At a June assembly in Osaka, Japan, cellular-industry stakeholders gathered to suggest options to a technical oddity with surprisingly far-reaching penalties. At stake was who calls the photographs in the case of defining interoperability: big-name distributors, smaller producers of specialised elements, cell-service suppliers, or a combination throughout the whole {industry}.

The interoperability battle has led to the Open RAN motion, whose supporters hope to disrupt the wireless-industry hierarchy and permit extra corporations to take extra vital roles in community infrastructure.

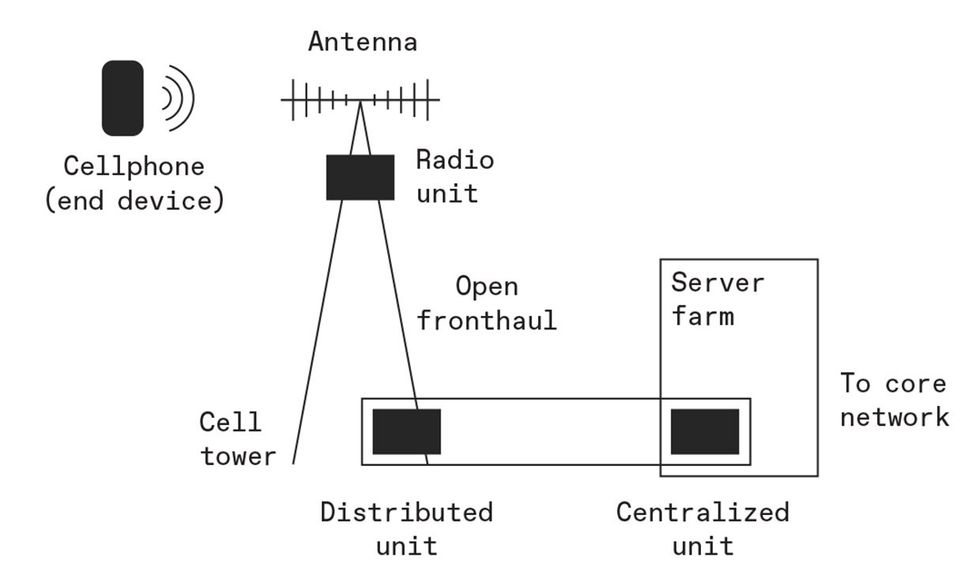

A radio entry community (RAN) is the portion of a mobile community that connects particular person gadgets, like telephones, to a central, wired core community (suppose cell towers). Open RAN desires to make the interfaces between particular person RAN elements “open”—able to interacting with each other no matter who made every element. The thought runs opposite to conventional RAN growth, by which a vendor like Ericsson, Huawei, or Nokia would construct an end-to-end community that might not interface with one other vendor’s elements.

After initially resisting the Open RAN motion, massive distributors at the moment are actively engaged.

The Open RAN motion gained steam in 2018 with the formation of the O-RAN Alliance, primarily based in Alfter, Germany. Which isn’t to say the whole {industry} was on board instantly. Certainly, the {industry} was initially divided into two camps by the difficulty.

The radio entry community (RAN) capabilities as a mobile community intermediary, connecting finish gadgets like cell telephones to the bigger world. Open RAN proponents need the interfaces between RAN elements, notably the radio unit (RU), distributed unit (DU), and centralized unit (CU), to be standardized in order that elements from totally different corporations will be combined and matched. The preferred division, or “cut up,” is named 7.2x and prioritizes creating a versatile (therefore the “x”) interface known as the open fronthaul between the RU and the DU.IEEE Spectrum

The radio entry community (RAN) capabilities as a mobile community intermediary, connecting finish gadgets like cell telephones to the bigger world. Open RAN proponents need the interfaces between RAN elements, notably the radio unit (RU), distributed unit (DU), and centralized unit (CU), to be standardized in order that elements from totally different corporations will be combined and matched. The preferred division, or “cut up,” is named 7.2x and prioritizes creating a versatile (therefore the “x”) interface known as the open fronthaul between the RU and the DU.IEEE Spectrum

On one aspect had been the distributors that construct the community elements and search to bake in aggressive benefit by making their methods incompatible with one other vendor’s tools. On the opposite aspect had been the community operators—suppose AT&T, Deutsche Telekom, Orange, or every other cell-service supplier—that wished the chance to mix-and-match elements and keep away from getting locked into one vendor’s ecosystem, even throughout mobile generations.

There was additionally a hope that opening up the interfaces would permit smaller distributors to enter the market. These distributors would theoretically be capable of give attention to constructing one element rather well and never have to fret about prospects passing them over as a result of they couldn’t simply combine their tools into an end-to-end system.

Open RAN’s development over the previous a number of years has appeared, at instances, each breakneck and caught within the mud. The O-RAN Alliance, for instance, has gone from simply 5 founding members to properly over 300 contributors in simply half a decade, and the group already has 101 publicly out there Open RAN specs, with extra being developed by the group’s technical teams.

Whereas half a dozen “splits”—methods to divide up RAN elements to implement open interfaces—have already been explored throughout the {industry}, subsequent developments have zeroed in on a selected cut up known as 7.2x that creates the Open Fronthaul Interface. Open Fronthaul strikes knowledge between two RAN elements known as the radio unit—such because the antennas on the high of a cell tower—and the distributed unit, which checks for errors and duplicated knowledge, amongst different duties.

Regardless of 7.2x’s ascendency, progress in different instructions has slowed as distributors and operators disagree on what counts as a sufficiently “open” interface. And general funding in Open RAN deployments has fallen: Analysts at Dell’Oro Group not too long ago estimated that income from Open RAN will account for solely 15 p.c of the worldwide RAN market by 2027, which is 5 p.c lower than they’d beforehand projected. And whereas Vodafone in the UK introduced earlier this 12 months—following a 2020 order from the UK authorities to rip and change Huawei elements by 2027—that it could set up Open RAN elements in 2,500 cell websites, the corporate is opting to interchange way more (3,500 websites) with Ericsson tools.

Open RAN’s development over the previous a number of years has appeared, at instances, each breakneck and caught within the mud.

Open RAN requires new mobile deployments, and outdoors of rip-and-replace situations, the wi-fi {industry} isn’t anticipating extra. In spite of everything, the whole {industry} has simply completed its monumental, multiyear effort of preliminary 5G rollouts. “Most operators that I’m accustomed to in Western Europe and within the U.S. will most likely not for the following 5 to seven years actually begin massively deploying one thing else,” says Kim Larsen, a wireless-industry advisor who was beforehand the chief know-how and knowledge officer for T-Cellular within the Netherlands. That sort of timeline aligns with when many community operators will start fascinated with 6G deployments, which is why open RAN might discover a bigger position in that era.

Which brings us again to Osaka. There are nonetheless loads of technical questions that require solutions as Open RAN continues to take form. On the agenda in Japan was a selected query about methods to incorporate huge MIMO (brief for multiple-input, multiple-output) antenna arrays, which incorporate massive numbers of antennas to collectively beam exact indicators to gadgets.

At problem was the truth that huge MIMO arrays weren’t enjoying properly with open fronthaul interfaces. The brief model is that due to the particulars of cut up 7.2x, Open Fronthaul, when paired with huge MIMO, must deal with an excessive amount of knowledge site visitors. Distributors and community operators had been seeing efficiency degradation as much as 40 p.c in comparison with single-vendor RAN installations.

Huge MIMO has seen widespread use in 5G networks and will play an even larger position in 6G networks, so it’s necessary to verify it would work with Open Fronthaul. On the Osaka assembly, O-RAN Alliance members agreed to undertake two options to the issue as “operation modes” that may very well be chosen, relying on the wants of a selected community operator.

The expectation is that the big distributors will simply implement each operation modes into their RAN interfaces. The profit is obvious: Quite than growing, manufacturing, and promoting two types of elements, they will present one resolution to any community operator’s wants. The trade-off is that the elements on both aspect of Open Fronthaul have turn out to be extra advanced, with duplicated options and capabilities.

Extra notable than any particular technical settlement, nonetheless, is how the compromise in Osaka is indicative of the bigger development occurring in Open RAN’s growth: After initially resisting the motion, massive distributors at the moment are actively engaged within the course of. Relating to the Osaka settlement, analyst Caroline Gabriel at Analysys Mason wrote, “Except Mavenir, the record of contributors may very well be associated to any conventional RAN requirements work.” (Gabriel didn’t reply to requests for remark).

Regardless of the inflow of participation by massive gamers, the O-RAN Alliance says that every one gamers will proceed to have an equal alternative to contribute.

Larsen says it’s not correct to view the {industry} as totally recoalescing across the traditional distributors. “I don’t suppose it essentially signifies that in case you have been a startup or a smaller participant that all the pieces is misplaced,” he says. “I believe you most likely will see a segmentation. Some, and that is perhaps the larger, traditional individuals on the block like Nokia, Ericsson, and Samsung, will give attention to the massive incumbent gamers. And the smaller startups will give attention to non-public networks, which is a very rising enterprise.”

UPDATE 15 Sept. 2023: The story was up to date from a earlier draft of the current story, which was initially posted in error.

From Your Web site Articles

Associated Articles Across the Net