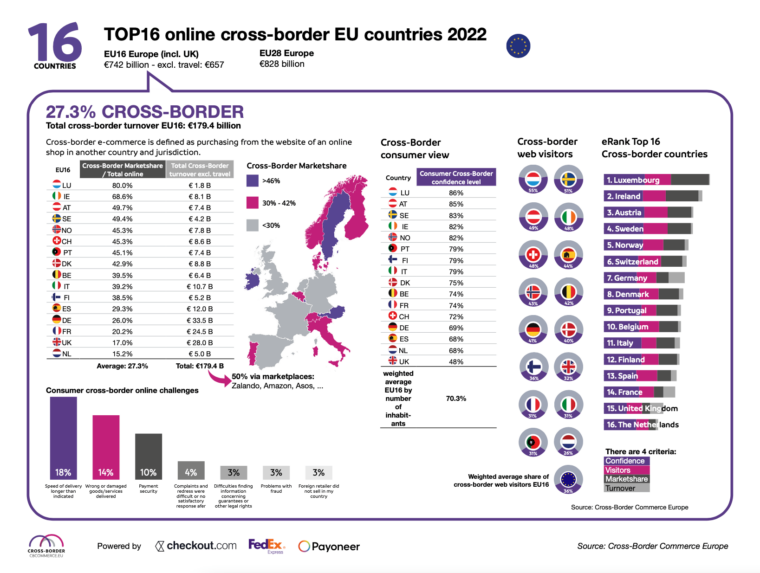

When it comes to cross-border market share, in comparison with the entire on-line market, Luxembourg is the highest 1 cross-border nation in 2022. Its cross-border market share is 80 p.c. The nation’s complete cross-border turnover was 1.8 billion euros.

The information comes from the most recent Prime 16 on-line cross-border EU international locations, which is printed yearly by Cross-Border Europe. The examine compares the turnover of on-line cross-border gross sales inside Europe. The whole on-line cross-border turnover in Europe was price 179.4 billion euros in 2022. The examine additionally compares the nation’s cross-border market share, cross-border client confidence and the share of cross-border internet guests.

Prime 16 on-line cross-border EU international locations in 2022

The highest 16 international locations are:

| 1 | Luxembourg |

| 2 | Eire |

| 3 | Austria |

| 4 | Sweden |

| 5 | Norway |

| 6 | Switzerland |

| 7 | Germany |

| 8 | Denmark |

| 9 | Portugal |

| 10 | Belgium |

| 11 | Italy |

| 12 | Finland |

| 13 | Spain |

| 14 | France |

| 15 | United Kingdom |

| 16 | The Netherlands |

Cross-border confidence stage 86% in Luxembourg

Luxembourg ranks as the highest cross-border nation due to its giant market share (80 p.c). Moreover, the buyer cross-border confidence stage may be very excessive (86 p.c). It additionally has a considerable amount of cross-border internet guests. In line with the report, customers actively interact in cross-border procuring on platforms like Zalando, Asos, Veepee, FNAC and Amazon (.de and .fr).

UK has highest cross-border turnover

Whereas the rating takes on-line cross-border turnover under consideration, the market share weighs heavier. For instance, the UK has the very best cross-border turnover with 28 billion euros. Nonetheless, the market share is considerably decrease than the opposite international locations, with 17 p.c.

The UK generated a cross-border turnover of 28 billion euros.

The Netherlands takes the final place within the rating. Its cross-border market share is 15.2 p.c. This quantities to five billion euros. Which means Dutch customers don’t purchase items from cross-border on-line shops that usually. This may be attributed to the presence of robust native shops, like Bol.com, Coolblue, Wehkamp and AH. When Dutch customers do resolve to buy cross-border, they typically flip to Zalando.