Inclusive monetary companies

For a lot of, entry to monetary companies like credit score is important for autonomy and financial freedom. Nonetheless, the credit score system’s inflexible classes and controls miss some shoppers. In line with a TransUnion 2022 international research, 8.1 million individuals within the U.S. (3% of adults) are thought-about credit score unserved, and one other 37 million are thought-about credit score underserved (14% of adults); in Canada, 9.6 million individuals are both credit score unserved or underserved, greater than 30% of adults.

Techniques that consider client knowledge could be fraught with biases. Within the UK, the Monetary Conduct Authority (FCA) discovered particular person credit score data is considerably totally different throughout its three giant credit score reference companies (CRAs). It studies comparatively low understanding about credit score amongst shoppers, and located it’s troublesome to entry credit score data, or to lift disputes.

Equally, a 2015 U.S. Shopper Monetary Safety Bureau (CFPB) research checked out “credit score invisibles” —people with no credit score or a restricted credit score historical past who’re much less more likely to be accredited for loans primarily based on the information offered by the three nationwide credit score reporting companies (NCRAs). The CFPB concludes this bias disproportionately impacts Black and Hispanic monetary shoppers.

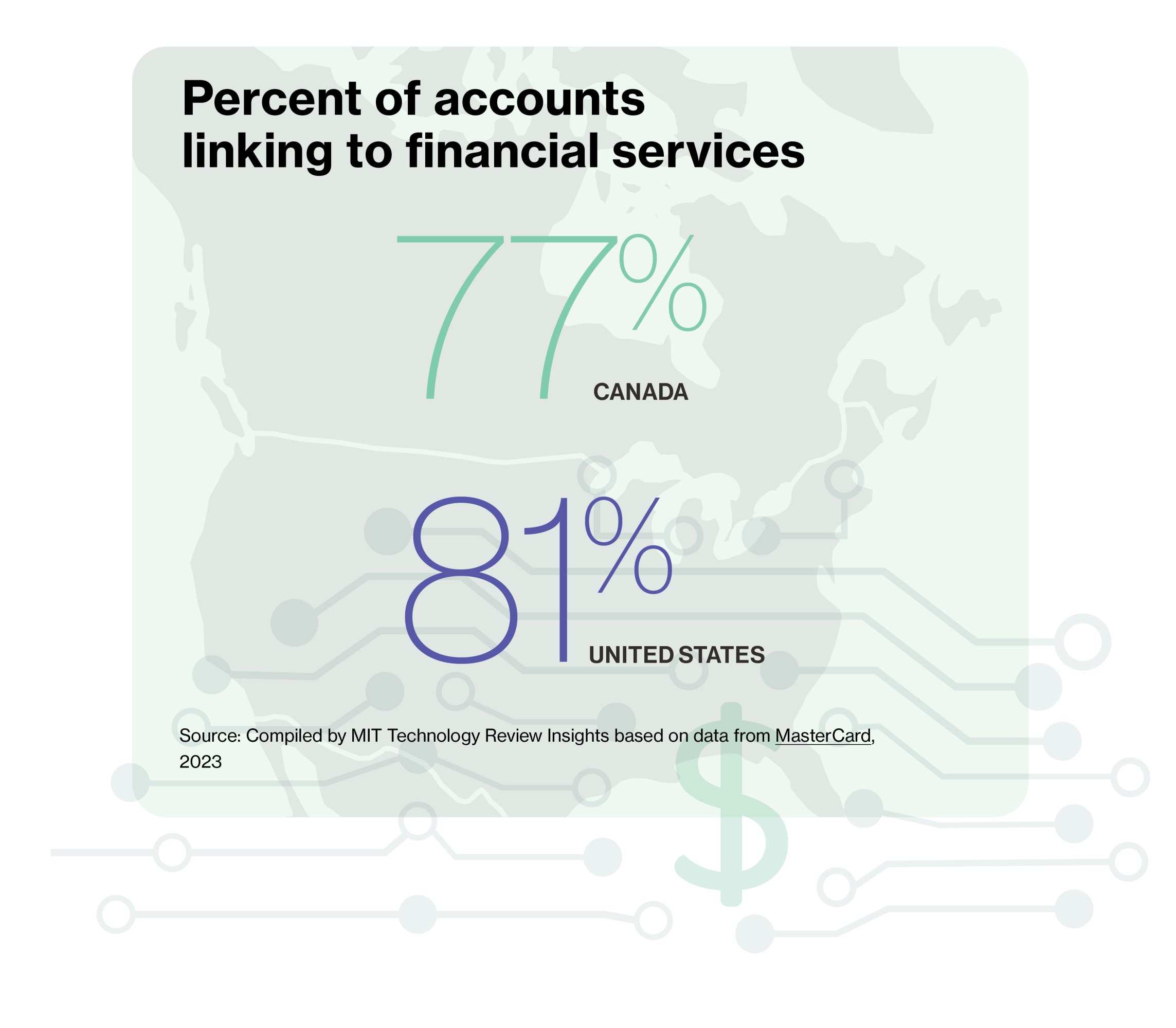

Immigrants encounter bias in credit score rating calculations as nicely. Raja Chakravorti, common entry lead at monetary companies firm Plaid, says Honest Isaac Corp-oration (FICO) rating calculations don’t constantly pull knowledge correctly throughout borders, one thing he hopes open finance will help repair. “One of many hopes and benefits of open banking or open finance is that we’re creating extra of that constructive trajectory, and over time, monetary companies would turn out to be extra inclusive,” he says.

Chakravorti says conventional credit score bureau knowledge just isn’t the one technique to discover out whether or not a client is an efficient monetary danger. Alternate knowledge—similar to investments, loans, utility funds, and subscription funds—can present an individual’s monetary conduct and in addition point out monetary well being, he says. How a client manages private funds, like paying payments on time and constantly, can present how probably they’re to satisfy monetary tasks, he says.

This content material was produced by Insights, the customized content material arm of MIT Know-how Evaluation. It was not written by MIT Know-how Evaluation’s editorial employees.