliance and securing shoppers’ bank card information.

- Retail and E-commerce: Name recording is a device usually utilized by name heart supervisors in retail and e-commerce companies to guage the standard of their buyer providers. Subsequently, non-compliance with PCI can expose these corporations to grave dangers, comparable to information breaches and authorized liabilities.

- Hospitality: Motels and different hospitality companies additionally connect nice significance to PCI compliance since prospects often give their bank card info when making bookings over the cellphone. Sustaining compliance helps scale back the potential of fraud.

Care so much about PCI compliance? Apply for a 30-day free trial of the Yeastar P-Sequence Telephone System to discover extra about our Name Recording functionality together with a bunch of intuitive instruments that provide the energy to offer top-notch customer support.