eCommerce firms lose $31 billion every year as a consequence of chargebacks. What began as a authorized mechanism to defend buyers from fraud has turn into a persistent menace to the profitability of on-line retailers—in addition to a problem for the customers who ought to profit from it.

Let’s take a look at how the chargeback course of works and why retailers ought to at all times hold the variety of open chargeback requests to a minimal.

What are chargebacks?

Let’s begin with the chargeback definition:

A chargeback is a transaction during which an issuing financial institution pulls funds from a service provider and offers them again to a shopper. This normally happens as a result of the patron has escalated a dispute about a purchase order to their financial institution for decision.

A chargeback is completely different from a refund. As a substitute of contacting the service provider from which the acquisition was made and requesting a refund, a client can go on to their financial institution and request that the funds be faraway from the service provider’s account.

How are chargebacks used?

What’s a chargeback in easy phrases? It’s a mechanism designed to guard clients from fraudulent retailers. At this time, nevertheless, we’re seeing the other downside: fraudulent clients making the most of sincere retailers.

Usually, a cybercriminal will acquire an individual’s card particulars and use them to make unlawful funds. The cardholder naturally has no thought till they occur to test their account or are contacted by the financial institution.

As soon as noticed, the cardholder can ask the issuing financial institution for a chargeback. The financial institution will examine the transaction in query and, if fraud is suspected, will forcibly take away the funds from the retailers’ account and return them to the cardholder’s account.

Chargebacks as a deterrent for retailers

Chargebacks are additionally meant to deter retailers from participating in unethical or fraudulent practices. These may embody delivering merchandise that don’t match the marketed specs or are faulty, accepting funds however not fulfilling the orders, or including hidden additional expenses to the patron’s card.

Since dissatisfied clients have the likelihood to request their a reimbursement by sidestepping the vendor altogether, eCommerce firms will usually attempt to present the most effective services to their purchasers. The overwhelming majority of companies are run this manner with none incentive. However for retailers who may take into account fraudulent exercise, chargebacks are a helpful guard.

The chargeback course of

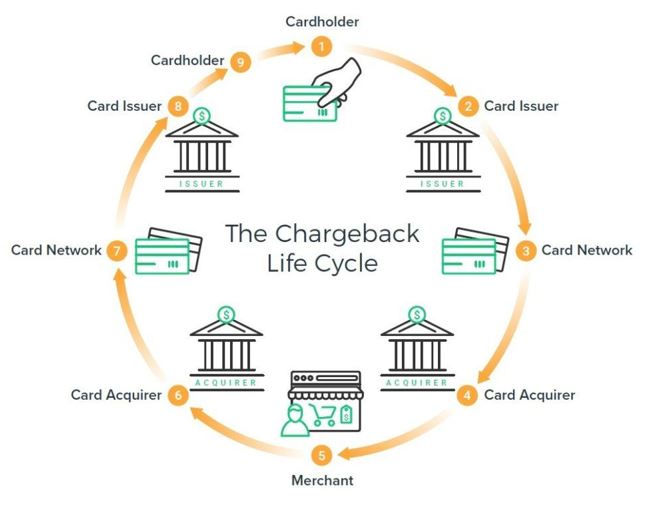

Right here’s a play-by-play of how chargebacks sometimes end up:

| 1. The cardholder disputes a transaction by contacting the card-issuing financial institution and requesting a refund.

2. The financial institution first checks if the transaction is eligible for a chargeback. If that’s the case, the transaction is charged again to the service provider’s buying financial institution through the related card community: Visa, MasterCard and so on. 3. The card community screens the chargeback for compliance towards its technical standards. If confirmed, the chargeback is forwarded to the service provider’s buying financial institution. 4. The buying financial institution could switch the cash immediately from the service provider’s account to the cardholder, or ahead the request to the service provider first. 5. The service provider receives the chargeback notification and, if sure circumstances are met, can characterize (i.e. oppose) the chargeback to its buying financial institution, offering documentation to indicate that the transaction was respectable and may stand. If the mandatory standards will not be met, the service provider should settle for the chargeback.

|

6. The buying financial institution forwards the service provider’s illustration to the cardboard community, who then forwards it to the cardboard issuer.

7. The card issuer then critiques the case once more and, if the service provider’s case is compelling, expenses the cardholder’s account once more for the disputed transaction. Nonetheless, if the issuing financial institution considers that the chargeback concern has been inappropriately addressed by the service provider’s illustration, it could submit the dispute to the card community. This triggers arbitration by the cardboard community. 8. In arbitration, the cardboard community decides which occasion is accountable for the disputed transaction. Ought to the service provider want to struggle the arbitration determination as nicely, there may be a further price of roughly $500, though only a few transactions would justify the price of such an motion. |

What are probably the most frequent causes of chargeback requests?

Based on 48% of retailers, Card Not Current (CNP) fraud is the biggest supply of all chargebacks, whereas a major quantity additionally comes from order not acknowledged complaints. Greater than 80% of customers admit that they’ve filed a chargeback out of comfort, which is fairly worrying.

Order Not Acknowledged

‘Order not acknowledged’ happens when the patron doesn’t recall putting a brand new order or doesn’t acknowledge a transaction that’s listed on their financial institution assertion. It’s usually associated to subscriptions with recurring billing.

Most clients don’t know (or bear in mind) that they agreed to be mechanically billed for a services or products, actually because they only checked a field within the purchasing cart with out actually studying it, or as a result of the field was pre-checked and so they didn’t notice what it meant. Due to this fact, they may dispute the cost.

Fraud

Fraud is more durable to detect and struggle, as it could actually take many advanced types. Card Not Current (CNP) cost fraud has exploded lately in keeping with eCommerce, with cell funds and information breaches exposing buyers’ information to fraudsters.

The 50% of fraud losses comes from ‘pleasant fraud’ and chargeback fraud.

- Pleasant fraud occurs when a member of the family buys one thing utilizing the patron’s cost card with out them being conscious of it. Due to this fact, when the cardboard holder sees the unknown order on their card assertion, they open a chargeback request.

- Chargeback fraud is when a client deliberately abuses their chargeback rights to each retain a bought merchandise and get their a reimbursement.

The elevated shopper consciousness of chargeback rights and the convenience of disputing a cost—coupled with the problem retailers have in preventing chargebacks—has led to an escalation in chargeback fraud lately.

Understandably, a rise in chargeback exercise has a substantial influence on a service provider’s backside line and is damaging for the eCommerce local weather general.

The intense influence of chargebacks

Bank card chargeback requests produce cascading results that ripple far past the refund prices themselves. For a begin, each single time buyers file a chargeback request, the service provider is required to pay a chargeback price—no matter how the chargeback course of is ultimately resolved.

Chargeback charge

As well as, even when retailers dispute chargebacks and win these disputes, their chargeback charge doesn’t enhance.

| What’s the chargeback charge? Chargeback charge is a metric that describes the ratio between the whole variety of transactions and the whole variety of chargebacks a service provider has earned. It’s calculated by dividing the variety of open chargebacks by the variety of finalized transactions within the earlier month. Why is that this essential? As soon as chargeback charge creeps above a sure stage (roughly 0.9%) cost suppliers could terminate accounts with retailers. |

The typical eCommerce chargeback charge for retailers utilizing the 2Checkout digital commerce platform is between 0.3% and 0.4%. That is nicely beneath the 0.9 % threshold and regarded a really wholesome chargeback charge.

Danger of fines and penalties

Each chargeback request, legitimate or not, brings retailers one step nearer to fines and even dropping their service provider accounts with the buying banks.

Relying on the cardboard affiliation’s guidelines, fines imposed on retailers for exceeding chargeback charge thresholds can attain $10,000 or extra. Repeat offenses will then result in service provider account termination and presumably inclusion on MasterCard’s MATCH record, which can forbid the enterprise from acquiring one other common service provider account with buying banks for 5 years.

Companies that discover themselves in such a scenario usually don’t have any recourse however to use for excessive threat service provider accounts, which normally include steep prices that minimize deeper into the service provider’s profitability.

Chargebacks are a tough struggle for sincere retailers

The adverse influence of chargebacks is compounded by the truth that despite the fact that a reported 72% of retailers reply to chargebacks, the typical web win charge is slightly below 9%.

However, retailers can – and may – arrange preventative measures to defend themselves from chargebacks. Doing so won’t solely assist them keep away from vital revenue losses, but in addition contribute to the well being of worldwide commerce general.

It’s 2023—What can I do to stop chargebacks?

All of it comes all the way down to offering a terrific buyer expertise: efficient and well timed communication in the direction of the patron, transparency, responsiveness in customer support, and options and insurance policies that encourage buyer retention and discourage fraud.

Your greatest useful resource for actionable methods to cut back—and ultimately cease—chargebacks is our free e book on Understanding Chargebacks. Test it out now and slash your chargeback charge!