Whereas North America and Europe debate the inevitable cashless future, the Asia-Pacific (APAC) area has already skilled a exceptional shift within the adoption and utilization of different cost strategies (APMs) in recent times.

The surge in digital wallets, eCommerce, and rising applied sciences has propelled the area to the forefront of the worldwide cashless revolution.

This text supplies an summary of the present APAC funds panorama, highlights common cost strategies throughout numerous nations, and discusses the impression of APMs on the general procuring expertise.

APAC Funds Overview: Low Penetration of Conventional Banking

In China, shoppers pay with both WeChat or Alipay – two of the nation’s favorite cost platforms that deal with 94% of China’s US$5 trillion cell pockets transactions yearly. Inside India, cell transactions have doubled after the federal government made 500 and 1000 rupees unlawful tender.

In Korea, the rise of TPay, a system that clears US$435 a month for licensed funds utilizing cell provider information, has helped the nation grow to be virtually utterly cashless.

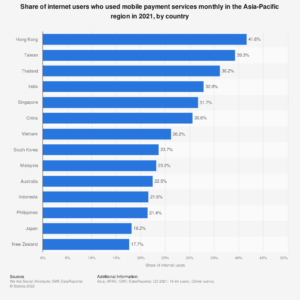

With none doubt, the APAC area is main the adoption of those new different cost techniques by means of the usage of rising applied sciences and fuelled by altering shopper procuring behaviors – with 95% of Asia-Pacific shoppers procuring on-line often.

This pattern additionally reveals its presence within the West, with Caesars Leisure, a Las Vegas lodge and on line casino expertise, integrating WeChat as a cost program, permitting visiting Chinese language vacationers to make use of their WeChat Pay inside their services.

One other issue fueling the accelerated shift wards digital funds was the COVID-19 pandemic, as shoppers and companies alike have sought contactless and environment friendly cost options. In China alone, the eCommerce market elevated by 17% and continued to develop in the course of the pandemic, with Gen-Z customers making up 56% of latest web procuring customers.

The drive to undertake AMPS within the APAC area has led to the next rising key cost tendencies: providing unmatched cost processing, utilizing non-public information to personalize buyer experiences, constructing long-term cost methods, and quickly transferring away from money.

However whereas these developments could — and to some extent will — affect how we pay globally, variations in cost providers are inevitable and mandatory. In the end, funds are like languages. And what’s working in China, South Korea, and different Asian-Pacific nations received’t essentially work elsewhere.

Common Cost Strategies in APAC

The various and huge shopper base in APAC nations has led to the emergence of varied common cost strategies catering to the distinctive wants of every market:

China – AliPay and WeChat

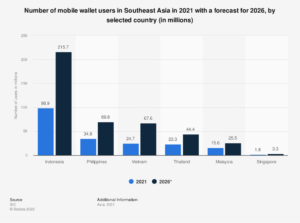

In China, AliPay, operated by Ant Group, is the most utilized digital cost app. In the meantime, Southeast Asia is witnessing a surge in digital cost adoption, with rising startups like Indonesia’s Gojek and Singapore’s Sea platform gaining traction.

A Rakuten Perception survey in October 2022 revealed that GoPay by Gojek was the most popular e-payment service in Indonesia, utilized by 78% of respondents. Moreover, PayPal dominated the Southeast Asian market, with a major presence in Indonesia, Malaysia, the Philippines, Singapore, and Vietnam.

Stand up-to-date market metrics and insights that can assist you enter the Chinese language eCommerce market and tackle established regional gamers.

Globally, nations are following go well with and embracing their very own variations of digital cost strategies:

India – UPI (Unified Cost Interface)

UPI is amongst India’s main different cost platforms, accounting for 10% of the nation’s retail transactions. This real-time cost system permits customers to conduct P2P or P2M transactions through their cell gadgets.

Moreover, UPI is built-in with different nations’ techniques, resembling Singapore’s PayNow, Bhutan’s BHIM app, and Nepal’s NIPL.

Get the insights and steering wanted for coming into and attaining traction within the Indian eCommerce market.

Australia – POLi

Australia’s developed financial system, minimal restrictions on imports, and considerable pure assets set the stage for cashless transactions to grow to be the norm by 2025.

POLi is an alternate cost technique that enables companies to obtain funds straight into their financial institution accounts.

Learn the way to enter the Australian eCommerce market right here.

Thailand – TrueMoney

In Thailand, TrueMoney is the go-to e-wallet, boasting over 15 million customers and enticing low acceptance charges. A Visa examine revealed that 9 out of 10 Thai shoppers favor cashless funds, pushed by COVID-19 considerations and the rising variety of companies providing cashless choices.

TrueMoney supplies a safe and handy cashless expertise and empowers customers to pay payments, switch cash, guide points of interest, and extra.

Bangladesh – bKash

Though Bangladesh was sluggish to undertake digital funds, the COVID outbreak accelerated this shift. Regardless of challenges like monetary exclusion and belief points, the nation’s central financial institution anticipates continued development in digital funds, together with bKash.

As a cell monetary service, bKash permits customers to deposit cash into their cell accounts and entry numerous providers resembling invoice funds and cash transfers.

Pakistan – Easypaisa

EasyPaisa, launched in 2009, is a mobile-based cost service in Pakistan that caters to Telenor Pakistan cell phone customers. Rating because the world’s third-largest cell cash deployment – enabling customers to pay payments, switch funds, and entry authorities advantages. This versatile service streamlines transactions for customers throughout Pakistan, aligning with the rising pattern of different cost strategies.

Transferring ahead, understanding how APAC nations sort out APM adoption shall be essential for companies trying to provide seamless cost experiences on this numerous area.

How APAC nations face the APM adoption

The usage of APMs is strongest within the APAC areas – reflecting the area’s numerous inhabitants’s distinctive preferences and wishes. Customers overwhelmingly favor eWallets, financial institution transfers, and cash-on-delivery choices over conventional cost strategies.

Let’s take a look at a few of the causes behind this.

Modernizing Legacy Infrastructure and ISO 20022

Nice system adjustments have their fair proportion of problems. With the more and more widespread adoption of smartphones and shoppers’ preferences to make use of eWallets, conventional legacy banking techniques are lagging – they merely had been by no means designed to deal with the pressures of 24/7/365 real-time transactions.

The necessity to replace the system is obvious. Banks within the APAC area are scrambling to maneuver in direction of the brand new ISO 20022 commonplace, which is able to contain processing bigger information volumes quicker for real-time funds, every day liquidity administration, fraud detection, and compliance checks.

Nonetheless, person adoption continues to be a problem, with a examine displaying that implementation of user-focused expertise will in the end result in wider acceptance of a very cashless society.

Smartphones and eWallets are influencing APAC’s cost processing panorama

China accounts for the highest utilization of smartphones on this planet, with over 865 million customers. India is trailing not too far behind, with 606 million customers. Moreover, the nation’s rising adoption price of the Web and digitizing market sector in India are influencing residents’ APM utilization.

Each of those nations have adopted eWallets providing cost comfort and safety. Because of this, many banks and cost processors are actually re-evaluating their enterprise methods, particularly in bettering their current infrastructure, as talked about earlier than, to maintain up with their shopper base and retain market share.

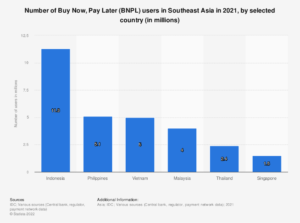

Purchase Now, Pay Later (BNPL) in APAC

The emergence of BNPL options has additional reworked the funds panorama within the area. In accordance with Statista information, these versatile financing choices have gained traction in APAC, offering shoppers with handy and accessible alternate options to conventional credit score merchandise.

The “Purchase now, pay later” pattern has skilled a major increase among the many Gen Z and Millennial workforce; nevertheless, this development could wane as financial circumstances decelerate.

Moreover, it’s anticipated that APAC nations will comply with within the UK authorities’s footsteps in implementing stricter rules on BNPL, which may additional impression its future prospects.

Various Cost Strategies in APAC

This altering panorama calls for an in-depth understanding of shopper preferences and the market’s course for companies in search of a frictionless cost expertise within the Asia-Pacific area.

There’s a notable urge for food for innovation in APAC, with creating markets resembling Malaysia, India, Thailand, and Indonesia demonstrating a larger adoption price of APMs. These shoppers, who think about themselves tech-savvy, are eager to seek out the proper options for his or her wants.

Though playing cards and card-powered wallets stay common in developed APAC nations like Japan, Taiwan, Singapore, and South Korea, the choice for eWallets and financial institution transfers has elevated considerably throughout the area.

Some rising economies are bypassing the cardboard stage altogether and in search of out new methods to pay on-line.

The multitude of APMs used throughout APAC, resembling Paytm in India, OVO Pockets in Indonesia, True Cash in Thailand, and Maybank2u in Malaysia, presents each alternatives and challenges for companies.

As their reputation surges globally, companies should maintain their finger on the heartbeat, adapting to ever-changing markets and shopper preferences.

APMs and the Seamless Buying Expertise

APMs are extra than simply numerous cost choices; they’re designed to combine seamlessly into the client expertise, catering to numerous preferences. This tailor-made strategy enhances buyer satisfaction and encourages repeat transactions whereas lowering friction within the checkout course of and leading to larger conversion charges for on-line retailers.

Furthermore, APMs have the potential to revolutionize the procuring expertise. For instance, Singapore’s PayNow, a peer-to-peer funds switch service initially out there to retail clients, has expanded its scope to incorporate companies and retailers.

By enabling immediate funds by means of a easy QR code scan or cell quantity enter, PayNow eliminates the necessity for coming into prolonged checking account particulars, making transactions quicker and extra handy. This ease of use promotes a smoother procuring expertise and fosters cashless transactions nationwide.

By incorporating APMs like PayNow into their cost choices, companies can create a seamless procuring expertise that meets the wants and preferences of their clients, in the end boosting satisfaction and driving repeat enterprise.

Conclusion

The rise of different cost strategies within the APAC area has revolutionized the eCommerce panorama, offering shoppers with many choices that cater to their distinctive preferences and necessities.

Because the area continues to guide the international cashless revolution, companies should adapt and embrace these rising applied sciences to stay aggressive and meet the evolving wants of their clients.

Within the face of an more and more digital world, APAC’s fast adoption of APMs serves as a testomony to the transformative energy of expertise and its potential for reshaping international commerce. And as this area continues to innovate and push boundaries, the remainder of the world will comply with go well with, resulting in a extra related, handy, and safe future for all.