Two years in the past, Astra hailed its acquisition of satellite tv for pc propulsion startup Apollo Fusion as a strategic transfer that will spherical out its launch enterprise and produce professional engineers into the fold. However beneath Astra management, Apollo Fusion rapidly disintegrated, with nearly all of the unique workforce resigning, leaving few individuals to employees the one a part of the enterprise that had substantial buyer demand and the promise of income.

An August 14, 2023 settlement settlement between Astra and Apollo Fusion holders, LinkedIn information displaying an worker exodus, inner firm paperwork, in addition to interviews with a number of sources, exposes what’s going to possible turn out to be a canonical cautionary story on aerospace acquisitions. Astra didn’t reply to TechCrunch’s a number of requests for touch upon this story.

Astra was flying excessive in 2021 when it introduced its plans to amass Apollo Fusion. The corporate was busy iterating its Rocket 3 launch automobile and within the center of closing a merger with a particular goal acquisition firm, or SPAC, that will furnish the mixed firm with a struggle chest topping round $500 million.

“Turning into a public firm is the following milestone in our mission to enhance life on Earth from area,” Astra CEO Chris Kemp stated in a press launch in regards to the merger on the time. “This can scale our enterprise and make area extra accessible.”

The Apollo acquisition, introduced a little bit greater than a month earlier than Astra went public, seemed to be step one in a plan to vertically combine its core launch enterprise with area providers. When the SPAC was introduced, Astra stated it was going to develop a “modular spacecraft platform” for its rockets. A number of months later, Astra additionally filed an utility with regulators to deploy greater than 13,600 broadband satellites, so a spacecraft engine enterprise appeared smart. In Could 2022, the corporate advised traders it might “energy the area financial system” with its Astra constellation, launched on Astra rockets, in 2023. There was no subsequent public replace concerning this mission, and it has launched none to this point.

Behind the scenes, the mixture of the 2 corporations led to numerous issues.

“There have been no hires”

Astra’s inner group construction — and the way Apollo Fusion employees match into it — was one of many first areas that sowed discontent.

Like many aerospace corporations, Astra makes use of a “matrix” group chart, the place workers report back to a standard supervisor that’s vertically above them within the org chart, and a further individual, like a product supervisor who would possibly handle groups throughout many departments. When carried out effectively, matrix buildings facilitate collaboration throughout groups engaged on advanced initiatives. However when pace of execution is paramount, it will probably usually gradual decision-making and stop groups from executing rapidly.

One supply, who spoke to TechCrunch on situation of anonymity, described how, post-acquisition, not one of the Apollo Fusion workforce members continued to report back to Apollo CEO and co-founder Mike Cassidy. Nor did they report back to the identical few managers; as an alternative, they every reported to somebody completely different inside Astra’s group.

It was an “uncommon construction,” the supply stated, “that all the Apollo Fusion workers had been reporting to somebody completely different at Astra.”

Choice-making at Astra was additionally impaired by advanced budgeting and approval processes. There can be lengthy debates over choices like job titles and reporting buildings. In consequence, typically the propulsion workforce wouldn’t get components ordered rapidly sufficient, or they had been unable to rent individuals to work on the spacecraft engines, sources stated.

“It was a really schizophrenic factor the place a part of administration was saying, ‘We’ve to speculate, now we have to do nice issues with Apollo,’ however there was no funding there. [There were] no hires,” the identical individual stated, talking of the months after the acquisition closed.

Inside paperwork reviewed by TechCrunch seem to assist these claims. One doc lists numerous roles inside the spacecraft engine workforce, spanning engineering and operations, that will have to be crammed to ensure that Astra to stay to its supply schedule; sources with firsthand data say these went unfilled for months after the requested begin dates.

The string of power points bred frustration, finally resulting in all however two of Apollo Fusion engineers and employees leaving the corporate, LinkedIn information and interviews with a number of sources present.

These frustrations had been clear even to individuals outdoors the corporate, in keeping with one other supply who handled Astra and Apollo Fusion as a buyer. They described the way it turned more difficult to speak with the Apollo Fusion workforce post-acquisition, with Astra injecting its personal enterprise growth individuals, who knew comparatively little in regards to the product, into present relationships.

Apollo Fusion workforce members began planning their departures, the shopper stated, referring to what he heard instantly from these workers: “Individuals from Apollo Fusion had been basically planning their exits left, proper and middle, as quickly as they had been ready to take action financially.”

A separate supply stated Astra displayed little curiosity in retention. “There was little interest in holding expertise,” the supply stated whereas describing the spacecraft engine enterprise. “There have been loads of Apollo those that had been trying to parachute out and extra enthusiastic about getting out.”

“It’s necessary to recollect, with Astra, every thing is in regards to the rocket,” this supply continued. “[The spacecraft engine business] has all the time been a stepchild. It solely turned necessary final fall once they realized that was going to be the place the overwhelming majority of their income was going to come back from.”

As time went on, the in-space propulsion workforce shrank whereas the launch facet swelled, a problem that was compounded by Apollo Fusion members quitting and never being changed. Nearly all of the Apollo Fusion workforce had cleared out by October 2022, lower than 18 months after the acquisition closed. LinkedIn information exhibits that Astra finally misplaced practically each Apollo Fusion staffer, together with the engineers that took the spacecraft engine product from clear sheet to flight heritage.

“There have been fewer individuals engaged on [the spacecraft engine] a 12 months after the acquisition than earlier than the acquisition, as a result of among the Apollo individuals both left or they had been pulled in to work on [Astra’s satellite project],” the supply stated. “So there have been fewer individuals regardless that that enterprise was booming.”

The general public bought its first intimation that there could also be points between the 2 newly merged corporations on August 14, when Astra unexpectedly introduced it was getting into right into a settlement settlement with Apollo Fusion holders “to settle and resolve any and all precise or threatened disputes” over the acquisition. The agency representing Apollo holders within the settlement declined to reply TechCrunch’s questions in regards to the dispute, and there are scant particulars into the precise nature of the battle within the submitting Astra submitted to the U.S. Securities and Trade Fee, nevertheless it seems to be associated to performance-based funds entitled to Apollo shareholders following the shut of the deal.

Per the phrases, Apollo shareholders will possible stroll away with $7 million in money to settle its disputes — a steep drop from the as much as $95 million in cash-plus-stock performance-based earnouts the 2 corporations agreed upon again in 2021.

Sluggish deliveries, outpaced competitors

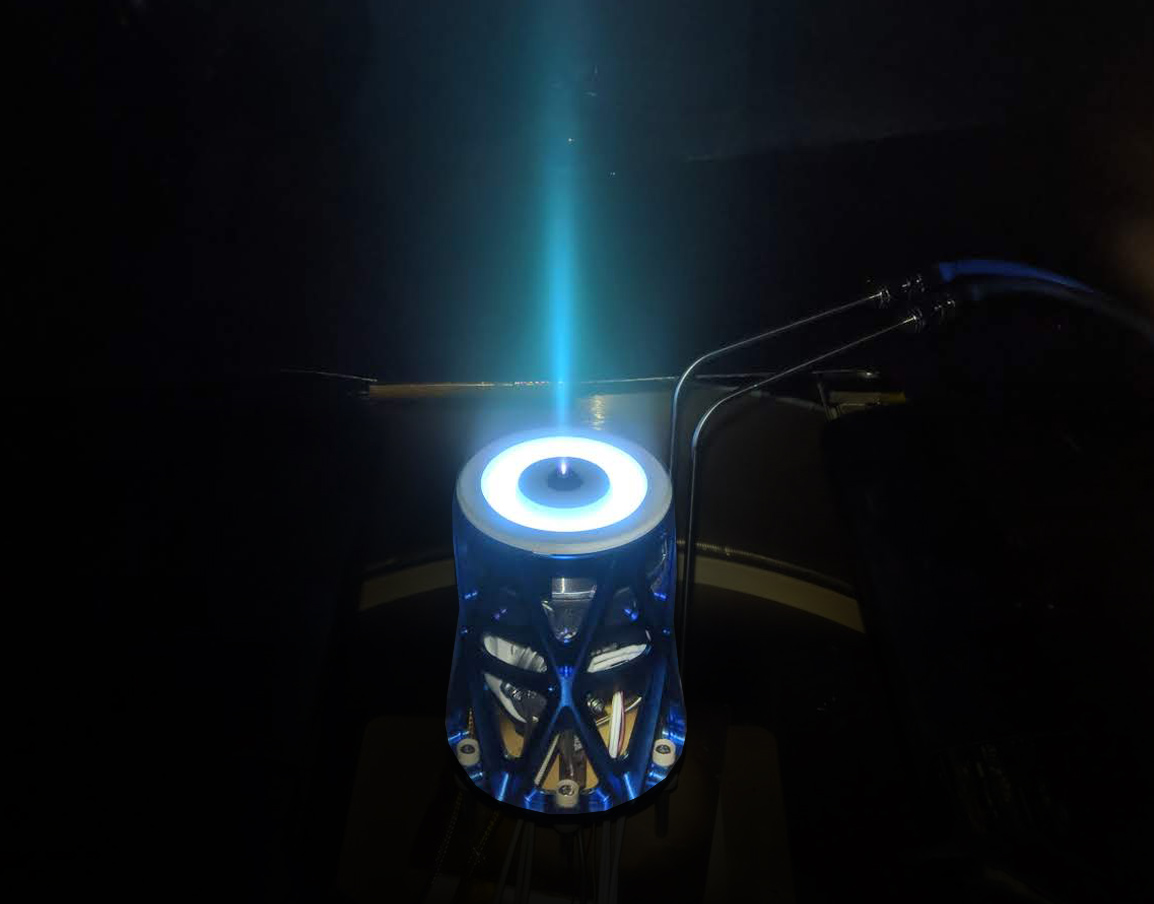

Two years on from the acquisition, the corporate has been gradual to ship spacecraft engine programs. Astra’s area programs enterprise pulled in $3.4 million in income in 2022 and simply $700,000 in income to date this 12 months (all of that made within the second quarter), in keeping with public statements. Astra says that it has a 278-engine backlog, value $77 million in income; assuming from these figures that every propulsion prices round $250,000, that will whole round 16 deliveries to this point.

To resolve this drawback, Astra just lately introduced that it might make a “strategic reallocation of its workforce,” reassigning 50 employees from its launch division to work on spacecraft engines. With this extra expertise, Astra stated “a considerable majority” of those orders are anticipated to be delivered by the top of 2024.

Nevertheless, inner paperwork considered by TechCrunch present that Astra supplied prospects with way more bold timelines. Within the fall of 2022, the corporate stated it was aiming to ship 42 propulsion programs every to Airbus and one other buyer by the top of 2023.

In a separate doc, Astra assured Earth statement agency Maxar that it might have delivered round 80 propulsion programs for different prospects by August 2023. Astra advised a separate buyer it might put 125 programs in area this 12 months.

It’s attainable that provider points or issues with prospects’ inner timelines contributed to the late schedules, however no matter contributing elements, it’s value noting simply how delayed the applications are: Astra anticipates delivering simply eight to 12 propulsion programs by the top of the third quarter of this 12 months, in keeping with its most up-to-date monetary steerage.

In distinction, different electrical propulsion suppliers have made important strides. Electrical thruster developer Busek now has greater than 100 programs working on-orbit for OneWeb; ExoTerra Useful resource gained flight heritage simply this month for its Halo Corridor-effect thrusters.

Astra appears decided to catch up, however they face numerous headwinds, together with a delisting discover from Nasdaq (which was prolonged for six months in April) and a quickly dwindling money reserve. The corporate stated it had $26.3 million of money and money equivalents as of the top of the second quarter this 12 months.

The corporate is presently “actively centered” on discovering traders for its launch and spacecraft engine companies, Kemp advised the media earlier this week.