Apple at this time introduced that its high-interest financial savings account for Apple Card has topped over $10 billion in deposits. Early indicators prompt that the financial savings account was a success, and at this time Apple has given us agency official numbers to again that up.

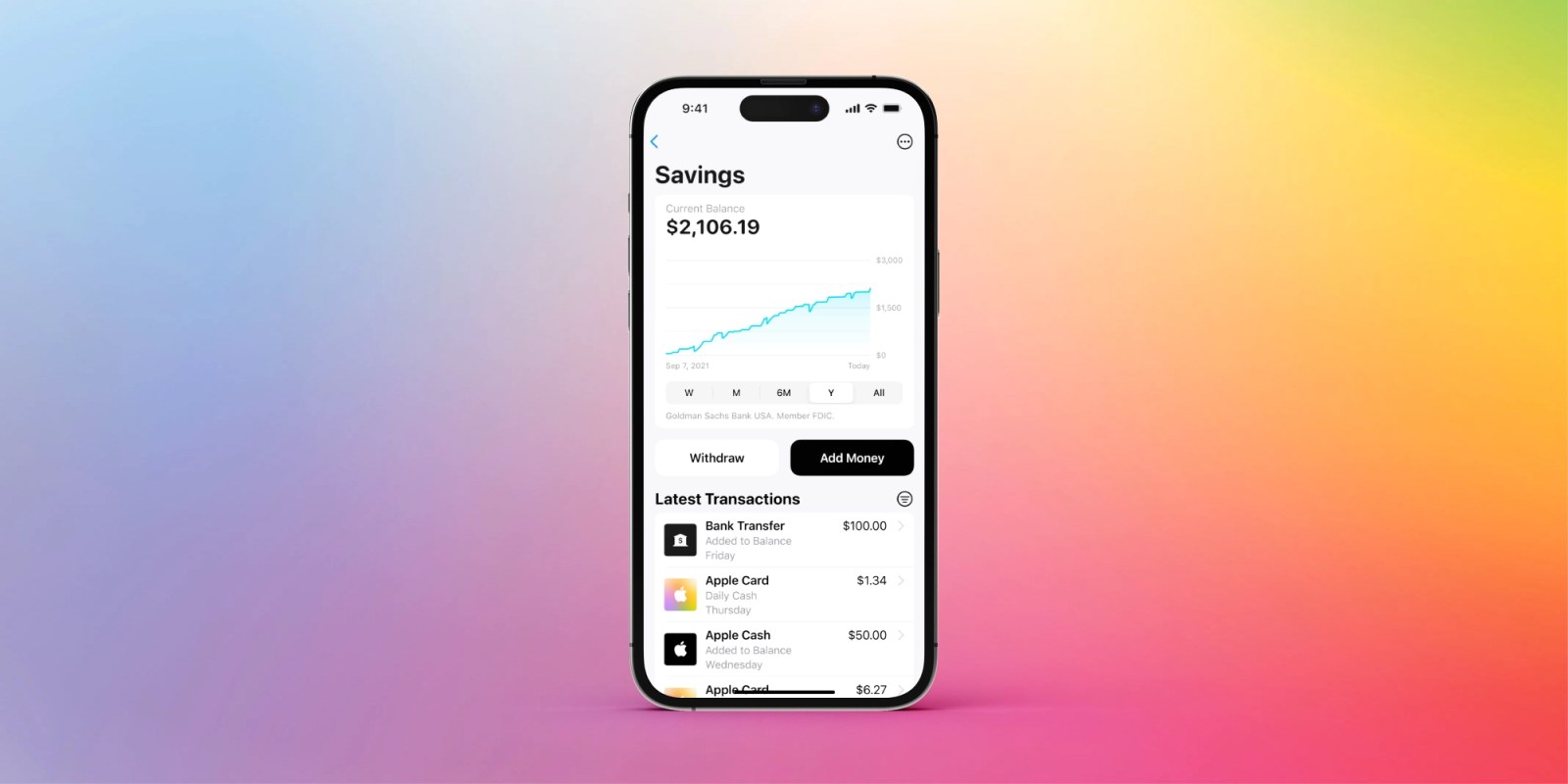

The financial savings account launched in April, out there to all Apple Card prospects in the US, in partnership with Goldman Sachs. The account affords a highly-competitive 4.15% rate of interest.

Apple Card launched in 2019 as a strategy to provide a easy, financially accountable, and personal, bank card. Not like most different bank cards available on the market, Apple Card has no membership charges, late charges, or different hidden prices related to utilizing the account. So long as you repay your steadiness every month, you should utilize the cardboard free of charge.

The Apple Pockets UI encourages paying off balances in a wholesome trend, and makes the fee calendar clear so customers aren’t stunned about upcoming curiosity fees.

Apple Card pays 1% cashback on purchases made utilizing the bodily card, 2% cashback on purchases made utilizing Apple Pay, and three% cashback on purchases made at choose retailers together with spending on the Apple Retailer and on Apple companies.

These Each day Money rewards can robotically be despatched to the Financial savings account to accrue and develop additional; Apple says 97% of its customers have opted to do that. Prospects can moreover transfer cash from different financial institution accounts into their Financial savings account. That is the place the headline determine comes from. Mixed, the overall quantity held in Apple Card Financial savings accounts has topped $10 billion.

Within the final couple of weeks, some publications have reported that Goldman Sachs is trying to exit the Apple Card association, as a part of a strategic shift away from shopper finance.

However at the very least for now, the Apple and Goldman Sachs partnership stays intact. In an announcement, Goldman Sachs stated they’re more than happy with the response to Apple Card Financial savings.

“We’re more than happy with the success of the Financial savings account as we proceed to ship seamless, invaluable merchandise to Apple Card prospects, with a shared deal with making a best-in-class buyer expertise that helps shoppers lead more healthy monetary lives,” stated Liz Martin, Goldman Sachs’s head of Enterprise Partnerships.

Alongside Financial savings, the Apple Card product workforce additionally launched Apple Pay Later earlier this yr, a function that enables prospects to unfold a purchase order over 4 separate funds. This function is presently in pre-release testing with a choose group of Apple Card prospects, and can roll out extra broadly within the coming months.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.