Did you discover how a lot the S&P 500 (SPY) moved this week on the varied employment reviews? That’s as a result of the well being of employment tells us lots concerning the well being of the financial system, doubtless future Fed actions and what that each one means for the inventory market. Learn on under for Steve Reitmesiter’s evaluation of the latest employment knowledge and the way that ought to impact inventory costs and your buying and selling plan.

All eyes have been locked in on the various employment reviews this week. That’s as a result of the state of jobs holds the important thing for the financial system…in addition to what’s prone to occur with future Fed fee choices.

Actually, you could possibly not have extra divergent info particularly as we evaluate the rip-roaring ADP report on Thursday versus the subdued Authorities model on Friday.

So, we now have a lot to debate at present on the labor entrance as to what it tells us about future Fed actions and the inventory market (SPY) outlook.

Market Commentary

On Thursday buyers couldn’t consider their eyes because the ADP Employment Change report confirmed a whopping 497,000 added. That was greater than 2X the anticipated end result.

This gave buyers a cause to hit the promote button as this end result was thought-about “too good”. That’s as a result of it sends a message to the Fed that the financial system is just too sizzling resulting in extra fee hikes on the way in which.

One other fascinating a part of this ADP report was seeing the +6.4% annual wage improve which is a sticky type of inflation that the Fed will not be going to love the sound of. With that the percentages for a fee hike on 7/26 jumped one other notch to 95% displaying that this can be very doubtless. Additional the percentages for a second hike by finish of the yr simply elevated to 50% from practically 0% likelihood a month in the past.

Hmmm…possibly buyers ought to begin taking the Fed at their phrase about future fee hike intentions as an alternative of making conspiracy theories like they’re bluffing.

Now let’s flip the web page to Friday morning the place we get the story of two jobs reviews. That’s as a result of the Authorities Employment scenario report was truly underneath expectations at simply 209,000 jobs added.

There isn’t any world during which each of those reviews might be true. One is correct and one is flawed concerning the employment traits.

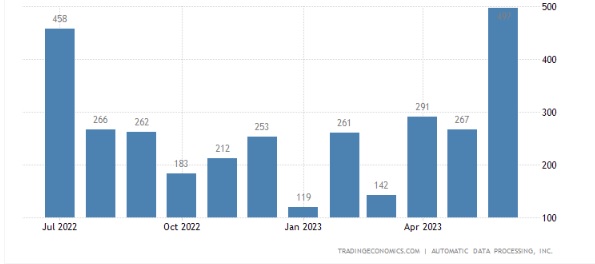

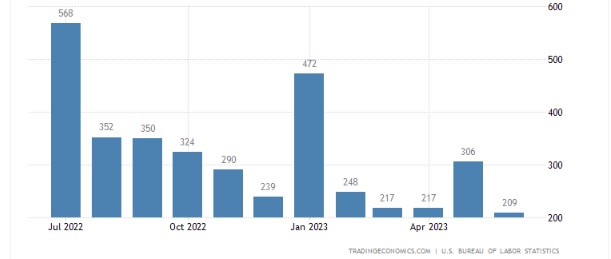

Traditionally I’ve discovered the ADP report back to be extra persistently dependable concerning the state of employment whereas the Authorities model is commonly topic to critical revision after the actual fact. But as you discover the month by month charts for every report under, the one logical conclusion is that ADP is flawed and Authorities is correct.

ADP Employment Change Month-to-month Previous Yr

Authorities Employment Scenario Month-to-month Previous Yr

The pattern of the Authorities Report is rather more in line with job provides mainly slowing all yr lengthy. This makes rather more logical sense in a world the place the Fed retains elevating charges to decelerate the financial system to tamp down inflation.

The one side that these reviews agree upon is that wage will increase are nonetheless too sizzling which is one thing that Powell has repeatedly centered on at his press conferences. Once more, there may be NO DOUBT that one other fee improve is within the playing cards for his or her assembly on 7/26.

Now let me add yet another ingredient to the financial system gumbo earlier than we focus on what all of it means for the market outlook and our buying and selling plans.

That may be a dialogue of ISM Providers which didn’t observe the trail of ISM Manufacturing falling into deep contraction territory. Actually, it rallied from 50.3 to 53.9 in June. Even higher was the New Orders element at 55.5 pointing to probably extra upside in future readings.

Add this all up, with clues from the Fed minutes, and you’ve got an financial system that’s amazingly resilient. Particularly on the employment facet. Whereas that is usually excellent news…that isn’t the case on this scenario provided that the Fed’s present mission is to decrease demand to win a battle versus inflation.

This latest information clearly reveals that extra fee hikes are on the way in which. And that will increase the percentages of future recession, however doesn’t assure that final result.

This all explains why shares are pausing at present ranges. Not a critical correction. Simply not chugging forward oblivious to the storm clouds off within the distance.

What many bulls are relying on is {that a} recession might by no means actually come collectively due to all the parents who chosen early retirement throughout Covid. This is the reason the labor market is so sturdy as a result of there are actually 2-3 million much less individuals in search of jobs resulting in traditionally low unemployment fee and creating ample stress on employers to offer raises.

That is an fascinating juxtaposition versus the Fed who desires to stamp out inflation with wage will increase being one of many stickier components. This is the reason so many market commentators, like Steve Liesman at CNBC, is speaking concerning the Consumed objective mountaineering charges “till one thing breaks”.

Clearly the important thing factor that should break is employment to provide much less earnings within the financial system which begets decrease spending. This motion would tame essentially the most persistent type of inflation in wages.

So who’s going to win this battle: Market Bulls vs. the Fed?

For me the basic logic nonetheless factors to future recession (like within the subsequent 12 months) with return of the bear market. BUT it’s not a forgone conclusion. Nor ought to we low cost the clearly bullish worth motion.

The answer is to tackle a balanced funding strategy nearer to 50% lengthy the inventory market. Then regulate extra bullish or bearish as new information roll in.

Only a few information will matter this month outdoors of the 7/26 Fed assembly adopted by the early August set of reviews like ISM Manufacturing, ISM Providers and Authorities Employment. Even the 7/12 CPI and seven/13 PPI inflation reviews will barely transfer the needle as it’s already assumed that inflation is just too excessive forcing the Fed to lift charges as soon as once more.

The most effective assumption is that the market will consolidate round latest highs with an opportunity of modest pullback creating a brand new buying and selling vary. This pause will finish as buyers digest the subsequent spherical of knowledge that helps higher decide the percentages of future recession…and thus path of the market.

I’ll do my finest to share well timed insights on that info because it is available in together with acceptable modifications to our buying and selling technique. Once more, I do lean bearish given the information in hand…however very happy to get bullish if that’s what logic dictates.

What To Do Subsequent?

Uncover my full market outlook and buying and selling plan for the remainder of 2023. It’s all out there in my newest presentation:

2nd Half of 2023 Inventory Market Outlook >

Simply in case you’re curious, let me pull again the curtain a bit of wider on the principle contents:

- Overview of…How Did We Get Right here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case extra doubtless)

- Buying and selling Plan with Particular Trades Like…

- Prime 10 Small Cap Shares

- 4 Inverse ETFs

- And A lot Extra!

If these concepts enchantment to you, then please click on under to entry this important presentation now:

2nd Half of 2023 Inventory Market Outlook >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares rose $0.24 (+0.05%) in after-hours buying and selling Friday. Yr-to-date, SPY has gained 15.54%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Jobs Market vs. Inventory Market? appeared first on StockNews.com