New analysis says that Apple Pay is simply the fifth hottest cost platform within the US, regardless of earlier claims that it was beating MasterCard.

In 2022, researchers claimed that Apple Pay had surpassed MasterCard within the annual greenback worth of transactions, and by a good distance. The place MasterCard processed round $4.8 trillion value of transactions, Apple Pay was seeing over $6 trillion.

Now based on comparability service Service provider Machine, Apple Pay is considerably much less well-liked than MasterCard. The important thing phrase there’s “well-liked,” although, because it seems the analysis relies on the variety of transactions, reasonably than the entire greenback worth of them.

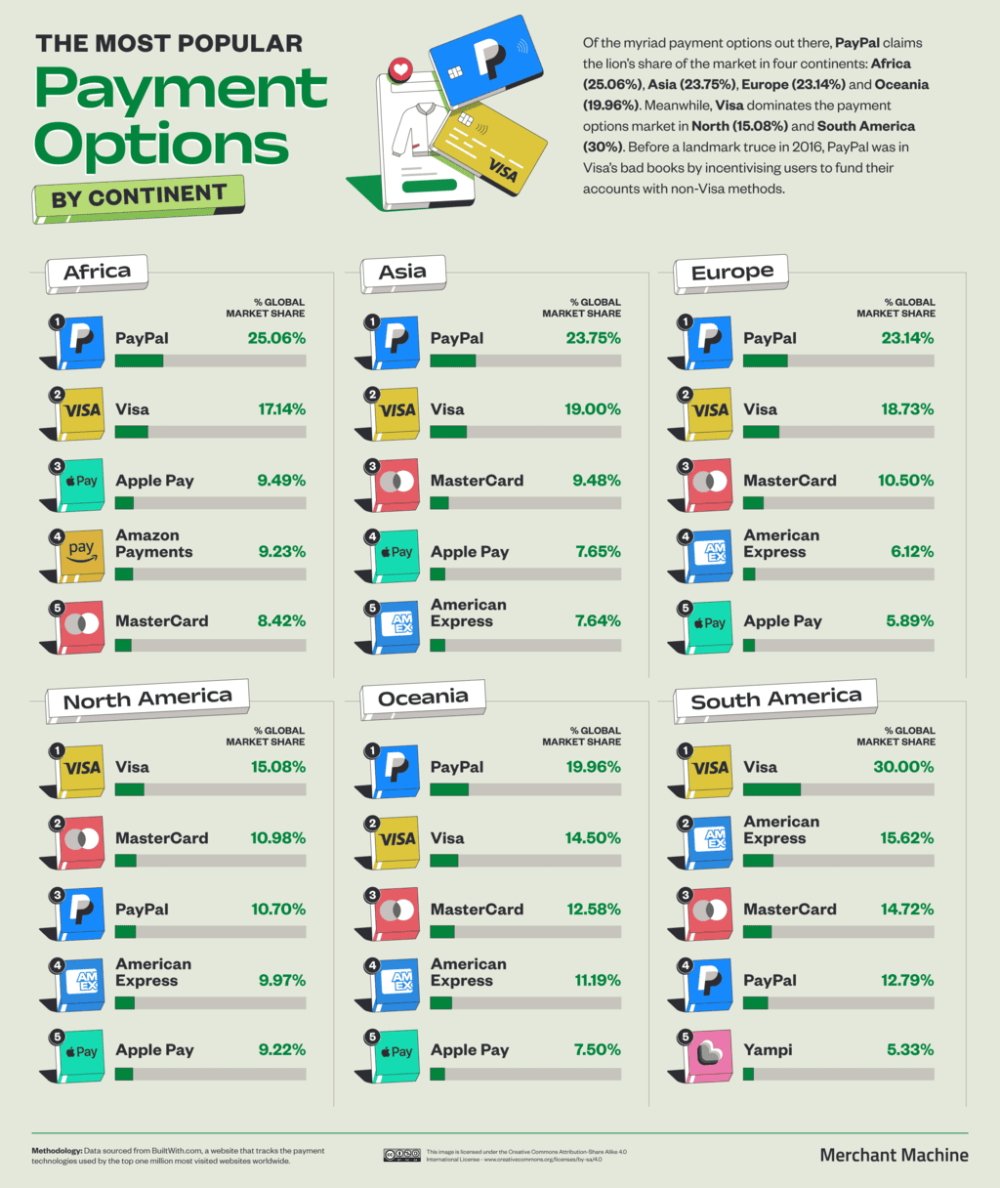

Nonetheless, by this measure, the checklist of the highest 5 cost platforms within the US — and their proportion of market share globally, is:

- Visa (15.08%)

- MasterCard (10.98%)

- PayPal (10.7%)

- American Categorical (9.97%)

- Apple Pay (9.92%)

PayPal tops the checklist in Africa, Asia, Europe, and Oceania. Visa tops the invoice in North America and South America.

Apple Pay’s worldwide recognition is comparable

It is not absolutely clear what Service provider Machine means by the phrase “globally,” although, as it is also produced a listing of the preferred cost strategies worldwide — and the figures are totally different. Or reasonably, the proportion market share figures are wildly totally different, but the rating nonetheless sees Apple at quantity 5:

- PayPal (20.53%)

- Visa (15.67%)

- MasterCard (10.49%)

- American Categorical (8.77%)

- Apple Pay (7.37%)

Apple Pay can also be fifth when solely figures from Europe are thought of. Or Oceania.

In South America, Apple Pay drops out of the highest 5 completely. However for Asia it’s in fourth place, whereas in Africa it is available in third.

Evaluating Apple Pay to Google and Amazon

The place Apple Pay is reportedly the fifth hottest cost technique on this planet, Amazon is behind it in sixth place. However Apple’s 7.37% is reasonably higher than Amazon Funds 6.04%.

Lagging behind them is Google Pay in eighth place (beneath Shopify Pay). It has a 4.3% international market share.

Service provider Machine believes that none of those Large Tech cost programs will beat debit playing cards and PayPal. But it surely bases that on a survey of the UK, and that survey was carried out by the controversial YouGov agency.

The analysis additionally lined the prevalence of Purchase Now, Pay Later (BNPL) providers. Apple launched its personal BNPL in June 2022. Whereas the analysis doesn’t rank BNPL by recognition, it would not even point out Apple Pay Later in any respect.

This analysis was reportedly based mostly on information from BuiltWith, and the cost platform used when shopping for from the highest a million most-visited websites worldwide.

Service provider Machines lately promoted itself with analysis about how usually Apple merchandise are seen in movies and TV.