Apple’s third fiscal quarter outcomes can be issued on August 3, accompanied by the standard name with analysts. Here is what to anticipate from the outcomes, and what Wall Road thinks of the iPhone maker.

Apple confirmed its quarterly outcomes can be launched on August 3 again on July 10. As is typical for the occasion, it will likely be adopted by a name hosted by CEO Tim Cook dinner and CFO Luca Maestri, with the outcomes launched at round 4:30 PM ET and the decision itself ranging from 5:00 PM ET.

Some Apple steering

As has been typical of the monetary outcomes from Apple itself since early 2020, the corporate has declined to supply agency numbers in its forward-looking steering. Nonetheless, throughout the second quarter earnings name, Maestri did provide up some particulars to think about.

In accordance with Maestri, income for the quarter is predicted to pattern equally year-on-year to Q2, as long as the macroeconomic outlook does not worsen. Overseas trade was additionally predicted to stay a headwind at 400 foundation factors, although Providers ought to proceed to see related development to the March quarter.

Maestri additionally stated the gross margin for the third quarter ought to relaxation at 44% to 44.5% with working prices starting from $13.6 billion to $13.8 billion. The power of the Gross Margin may also be attributed to the flat international trade fee, the CFO added.

YoY: Q3 2022 figures

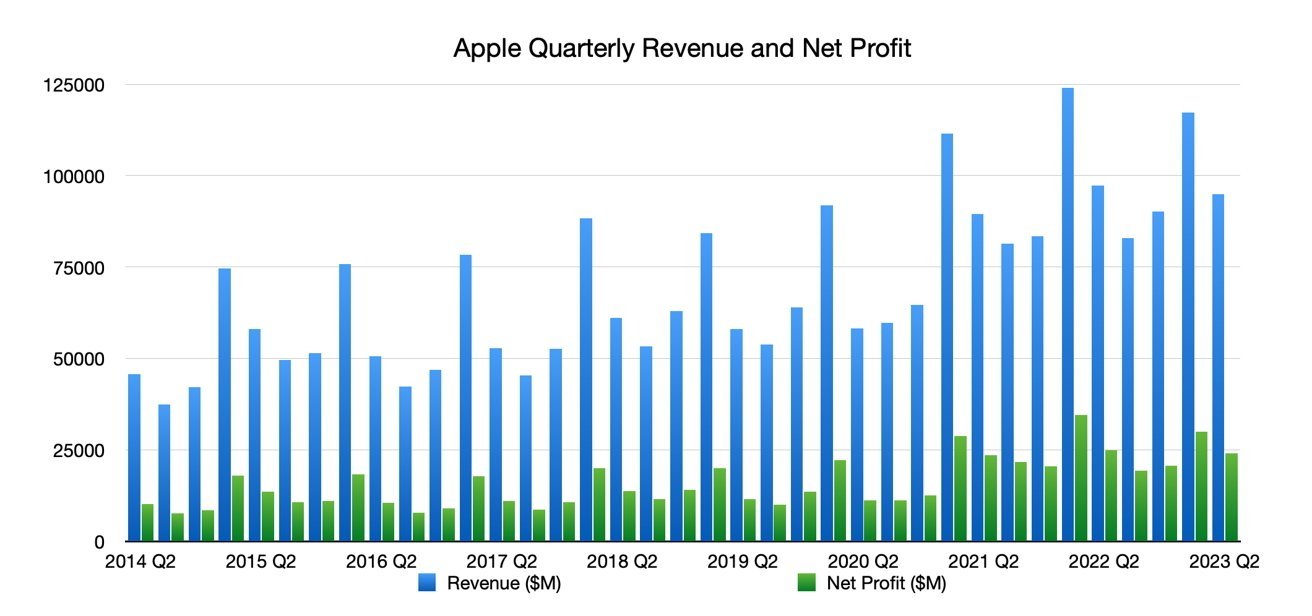

The third quarter is usually the bottom of Apple’s annual cycle of outcomes, with it sometimes incomes much less income than the entire different quarters within the 12 months. Even so, Apple does proceed to see enhancements within the quarter’s outcomes in comparison with the earlier 12 months’s report.

For Q3 2022, Apple noticed a 2% YoY enhance in income to $83 billion, with iPhone income up barely at $40.6 billion, iPad income barely down at $7.22 billion, and Mac income additionally all the way down to $7.38 billion. Wearables, Residence, and Equipment noticed a slight discount to $8.08 billion, however Providers continued to see development to $19.6 billion.

Quarter releases

Surfacing late within the quarter are updates to the Mac Studio and Mac Professional, and the introduction of a 15-inch MacBook Air. None of those merchandise will make a fabric affect on the quarter, however ought to do effectively for the This autumn figures.

What Wall Road thinks

Utilizing figures sourced from Yahoo Finance,a consensus of analysts have put ahead the concept that Apple’s income can be $90.29 billion, based mostly on the reviews of 25 analysts. The entire vary was from a low of $82.81 billion to a excessive of $97.17 billion.

The earnings per share is reckoned to be about $1.36, based mostly on opinions from 28 analysts. That features a low estimate of $1.17 and a excessive of $1.51.

Particular person analysts on Apple

Wedbush

On July 30, Wedbush stated Apple might “flex the muscle mass” throughout the outcomes, citing excessive demand for the iPhone 14 Professional in China. With a “clear uptick in demand” in China, the excessive iPhone income in China may very well be a excessive level, particularly this late within the iPhone product cycle.

With roughly 25% of the present set up base not upgrading their iPhone for 4 years or extra, and the prospect of an “anniversary version” iPhone 15, Wedbush feels there may very well be a “steadier transition” from iPhone 14 to iPhone 15 in comparison with earlier generational switches.

Providers can also be an “underappreciated asset” by Wall Road, with an acceleration in development again to double digits anticipated within the coming quarters.

Wedbush maintained an “Outperform” ranking for Apple, in addition to a $200 worth goal.

Morgan Stanley

In a July 25 word, Morgan Stanley believes Apple could have an as-expected June quarter, with income trending equally year-on-year to Q2. Which means an earnings per share of about $1.19 and $81.7 billion in gross sales.

These could change if the macroeconomic outlook does not worsen. Overseas trade is predicted to remain as a headwind at 400 foundation factors.

Certainly, Morgan Stanley was extra enthusiastic concerning the fourth quarter in September, insisting it may very well be “5-10% above Consensus.” 12 months-on-year income development can also be anticipated for the primary time in 4 quarters, the report claimed, with iPhone and Providers being the principle accelerators.

Morgan Stanley reiterated its worth goal of $220.

Goldman Sachs

Anticipating no surprises, the July 25 Goldman Sachs word is equally enthusiastic concerning the September quarter, however stayed considerably on matter concerning the June quarter.

An EPS of $1.21 is predicted, pushed by “outperformance in Mac and Providers.” Mac income of $9.4 billion is predicted, versus the year-ago quarter harmed by provide chain points, whereas Providers might attain $21.8 billion over App Retailer spending.

On September’s quarter, Goldman Sachs proposes the launch of the iPhone 15 is “promising” because the “comparatively weaker efficiency in iPhone 14 to-date suggests {that a} bigger share of the put in base could need to improve.” The analysts mood expectations by warning of reviews of manufacturing points that “could end in a delayed launch or restricted availability on the time of launch.”

Deutsche Financial institution

On July 24, Deutsche Financial institution raised its worth goal for Apple from $180 to $210, and reiterated its “Purchase” ranking for the inventory.

The Deutsche Financial institution word anticipates Q3 outcomes to be in line or barely higher than Wall Road estimates, with upsides on iPhone, Mac, and Providers. It additionally believes that, whereas the Road expects a 5% YoY decline on iPhone, Apple might nonetheless see development within the space.

Overseas trade dynamics, which beforehand had a unfavourable impact on development and gross margins, may even see some enchancment, in flip rising the EPS.

Deutsche Financial institution views Apple “favorably given its prime quality of earnings and powerful stability sheet.”