Citadel founder and CEO Ken Griffin had some free recommendation for an at-capacity crowd of MIT college students on the Wong Auditorium throughout a campus go to in April. “If you end up in a profession the place you’re not studying,” he advised them, “it’s time to alter jobs. On this world, if you happen to’re not studying, you could find your self irrelevant within the blink of a watch.”

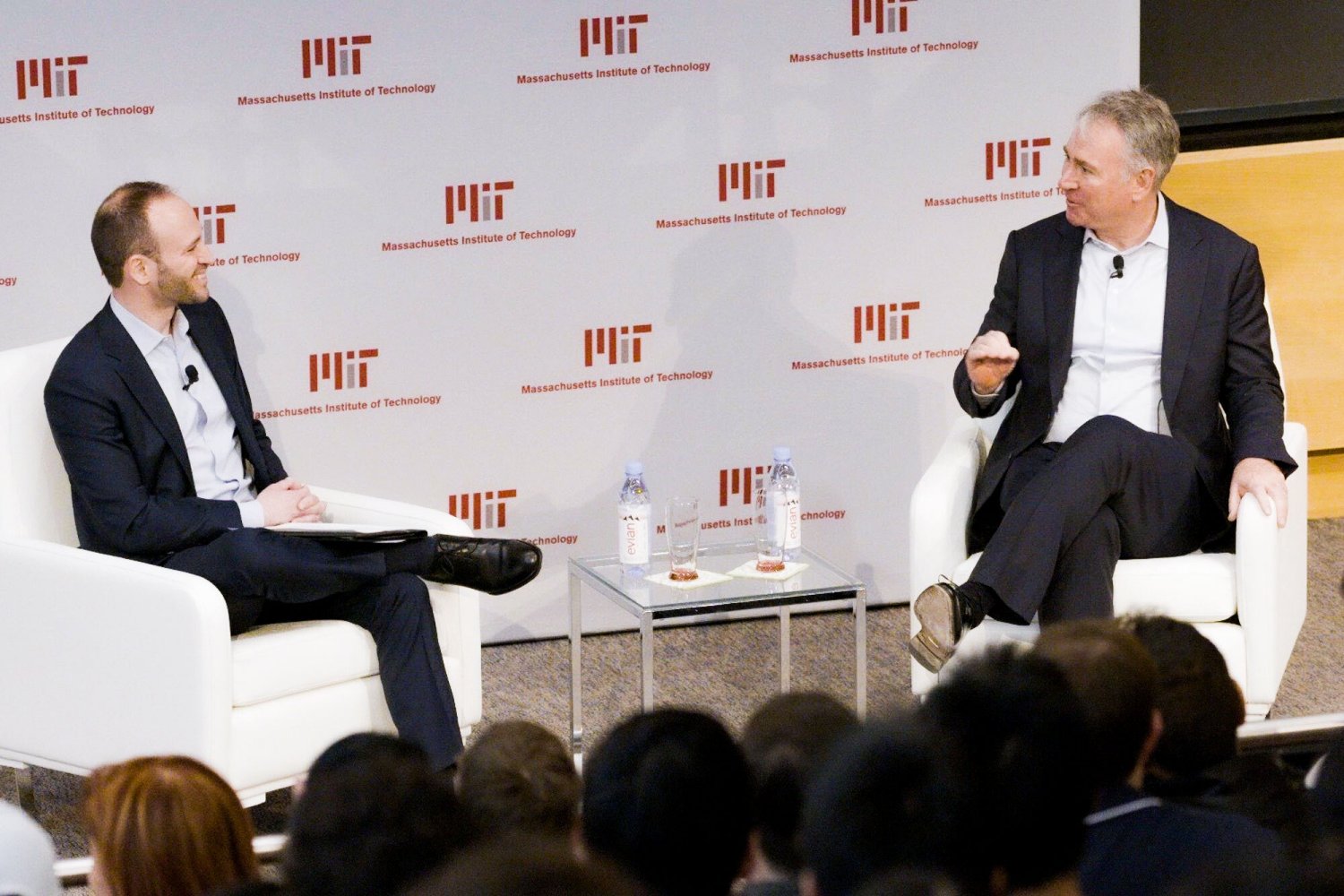

Throughout a dialog with Bryan Landman ’11, senior quantitative analysis lead for Citadel’s World Quantitative Methods enterprise, Griffin mirrored on his profession and supplied predictions for the influence of know-how on the finance sector. Citadel, which he launched in 1990, is now one of many world’s main funding corporations. Griffin additionally serves as non-executive chair of Citadel Securities, a market maker that is called a key participant within the modernization of markets and market constructions.

“We’re excited to listen to Ken share his perspective on how know-how continues to form the way forward for finance, together with the rising tendencies of quantum computing and AI,” stated David Schmittlein, the John C Head III Dean and professor of promoting at MIT Sloan College of Administration, who kicked off this system. The presentation was collectively sponsored by MIT Sloan, the MIT Schwarzman Faculty of Computing, the College of Engineering, MIT Profession Advising and Skilled Growth, and Citadel Securities Campus Recruiting.

The long run, in Griffin’s view, “is all concerning the software of engineering, software program, and arithmetic to markets. Profitable entrepreneurs are those that have the instruments to unravel the unsolved issues of that second in time.” He launched Citadel just one 12 months after graduating from school. “Historical past to date has been type to the imaginative and prescient I had again within the late ’80s,” he stated.

Griffin realized very early in his profession “that you might use a private laptop and quantitative finance to cost traded securities in a approach that was far more superior than you noticed in your typical fairness buying and selling desk on Wall Road.” Each companies, he advised the viewers, are in the end pushed by analysis. “That’s the place we formulate the concepts, and buying and selling is how we monetize that analysis.”

It’s additionally why Citadel and Citadel Securities make use of a number of hundred software program engineers. “Now we have an enormous funding right this moment in utilizing trendy know-how to energy our decision-making and buying and selling,” stated Griffin.

One instance of Citadel’s software of know-how and science is the agency’s hiring of a meteorological crew to broaden the climate analytics experience inside its commodities enterprise. Whereas energy provide is comparatively simple to map and analyze, predicting demand is far more troublesome. Citadel’s climate crew feeds forecast knowledge obtained from supercomputers to its merchants. “Wind and photo voltaic are big commodities,” Griffin defined, noting that the times with highest demand within the energy market are cloudy, chilly days with no wind. When you’ll be able to forecast these days higher than the market as a complete, that’s the place you’ll be able to establish alternatives, he added.

Professionals and cons of machine studying

Asking concerning the influence of recent know-how on their sector, Landman famous that each Citadel and Citadel Securities are already leveraging machine studying. “Available in the market-making enterprise,” Griffin stated, “you see an actual software for machine studying as a result of you’ve got a lot knowledge to parametrize the fashions with. However once you get into longer time horizon issues, machine studying begins to interrupt down.”

Griffin famous that the information obtained by way of machine studying is most useful for investments with brief time horizons, resembling in its quantitative methods enterprise. “In our basic equities enterprise,” he stated, “machine studying just isn’t as useful as you’d need as a result of the underlying techniques will not be stationary.”

Griffin was emphatic that “there was a second in time the place being a extremely good statistician or actually understanding machine-learning fashions was enough to earn money. That gained’t be the case for for much longer.” One of many guiding ideas at Citadel, he and Landman agreed, was that machine studying and different methodologies shouldn’t be used blindly. Every analyst has to quote the underlying financial concept driving their argument on funding selections. “Should you perceive the issue otherwise than people who find themselves simply utilizing the statistical fashions,” he stated, “you’ve got an actual probability for a aggressive benefit.”

ChatGPT and a seismic shift

Requested if ChatGPT will change historical past, Griffin predicted that the rise of capabilities in giant language fashions will remodel a considerable variety of white collar jobs. “With open AI for many routine business authorized paperwork, ChatGPT will do a greater job writing a lease than a younger lawyer. That is the primary time we’re seeing historically white-collar jobs in danger on account of know-how, and that’s a sea change.”

Griffin urged MIT college students to work with the neatest individuals they will discover, as he did: “The magic of Citadel has been a testomony to the concept by surrounding your self with shiny, formidable individuals, you’ll be able to accomplish one thing particular. I went to nice lengths to rent the brightest individuals I may discover and gave them accountability and belief early of their careers.”

Much more important to success is the willingness to advocate for oneself, Griffin stated, utilizing Gerald Beeson, Citadel’s chief working officer, for example. Beeson, who began as an intern on the agency, “persistently sought extra accountability and had the foresight to coach his personal successors.” Urging college students to take possession of their careers, Griffin suggested: “Make it clear that you just’re keen to tackle extra accountability, and take into consideration what the roadblocks will probably be.”

When microphones have been handed to the viewers, college students inquired what adjustments Griffin want to see within the hedge fund business, how Citadel assesses the chance and reward of potential tasks, and whether or not hedge funds ought to give again to the open supply neighborhood. Requested concerning the position that Citadel — and its CEO — ought to play in “the broader society,” Griffin spoke enthusiastically of his perception in participatory democracy. “We want higher individuals on either side of the aisle,” he stated. “I encourage all my colleagues to be politically energetic. It’s unlucky when corporations shut down political dialogue; we really embrace it.”

Closing on an optimistic word, Griffin urged the scholars within the viewers to go after success, declaring, “The world is all the time awash in problem and its shortcomings, however it doesn’t matter what anyone says, you reside on the biggest second within the historical past of the planet. Take advantage of it.”