Mid-September greetings from Missouri, the place fall is starting to interrupt out. The shut of the Royals season is coming quickly (opening pic), soccer is again (though the Chiefs’ opening recreation left a lot to be desired) in addition to apple cider, pumpkins, and the brand new iPhone 15. Apple’s new flagship product began pre-orders on Friday and hits most retailer cabinets subsequent weekend. We’ll contact on how every provider is advertising the brand new gadgets in subsequent week’s Interim Temporary and embody our newest tackle backlogs by mannequin and reminiscence (right here’s our first tackle Apple iPhone 14 availability from September 2022). We expect demand shall be stronger than expectations, significantly for the Professional and Professional Max. And we expect cable performs an even bigger position than ever within the iPhone 15 launch success.

However Apple’s system launch was not the one newsworthy merchandise since Labor Day. We now have inventory buyback and dividend bulletins, spectrum purchases, resolved programming disputes, FTC trial opening arguments, and far, far more. Now that the Briefer is part-time at Fastwyre, the information cycle explodes – how handy!

This week, we discover two long-standing assumptions (cable’s perpetual broadband dominance and T-Cellular’s perpetual challenger standing) and query whether or not both is appropriate.

As talked about within the final Temporary, we’ll proceed with our each different week format (interim Temporary format will proceed to be posted on-line) besides throughout earnings season after we may have weekly Briefs and day by day posts on the Sunday Temporary web site.

The fortnight that was

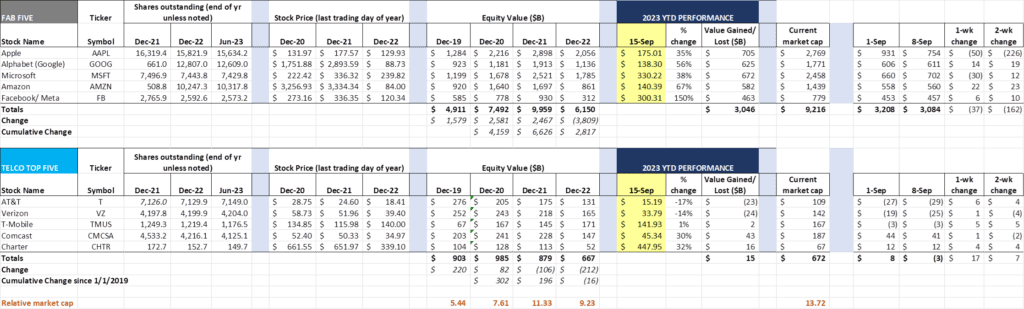

During the last two weeks, the Fab 5 have misplaced $162 billion in market capitalization whereas the Telco High 5 have gained $7 billion. The $162 billion loss consists of a $226 billion lower in Apple’s market capitalization offset by small ($64 billion) features by every of the opposite Fab 5 holdings. The $7 billion is made up of modest features from T-Cellular, AT&T and Constitution offset by small losses in Verizon and Comcast.

By means of the primary 8.5 months of 2023, the Fab 5 have gained $3.05 trillion, offsetting 80% of 2022’s $3.81 trillion loss. Lengthy-term holders of any of those equities are nonetheless smiling, and the prospects for continued development are excessive. As we mentioned in a earlier Temporary, the web debt ranges for every of the Fab 5 firms are nonetheless very wholesome (solely Amazon has a constructive internet debt quantity and it’s a measly $3.2 billion – the opposite 4 have destructive internet debt ranges). The one factor that may dent the long-term prospects of any of those firms is a coordinated world effort to limit their success by means of elevated regulation and authorized scrutiny.

Google is the present goal of US authorities consideration. This week, the Division of Justice and 38 states started their trial towards the Mountain View behemoth, alleging that their offers with cellphone producers (primarily Apple and Samsung) and telecom carriers to realize distinguished if not unique browser positioning on smartphones was unlawful. There’s a number of nice protection of the trial right here from The New York Instances.

Judging from the primary few days of the trial, this argument goes to be tough to win, and even when they do, the treatment is even trickier. The federal government should show that Google prevented Apple from that includes the Safari browser on iPhones (and Samsung from their home-grown browser on their telephones). Remember that throughout a part of the timeline in query, then Google CEO Eric Schmidt sat on the Apple Board of Administrators (August 2006-August 2009).

Throughout a Monetary Instances interview in 2013 (captured right here by CNET, an trade publication), Schmidt particularly said that his resignation from the Apple Board was not because of browser competitors (Safari vs. Chrome), however for cellular working system competitors (iOS vs. Android). Per the article – “Apple didn’t thoughts the Chrome vs Safari points,” recollects Schmidt, “however they actually did thoughts the iOS vs Android points.”

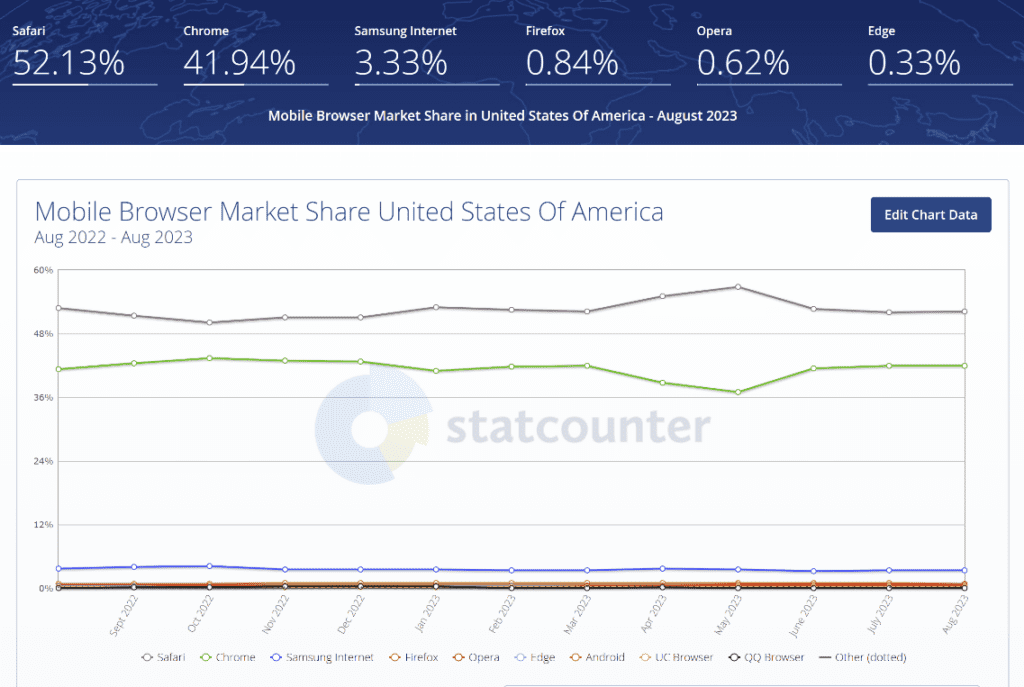

What’s most fascinating to us is that, even with the assertions made by the DOJ within the trial, Google Chrome just isn’t the dominant browser within the US Cellular market per Statcounter:

Chrome is at the moment #2 in cellular browser market share (though they’re #1 by 20%+ factors throughout all platforms). The argument that “shopping for their manner” into the cellular market resulted in monopolistic cellular browser market share just isn’t supported by present knowledge (assuming Statcounter is appropriate). If something, the info reveals a duopoly that carefully correlates to cellular working system market share. Equally, Apple’s iPad defaults to their Safari browser, and, in consequence has a barely increased market share than Chrome.

The federal government may need a stronger case in different areas corresponding to promoting, however even there, Fb/ Meta and Amazon are making nice strides towards their bigger competitor (and conventional print and media promoting remains to be going sturdy) – promoting is extra dynamic than it was a decade in the past as a result of of Google. Or they could make the argument that Google someway prevented Blackberry, Palm, and Sybmian working platforms from succeeding (which might be one of many best items of revisionist historical past ever concocted – Blackberry killed itself by means of it’s closed platform and wanted no assist from Silicon Valley). Backside line: Whereas there could be an intriguing story and a few further historic insights revealed over the remaining 9 weeks of the trial, present cellular browser market share reveals that Google just isn’t the dominant participant and that funds to Verizon, AT&T, T-Cellular, Apple, and Samsung didn’t catapult them into dominance.

In the meantime, we’ll seemingly see the authorized arguments from the FTC and DOJ pertaining to Amazon’s dominance over third-party sellers on its Market platform. Per the Wall Road Journal (article right here), “The lawsuit will goal a variety of Amazon’s enterprise practices, corresponding to its Success by Amazon logistics program and pricing on Amazon.com by third-party sellers, among the folks mentioned. The lawsuit will recommend that Amazon makes “structural cures” that might result in a break up of the corporate.”

If the DOJ motion towards Google turns up the antitrust warmth to 400 levels, the FTC lawsuit towards Amazon seems to be a full broil. We’ll withhold commentary on the prognosis of the go well with till it’s filed, however it seems that the treatment sought is far more extreme than “lookback” fines and minor course of adjustments of the previous.

Similar because it ever was (3Q earnings preview – Half 1)?

The thesis of third quarter earnings is “Similar because it Ever Was.” For these of you not attuned to the choice but standard Eighties rock band The Speaking Heads, that they had a success known as “As soon as in a Lifetime” (hyperlink is to the official video – the phrase “Similar because it Ever Was” permeates the tune). As they fought typical knowledge by means of their music, we’re going to current a couple of unconventional views of trade dynamics, beginning this week with cable and ending with T-Cellular.

Similar because it Ever Was #1: Cable will proceed to dominate the broadband panorama. Competitors shall be fleeting as Comcast, Cox, and Spectrum use promotional pricing to thwart fiber and glued wi-fi.

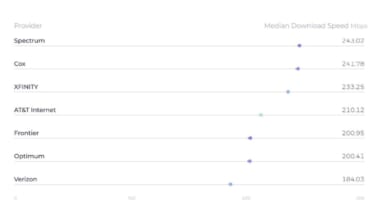

Cable is in a tricky spot – they take pleasure in majority (typically dominant) broadband market share of their markets, delivering towards the DOCSIS 3.1 normal, and, utilizing Ookla knowledge as a information, largely successful the pace wars (see close by chart for obtain pace rankings as of September 1).

However there are cracks in cable’s authentic formulation concocted over twenty years in the past. At the moment, their technique was to get rid of some other wire into the home however the coax cable. Copper needed to go, and, with video and broadband already traversing the present coax, the triple-play (together with residence cellphone) started.

It was probably the most profitable market share seize within the historical past of telecom, leading to 20-30% share of whole properties handed in lower than 5 years. The telcos didn’t know what hit them, and had been compelled to reply with satellite tv for pc alliances (or worse, U-verse TV) and the corresponding reseller economics. Cable peaked at round 35% of buyer properties on their triple play supply in 2016 (per Constitution’s 2Q earnings launch from that 12 months right here – word that single play was simply above 38% of the bottom and triple play was at 35%. Apparently, Comcast’s triple play determine was over 36% in 2Q 2016 with single play at 30% – particulars right here).

Now the tables are turned. Cellphone just isn’t solely not desired, cellular service has taken its place. Video, particularly for Constitution, has turn out to be a value albatross for the corporate. The latest settlement with Disney (announcement right here) helps, particularly as they put together to launch Xumo in a month or so (see article from Mild Studying on Xumo’s position with Constitution video right here), however jettisoning eight minor channels gained’t materially assist the gross margin of their product lineup. And with elevated fragmentation, Constitution will have the ability to introduce skinner bundles, however they nonetheless begin with a $23/ mo. broadcast surcharge in lots of markets. Video is their legacy, however different choices (together with ones provided over Xumo) are crowding out the set prime field.

With cellphone on life assist and video transitioning to a brand new distribution enterprise mannequin (though nonetheless leveraging the HFC plant into the house), the place does that depart the corporate with respect to “proudly owning the house?” The corporate line is “Wi-Fi is the first knowledge and voice distribution inside the house for cellular, and our Wi-Fi rocks. We provide competitively priced cellular providers that leverage Verizon’s community.”

Let’s evaluate the state of affairs to Constitution’s entry into Digital Cellphone. Competitors for cellphone providers was from a) the the incumbent phone and DSL supplier, and b) over-the-top suppliers like Vonage, MagicJack or Ooma. Wi-fi substitution elevated in recognition as limitless plans had been launched and protection improved all through the 2000s.

Evaluate that state of affairs to the bevy of wi-fi alternatives that exist for $30 for two strains:

This checklist is admittedly small, and there are a lot of extra (together with Easy Cellular and Metro by T-Cellular) that begin with limitless at $35/ month, however the backside line is that cable doesn’t “personal” the $30 value level by any stretch. Given feedback by T-Cellular and others at latest analyst conferences, it seems that lots of cable’s gross additions are coming from the pay as you go (learn: keen to change) world.

That leaves quite a bit on broadband’s shoulders. Right here’s the economics of Spectrum’s plan with and with out promotion in comparison with AT&T retail (fiber + cellular), Verizon retail (fiber + cellular), and T-Cellular retail (mounted wi-fi + cellular):

| Plan | Promotion | Put up-promotion |

| Spectrum One | $49.99/mo | $114.99/mo |

| AT&T (with cellular low cost) | $100/mo | $100/mo |

| Verizon (right here and right here) | $89.99/mo | $89.99/mo |

| T-Cellular US (right here and right here) | $115/mo | $115/mo |

As a result of the bottom tier obtainable for the T-Cellular plan is Magenta Max, the $115 contains Apple TV+ and Netflix normal tier (480p, one TV) in addition to a full 12 months of AAA. We aren’t fairly certain find out how to make that an apples-to-apples comparability so leaving the bundle package deal as charged.

General, the pricing is $1,980 over two years for Spectrum One. For Verizon (Fios + Limitless Plus), that value can be $2,160. For AT&T, that value can be $2,400 and for T-Cellular (with above caveats) that might be $2,760. After the third 12 months, AT&T and Verizon are almost the identical value.

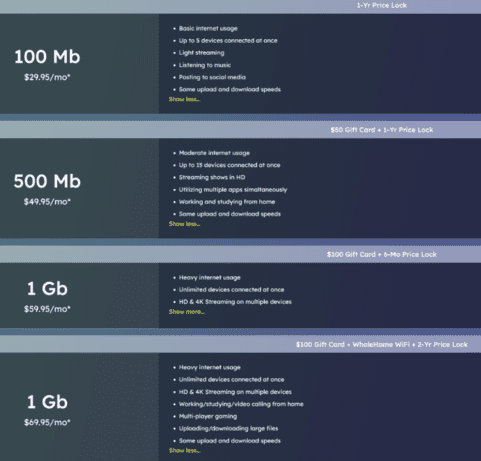

Add in MetroNet, a big fiber supplier that competes with Constitution in Ohio, who affords the charges within the close by desk. For a one-year value lock, a MetroNet buyer may get greater than 50% extra extra bandwidth (500 Mbps). MetroNet + Seen can be $75/ mo. for the primary 12 months, after which $85/ mo. after that, barely lower than Spectrum on the 24-month comparable mark.

Backside line: Constitution (and Comcast) have an incredible and precious cellular product, but it surely’s not the “no brainer” in a bundle that the Triple Play was 15-years in the past. Fiber suppliers corresponding to Greenlight (upstate NY), Allo (Nebraska), Frontier (New York, Florida, Texas), Fastwyre (Missouri) and AT&T (California, Texas, Florida) have newer plant and compelling stand-alone value factors.

Similar because it Ever Was #2: T-Cellular will proceed to develop and dominate value management, extending their un-carrier habits for the forseeable future. This may drive elevated capital wants, decreasing the supply of money for shareholder-friendly inventory buybacks and dividends.

We fully missed the magnitude and dimension of T-Cellular’s post-Labor Day annoucnement (right here). It consisted of the next factors:

- The present $14 billion share repurchase settlement has been accomplished;

- The T-Cellular Board accredited a brand new $15.25 billion share repurchase settlement that ought to full by the tip of 2024;

- As well as, T-Cellular can pay a complete of $3.75 billion in dividends to shareholders (50+% of this to Deutche Telekom, the bulk shareholder of T-Cellular USA) beginning with a $750 billion cost in 4Q 2023.

We weren’t shocked by the second share buyback and almost hit the mark on the general determine (our estimate was $17 billion in sharebuybacks and no dividend). We’re shocked by T-Cellular’s perceived must have a dividend (albeit lower than a 2% yield), and don’t assume that they achieve a bigger share of development + earnings consumers in consequence.

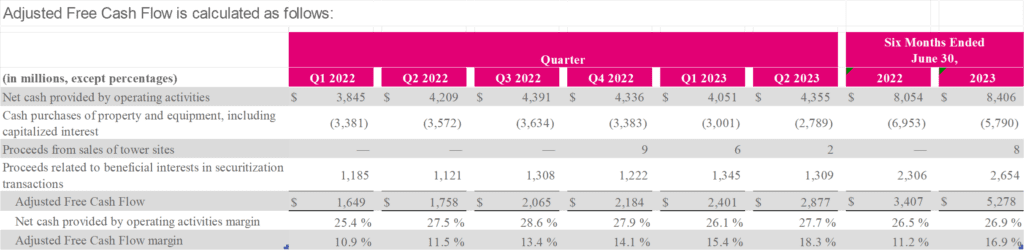

As most Sunday Temporary readers are conscious (Temporary right here from February), T-Cellular has a really brilliant money move future in entrance of it. Right here is their free present money move development (schedule obtainable right here):

Having seen AT&T and Verizon succumb to ever-increasing dividends, and understanding the general tax inefficiencies of dividends versus share repurchases, we that this technique is inaccurate. Even with the terrific 600 MHz spectrum buy from Comcast introduced this week (a sensible transfer by each firms – announcement/ weblog submit right here from Tom Nagel at Comcast), in addition to rumors in Bloomberg that T-Cellular is about to leap into the residential fiber recreation (one other game-changing transfer we applaud if true), the dedication and expectations created by an ever-increasing dividend feels very very like an incumbent provider transfer.

Backside line: T-Cellular is doing a number of nice issues. Establishing a dividend just isn’t certainly one of them.

In two weeks, we’ll conclude the “Similar as is Ever Was” collection with a have a look at Verizon and AT&T. Till then, when you have mates who want to be on the e-mail distribution, please have them ship an e mail to [email protected] and we’ll embody them on the checklist (or they will enroll straight by means of the web site). Go Royals, Sporting Kansas Metropolis, and Tremendous Bowl champion Kansas Metropolis Chiefs!