A few years in the past, India dreamt of changing into a hub for electronics product manufacturing. At the moment, let’s assess the truth of that dream and determine the important thing elements required to remodel it into a considerable trade

The World Commerce Group’s (WTO) Data Know-how Settlement ushered in a brand new period for Indian shoppers in 1997, granting entry to world shopper electronics manufacturers and cutting-edge know-how at aggressive costs. From the enduring Sony Walkman, which revolutionised music on-the-go, to the ever-present smartphone of in the present day, these gadgets grew to become integral to our lives.

Nonetheless, the inflow of international shopper electronics manufacturers didn’t bode effectively for distinguished home manufacturers similar to Onida, Videocon, BPL, Zenith, and many others, who struggled to attain comparable scale and worth addition.

Apparently, your entire electronics market was not rattled by this wave. Sure sectors, similar to industrial electronics (power meters and inverters) and 2-wheeler automotive electronics, remained comparatively much less impacted by the inflow of worldwide manufacturers. This was as a result of these two realms of electronics already had an area ecosystem which designed, manufactured, and produced elements domestically. These indigenous producers discovered a strong market by supplying their merchandise to famend power meters and utility corporations and automakers similar to Bajaj, TVS, Hero, and many others, enabling them to keep up their foothold within the Indian market.

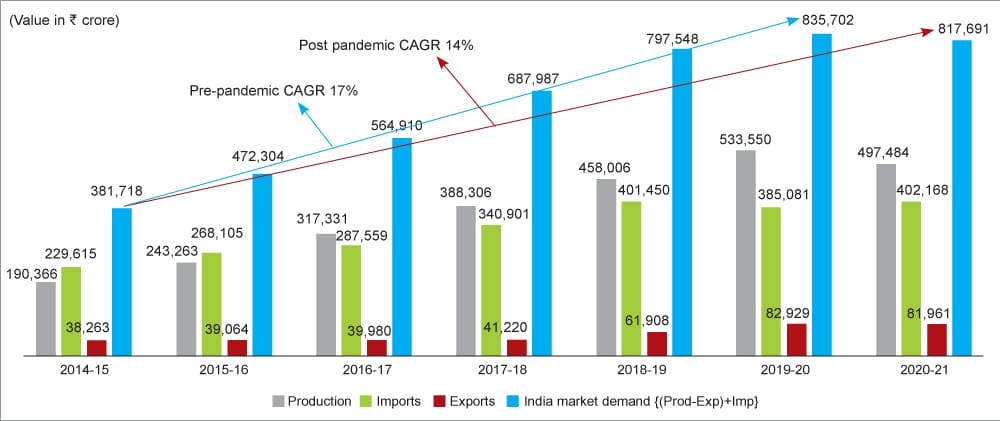

Quick ahead to in the present day, India’s electronics manufacturing trade is ambitiously aiming for a $300 billion goal output, with a hopeful projection of $120 billion in exports by the monetary 12 months 2026-27. This progress trajectory aligns with the nation’s broader imaginative and prescient of reaching a $1 trillion digital economic system by 2025. Whereas these objectives are inspiring, it is very important acknowledge an important facet: India continues to closely depend on electronics imports to fulfill its home demand.

Rising enter prices resulting from excessive imports, coupled with surging home demand for shopper electronics, have now, greater than ever, created a pertinent want for an electronics manufacturing ecosystem that provides excessive worth to India’s native element manufacturing functionality.

Copying cues from the neighbours

As India scales up sources to encourage shopper electronics corporations to ‘Make in India’, its neighbours have develop into the front-runners in electronics manufacturing for greater than 4 a long time. The Indian Council for Analysis on Worldwide Financial Relations (ICRIER) launched a report that underlines the potential for India to be taught from the success tales of China and Vietnam within the electronics sector.

In the course of the early ecosystem-establishing days, the 2 nations prioritised exporting at scale to the worldwide market, over reaching excessive ranges of home worth addition. Each nations targeted on attracting international investments by providing a big and comparatively low-cost labour power.

China went the additional mile to extend home worth addition by investing in analysis and creating technical capabilities to develop into a key participant in manufacturing high-tech elements, from primarily being an assembler. With this method, it took China 40 years to attain exports value $900 billion!

| DVA = Complete Exports×DVAratio the place, DVA refers back to the whole worth of home inputs utilized in exports; DVAratio refers back to the home worth addition per unit of output (or whole demand). To extend DVA of smartphones, one might enhance the variety of smartphones exported or the DVAratio in every smartphone, say from 25% to 75%. By this logic, if each SCALE and RATIO could be elevated concurrently, it could result in a good greater DVA and therefore, quicker job creation. (Supply: ICRIER Report, Globalise to Localise) |

If we examine the beginning factors of India, China, and Vietnam within the electronics sector, the East-Asian nations possessed a extra strong manufacturing base and export-oriented industries from the outset, solely after which they constructed a aggressive home ecosystem and technical capabilities. This in the end resulted in greater participation in world worth chains, rising their share of home worth addition in exports. Then again, India needed to concentrate on ability improvement and workforce coaching to fulfill the calls for of the electronics trade.

Competing with Chinese language world worth chains value $900 billion looks like a idiot’s errand, however India has been taking vital steps to determine a reliable home manufacturing ecosystem, within the type of incentives and creating electronics manufacturing clusters. The query is, how efficient are these schemes in rising native worth addition?

The Catch-22 of PLI

To meet up with the success of China and Vietnam, the Indian authorities launched the production-linked incentive (PLI) scheme for cell phones and large-scale electronics manufacturing, with cell phones being the ‘belle of the ball’.

“We should shift our focus to ‘greater worth addition,’ which could be achieved by creating an area element manufacturing ecosystem, contributing 40% of the worth, and investing in native IP and know-how improvement, which provides one other 30%.”

—Sanjeev Keskar, Trade Professional and

former Managing Director, Arrow Electronics, India

As part of her Finances 2024 speech, Finance Minister Niramala Sitharaman introduced that cell phone manufacturing in India had elevated from 58 million items valued at about ₹189 billion in 2014-2015 to 310 million items valued at over ₹2,750 billion within the final monetary 12 months, because of numerous authorities initiatives, together with the phased manufacturing programme. The PLI for IT {hardware} has benefitted corporations similar to Dell, Optiemus Electronics, Dixon, Bhagwati Merchandise, and many others. The PLI for the large-scale electronics manufacturing (LSEM) sector has attracted main world gamers, together with Foxconn, Samsung, Pegatron, Rising Star, and Wistron, whereas main home corporations, together with Lava, Micromax, Optiemus, United Telelinks Neolyncs, and Padget Electronics, have additionally participated on this scheme.

Regardless of the whopping numbers for cell phone exports, India depends closely on imports for essential elements. The scheme prioritises meeting of cell phones over manufacturing the complete-knockdown (CKD) package in India. As well as, it’s no secret that the inducement implies that the federal government pays all producers in India—regardless of nationality—6% of a telephone’s bill worth, coming right down to 4% within the fifth 12 months for each incremental unit produced in India.

This, together with the tax incentives, energy, and land subsidies provided by the state governments, quantity to a mammoth expenditure on the State’s half. Nonetheless, the query stays—How a lot worth is added to India via this expenditure?

To reply that query, we dive deeper into the pool of numbers. Experiences from the Electronics Industries Affiliation of India (ELCINA) present that the import dependency has diminished from 60% to 40%. Out of the full $120 billion value of electronics merchandise demand, nearly $80 billion was domestically manufactured, whereas $40 billion had been completed items imports in 2022.

Fantastic information, isn’t it? Nonetheless, what most stories fail to say is that out of the $80 billion of merchandise which were domestically manufactured, solely 15% of the full electronics used has been regionally manufactured. So, finally, India earns roughly $12 billion in an electronics market value $120 billion. It is because the subsidy is paid just for ending the telephone in India, not on how a lot worth manufacturing in India provides.

Trade skilled and former Arrow Electronics, India, Managing Director Sanjeev Keskar explains this additional. He says, “If we import CKD kits of cell phones and solely carry out SMT meeting in India, it leads to lower than 10% of worth recognition, and to attain even that, we’re providing a 4% PLI incentive. In the long term, this technique shouldn’t be viable. As an alternative, we should shift our focus to ‘greater worth addition,’ which could be achieved by creating an area element manufacturing ecosystem contributing 40% of the worth, and investing in native IP and know-how improvement, which provides one other 30%.”

“We possess distinctive expertise in semiconductor chip VLSI and embedded electronics design. Nonetheless, a lot of this expertise is employed in captive design centres of worldwide corporations or design providers companies. Whereas we safe jobs, we regularly miss out on the mental property (IP) worth they create. Subsequently, it’s crucial to prioritise the success of Indian startups in chip and embedded electronics design along side creating a strong native element ecosystem. Relying solely on manufacturing CKD kits would show disastrous in the long term,” Keskar says.

Weighing within the elements

The proposed timeline for reaching the $300 billion goal is the monetary 12 months 2026—with the present price of home worth addition, 15-20% for cell phones and 25-30% for different digital elements. These numbers presently fall wanting the goal of 35-40% and 45-50% set by the PLI scheme for cell phones and digital elements.

Regardless that electronics exports and home consumption has elevated by 14% during the last six years, information from ELCINA exhibits that the Indian element trade continues to face direct and oblique alternative losses. The report collated information from the Ministry of Electronics and Data Know-how (MeitY) and ELCINA’s esitmates, exhibiting that $121 billion value of electronics gear was made in India in 2022-23. To satisfy this demand, $52 billion value of elements had been required however solely $3 billion value of elements had been produced domestically.

Keskar explains, “In any electronics product, elements contribute roughly 40% of the full worth, 25% for semiconductors, 10% for passives, connectors, and cables, and 5% for naked PCBs. With a projected $300 billion progress potential, the demand for passive elements and naked PCBs is predicted to succeed in round $30 billion and $15 billion, respectively, each of that are predominantly imported presently. In contrast to semiconductor fabrication labs, meeting, testing, marking, and packaging (ATMP) amenities, passive elements, and PCBs don’t require huge investments.”

International electronics merchandise rely closely on passive elements, accounting for about 48% of the elements, and lively elements comprise the remaining 52%. The Confederation of Indian MSMEs in ESDM and IT (CIMEI) Director-Common Jairaj Srinivas believes India can manufacture easy elements similar to transformers, capacitors, and transistors. “These elements don’t require intensive experience. By encouraging and supporting native manufacturing of those passive elements, India can create a self-sustaining ecosystem for the electronics trade and cut back dependence on imports, fostering home manufacturing,” he provides.

Presently, the federal government has launched the Scheme for Promotion of Manufacturing of Digital Parts and Semiconductors (SPECS) to help the manufacture of passive elements and the PCB sector. “Beneath this scheme, a 25% incentive on capital expenditure funding is obtainable for manufacturing these merchandise, following a reimbursement coverage. Nonetheless, there’s a want to change this scheme to encourage wider participation, together with MSME industries. With a projected $45 billion alternative within the subsequent 5 years, this sector holds immense potential and might considerably contribute to India’s electronics manufacturing capabilities,” Keskar provides.

Salvaging the squirming sector

The home electronics manufacturing sector is squirming to compete with the likes of Wistron and Foxconn, who, with their gargantuan sources, have arrange huge meeting items however proceed to import important electronics elements. Making a degree taking part in discipline for home producers by lowering the bureaucratic pink tape for infrastructure growth, boosting mental property (IP) creation and funding in analysis and improvement of embedded electronics merchandise can contribute to nearly 30% of the worth within the electronics trade.

Infrastructure

These alternatives could be availed to make sure the success of Indian MSMEs that design electronics merchandise in India and electronics design-as-a-service startups, by creating pathways to high quality infrastructure and entry to funding to determine enormous manufacturing amenities to compete with the trade behemoths.

In April 2020, the federal government of India introduced the Electronics Manufacturing Cluster 2.0 (EMC 2.0) Scheme to determine an entire ecosystem for ESDM manufacturing/manufacturing. Whereas many might welcome this transfer, the EMC 2.0 Scheme fails to offer particular particulars about whether or not it offers funding for meeting or manufacturing items. Srinivas says that below the scheme, CIMEI has signed an MoU with the Uttar Pradesh state authorities, requesting 500 acres of land from the federal government to arrange an entire electronics manufacturing ecosystem. As per the scheme, the federal government will bear the vast majority of the prices for land improvement and organising a standard facility centre.

“The production-linked incentive for the elements is but to be finalised. Nonetheless, we now have spoken to almost 15 corporations in Taiwan and China serious about organising their manufacturing items as three way partnership companions in India. Beneath this association, the Indian companion will maintain a 51% stake, and the international companion will maintain 49%. This ensures that India has a significant stake within the organisation, and manufacturing will happen inside the nation, thereby strengthening the provision chain and minimising disruptions, particularly in component-level manufacturing,” provides Srinivas.

“Passive elements account for about 48% of the elements, and lively elements comprise the remaining 52%. To foster home manufacturing, India can manufacture easy elements similar to transformers, capacitors, and transistors, which don’t require intensive experience.”

—Jairaj Srinivas, Director-Common, The Confederation of Indian MSMEs in ESDM and IT (CIMEI)

Analysis and Growth

One of many fundamental causes India’s neighbours accelerated their lead within the electronics revolution was the concentrate on creating technical capabilities. In distinction, India’s present spending on analysis and improvement within the MSME sector is barely 2.5%. Small companies usually battle to allocate funds for analysis and improvement resulting from restricted monetary sources. Regardless of having Centres of Excellence for various electronics domains and numerous incubation centres, the success price for startups and small companies working within the ESDM trade stays low.

To advertise collaborative efforts with respect to analysis and improvement, Srinivas suggests collaboration and engagement by corporations with substantial monetary sources and vital company social accountability (CSR) funds to put money into R&D initiatives. “These corporations can contribute to the event of frequent amenities centres and set up contract analysis organisations that cater to varied sectors, together with the ESDM sector and past. Small companies can entry analysis amenities with out incurring substantial prices via such analysis alternatives, thereby selling R&D actions,” he provides.

| Whereas manufacturing talents might take a while to develop, harnessing what’s in hand will help strengthen the sector. With many design homes and startups, incentivising design exercise in India via the Design Linked Incentive (DLI) scheme will appeal to home and world gamers within the semiconductor trade. The scheme offers monetary and infrastructural help to corporations organising fabs or semiconductor-making crops, encouraging innovation, lowering dependence on international producers, and boosting India’s place within the digital revolution.

The DLI scheme consists of three elements: Chip design infrastructure help. C-DAC will set up the India Chip Centre to offer state-of-the-art design infrastructure and facilitate entry to supported corporations. Product design linked incentive. Authorised candidates engaged in semiconductor design can obtain as much as 50% reimbursement of eligible expenditures, with a ceiling of ₹150 million per utility. Deployment linked incentive. Authorised candidates deploying semiconductor designs in digital merchandise can obtain an incentive of 6% to 4% of web gross sales turnover over 5 years, with a ceiling of ₹300 million per utility. Thus far, seven startups with product purposes starting from synthetic intelligence (AI) to vector processes and picture sensors have been authorised for funding. The scheme is a part of the $10 billion India semiconductor mission introduced by the federal government in 2021. |

The electronics elements market in India measures as much as $64.2 billion, of which a big quantity continues to be imported. To cut back dependency on imports and develop into really atmanirbhar within the ESDM sector, initiatives such because the design-linked incentive scheme, for MSMEs and startups, propel producers to extend home worth addition, in the end making a high-value-addition electronics trade and producing employment in electronics element manufacturing. Whereas the PLI schemes encourage investments within the sector, there’s a dire want to determine and deal with the elements trade in another way relating to incentives. Longer gestation interval and a smaller investment-to-sales ratio name for prolonged incentive intervals to make sure a optimistic return on funding in element manufacturing for traders. With practically 50% of worth addition within the element ecosystem, specializing in localised manufacturing can increase the nation’s total financial progress and resilience.

Whereas the Sony Walkman could also be lengthy gone and forgotten, we will definitely hope that quickly sufficient each smartphone can have the bulk, if not all, of the elements utterly manufactured, and never simply assembled, in India.

The writer, Yashasvini Razdan, is a Know-how Journalist at EFY