Final week 3D Printing Trade revealed an replace on the Stratasys, 3D Programs, Nano Dimension, and Desktop Metallic merger and acquisition exercise.

Among the many sources for that article have been a number of reviews produced by analysts on the M&A exercise.

Nano Dimension’s Chairman and CEO has written to supply a response; particularly, Yoav Stern addresses the report produced by Lake Road Capital. His e mail is quoted beneath.

Yoav Stern begins by responding to the chance of the Nano Dimension tender finishing.

E-mail from Yoav Stern

“The success within the Tender of Nano to purchase 51% of Stratasys will not be depending on,” on upcoming Israeli courtroom selections relating to the legality….of Nano shareholder vote to take away a number of board and administration group members.”

There’s an Israeli Court docket (which is dealing with that challenge of “vote legality”) resolution, publicly revealed, from April sixteenth, 2023, part 110 ( hooked up) that states clearly that “Nano Dimension is allowed to run its enterprise within the unusual course together with M&A transactions and particularly together with finishing the Stratasys Transaction”

“The analyst urges Nano to understand that institutional traders don’t help their try to accumulate Stratasys.” That is completely inaccurate. We spoke with at the least 25 completely different institutional and different shareholders of Stratasys, and most of them have been able to help our tender – topic to a value adjustment up – to be larger than $18.

“Previous makes an attempt seen as not critical because of the massive unfold between the supplied and buying and selling value of Stratasys’ inventory”. This once more is completely inaccurate as a result of after we tendered the primary time at $18 at finish of Could 2023, the share was traded at lower than $14 and it went up following our tender. Since then, now we have elevated it to $20.05

“A merger between Stratasys and Nano will not be anticipated to yield the identical scale efficiencies as potential mergers with Desktop Metallic or 3D Programs would.” And elsewhere, Jensen is quoted as claiming the Nano is just an SMT firm with no success of its AME enterprise.

To cite our monetary statements and information releases:

Nano Dimension:

Income

- 2020- approx. $5M

- 2021- approx. $10M

- 2022 – $43.4M

- 2023 – run charge of $60M (based mostly on Q1/2023)

Gross Margin – 47% (2023)

Nano has 7 product traces – all built-in – and all promoting to the identical vertical markets like Stratasys.

AME machines (over 45 clients, 5-7 Western Armies, 4-5 Western Secret Providers, 5 largest Protection Contractors, House clients, and extra civilian clients).

AM ceramics and metallic (DLP) machines (approx. hundred machines bought).

AM micro-mechanic polymers (DLP) machines (Machines bought to Western Secret Providers and Half Producers).

Additive Digital Meeting Machines (hundreds of machines bought)

AI – Deep Studying High quality Algorithm Engines for Nano’s AM and different corporations’ industrial purposes.

Ink Programs and Software program for 2D-3D printing sub-systems.

Supplies improvement and manufacturing for Additive electronics.

What does the way forward for 3D printing for the subsequent ten years maintain?

What engineering challenges will have to be tackled within the additive manufacturing sector within the coming decade?

To remain updated with the most recent 3D printing information, don’t overlook to subscribe to the 3D Printing Trade publication or comply with us on Twitter, or like our web page on Fb.

When you’re right here, why not subscribe to our Youtube channel? That includes dialogue, debriefs, video shorts, and webinar replays.

Are you searching for a job within the additive manufacturing business? Go to 3D Printing Jobs for a choice of roles within the business.

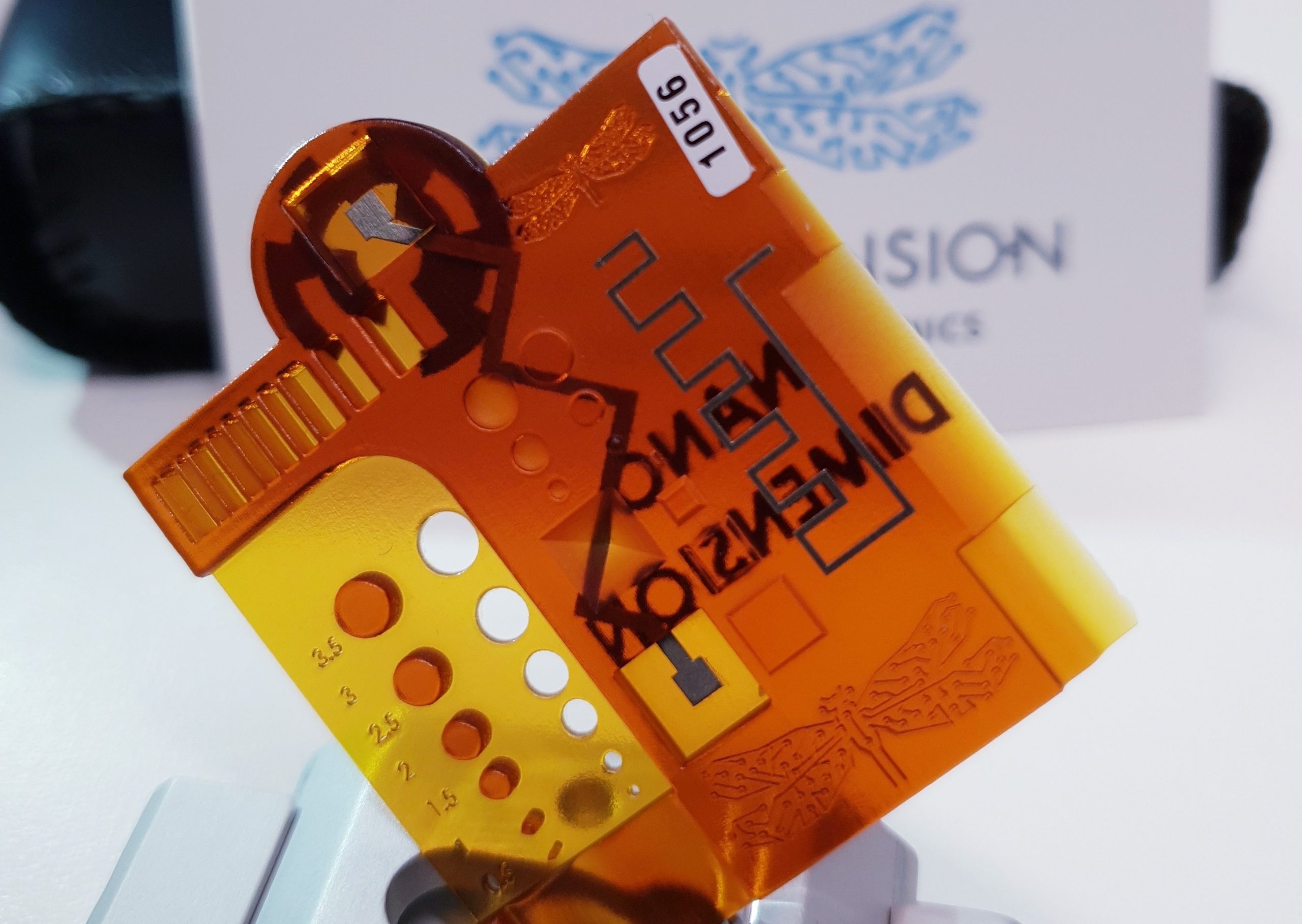

Featured picture reveals additive manufactured electronics (AME) produced utilizing considered one of Nano Dimension’s DragonFly machines. Picture through Nano Dimension.