Utilizing POWR Rankings together with technical and volatility evaluation to uncover excessive chance trades. Then use the leverage of choices to intensify the potential returns whereas decreasing the chance.

POWR Rankings determine one of the best shares utilizing a proprietary mannequin to place the odds of success in your favor. Since 1999, the very best A Rated POWR Shares have outperformed the S&P 500 by greater than 4X.

Pair that with in-depth technical and volatility evaluation. Then overlay it with the better leverage and far decrease price of choices and the facility will increase to a a lot greater diploma.

A not too long ago accomplished commerce on Caterpillar (CAT) might assist to supply additional perception into simply we glance to just do that within the POWR Choices service.

CAT was an A Rated -Robust Purchase- inventory within the POWR Rankings. It additionally was within the A Rated -Robust Purchase-Industrial Equipment Trade. Ranked very extremely at quantity 7 out of 78 inside the trade. Power throughout the board.

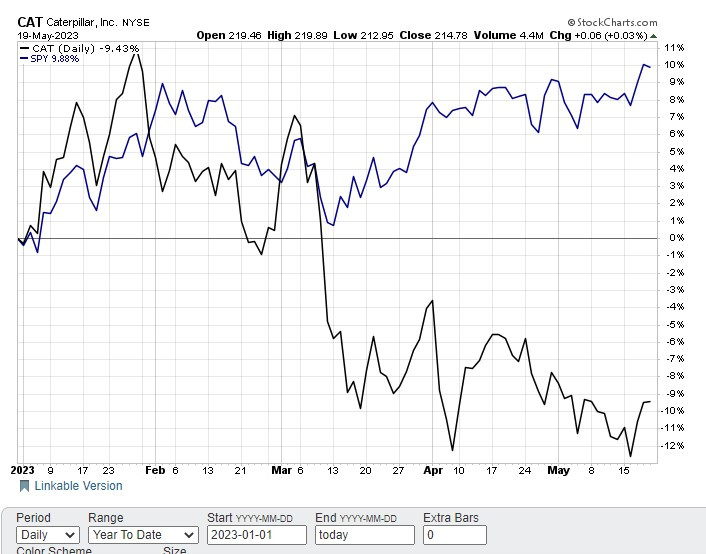

But, Caterpillar was a giant underperformer in comparison with the general market in 2023. The S&P 500 (SPY) had gained practically 10% whereas CAT had dropped over 9% thus far this 12 months. Observe how within the first two months of the 12 months the SPY and CAT have been rather more extremely correlated. (see chart beneath)

We anticipated CAT to begin to head larger and shut the comparative efficiency hole. A reversion again to a extra conventional relationship with the S&P 500 seen earlier to start out the 12 months was probably the most probabilistic path. Not a assure, only a larger chance.

Caterpillar was additionally starting to point out some power on a technical foundation. Shares had as soon as once more held the important $207 help stage. 9-day RSI and Bollinger P.c B bounced off oversold readings. CAT broke above the downtrend line and the 20-day transferring common. MACD generated a contemporary new purchase sign.

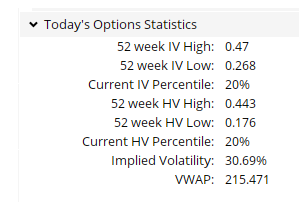

Caterpillar choices have been getting low-cost as nicely. Present implied volatility (IV) stood at solely the 20th percentile. This implies choice costs in CAT had been dearer 80% of the time over the previous 12 months.

On Could 22, POWR Choices entered a protracted name choice position-buying the August $240 calls at $4.00. It is a bullish commerce with an outlined threat of $400 per choice contract bought. Probably the most you’ll be able to lose is the preliminary premium paid.

Just a few weeks later (June 7), POWR Choices exited the CAT calls at $8.10. Internet acquire was $410 per contract, or simply over 100%, given the unique buy worth of $4.00 ($400) on Could 22.

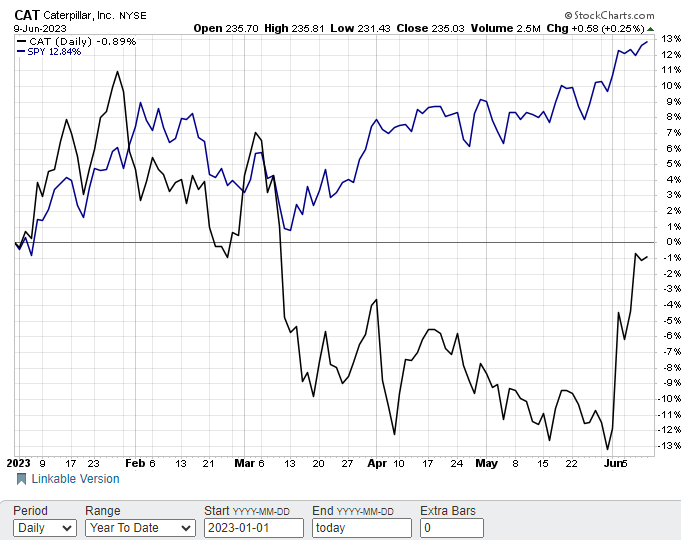

Why exit? The technicals had flipped from oversold to overbought and the comparative efficiency hole had converged.

Shares have been stalling out at main resistance close to $235. Bollinger P.c B hit an excessive nicely above 100. 9-day RSI exceeded overbought readings previous 70. MACD additionally was getting overdone. Shares have been now buying and selling at a giant premium to the 20-day transferring common.

The chart beneath reveals that CAT had made up loads of misplaced floor versus the S&P 500 (SPY). Whereas SPY did transfer larger by nearly 3% since Could 22, CAT had tripled that with a acquire of 9%.

This commerce highlights each the facility of the POWR Rankings and the facility of choices. Definitely, shopping for CAT inventory at round $215 on Could 22 and promoting it round $235 on June 7 would have been a pleasant commerce. Internet acquire would have been just below 10%. Shopping for 100 shares would have required $21,500 in money up entrance. Going absolutely margined nonetheless would have required $10,500. So not an inexpensive commerce.

Examine that to purchasing the August $240 name instead of the inventory.

The preliminary price would have been simply $400. Internet acquire would have been over 100%. So over 10 occasions the acquire with below 2% of the fee in comparison with the inventory commerce in CAT.

Combining the POWR Rankings with the POWR Choices methodology can present merchants with a strong, safer option to decrease the chance and enhance potential returns. For these taken with studying additional, you will discover out extra about POWR Choices by checking it out beneath.

POWR Choices

What To Do Subsequent?

In case you’re searching for one of the best choices trades for as we speak’s market, it’s best to try our newest presentation Tips on how to Commerce Choices with the POWR Rankings. Right here we present you tips on how to constantly discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you wish to be taught extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

Tips on how to Commerce Choices with the POWR Rankings

All of the Greatest!

Tim Biggam

Editor, POWR Choices E-newsletter

CAT shares closed at $235.03 on Friday, up $0.58 (+0.25%). 12 months-to-date, CAT has declined -0.89%, versus a 12.84% rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the complicated world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up How To Revenue By Combining The Energy Of POWR Rankings And The Energy Of Choices appeared first on StockNews.com