SaaS firms want the fitting info and instruments to assist themselves in all enterprise areas—together with finance. That’s why it’s essential to know SaaS accounting inside and outside.

However what precisely units it other than typical accounting, and what key metrics do you have to observe? On prime of that, which concerns ought to issue into your selection of SaaS accounting software program?

We’ll reply all these questions, plus some extra, on this information to SaaS accounting.

What makes SaaS accounting completely different?

Analysis estimates that by 2025 85% of enterprise apps will probably be SaaS-based—and this reliance on SaaS know-how tells us one factor very clearly. SaaS is right here to remain.

Picture sourced from bettercloud.com

So, how is accounting for SaaS companies completely different than for his or her non-SaaS counterparts?

The primary separating issue is the subscription-based mannequin that SaaS firms use. This sees them charging their customers a set month-to-month price—which could keep fully static or fluctuate, relying on how a lot flexibility a SaaS firm’s pricing tiers provide.

Since SaaS firms assist their customers scale up and down simply, this additionally implies that their income from a given consumer can enhance or lower immediately. This makes SaaS enterprise incomes tougher to foretell, which is why SaaS accounting differs from typical accounting.

Key monetary metrics for SaaS firms

SaaS firms typically have to observe completely different monetary metrics than their counterparts—although in some circumstances, there’s overlap. We’ll stroll you thru crucial monetary metrics for SaaS firms to keep watch over.

MRR and ARR

Month-to-month recurring income (MRR) and annual recurring income (ARR) are significantly related to SaaS firms, as these will make up the majority of their earnings per 30 days or yr. These metrics measure the form of earnings that recurs predictably every month or yr.

You should utilize your MRR to foretell your ARR by multiplying it by 12. This helps you kind a fact-based projection on your annual earnings, as your MRR is generated primarily based on recurring buyer income.

Payroll

A key enterprise expense for any firm, SaaS companies should additionally take note of their payrolls. These will sometimes fluctuate relying on components like fee bonuses for salespeople, in addition to elevated spending throughout enterprise upscaling.

Your payroll is an effective indication of the standing of your SaaS firm. For those who’re immediately spending far much less in your payroll, that’s a sign that your gross sales have decreased.

On the flip facet, spending greater than anticipated in your payroll can really be a superb factor, because it signifies you’re promoting extra.

Month-to-month monetary experiences

Producing experiences in your funds at the least as soon as every month allows you to get real-time insights into your spending and earnings. This helps you successfully observe any seasonal modifications in your corporation and rapidly determine any issues.

These experiences ought to all the time embody particulars of the place your cash went and the place it got here from. This helps you pinpoint your greatest sources of earnings—and the largest cash sinks.

Buyer Acquisition Value

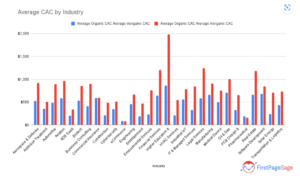

It’s uncommon to appeal to new SaaS prospects with out lifting a finger. The truth is, whereas buyer acquisition prices (CACs) can fluctuate relying in your business, CACs for software program firms can enter the ballpark of $400:

Picture sourced from firstpagesage.com

A decrease CAC means much less cash spent in trade for a paying buyer, which is all the time a superb factor. SaaS companies that save on CAC whereas nonetheless creating model loyalists can safe increased MRRs, which in flip makes these companies extra worthwhile.

Buyer Lifetime Worth

CLV, or buyer lifetime worth, describes the overall income a given buyer has generated for your corporation. Higher CLV means higher ROI in your buyer acquisition expenditures—which results in a increase in your backside line in the long term.

In different phrases, while you use buyer success to decrease churn and create loyalists, you make it possible for each greenback invested into buying and retaining a buyer pays off extra.

SaaS accounting concerns

Now that we’ve coated the sorts of metrics {that a} SaaS enterprise must give attention to, it’s time to take a look at the concerns that ought to issue into your SaaS accounting method. Every of those has a serious and constant impression in your funds, which is why they benefit thought.

Pay as you go bills and deferred income

You don’t all the time need to pay your bills the second they arrive, particularly not for those who knew they have been coming. In some circumstances, you’ll be capable of pay forward of time—while you’ve obtained the cash accessible—so that you don’t have to fret about coping with a lot of bills all of sudden.

Likewise, income isn’t all the time earned the second somebody pays on your companies. You should utilize the deferred income technique when a buyer pays upfront for a yr’s subscription. The deferred income technique allows you to unfold your income out over extra time, so it’s not all taxed without delay.

A devoted ERP system would provide help to with all of this, because it ensures you all the time know the place your sources will probably be spent and when. It retains observe of all of your day-to-day enterprise processes and gives you with detailed insights to streamline your operations and cut back bills.

Software program growth prices

A significant a part of efficiently hitting your SaaS targets entails creating the precise product you envision. That is accomplished via software program growth, which is why the prices related to that growth are a SaaS accounting consideration.

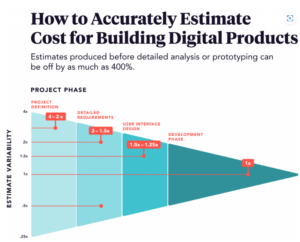

Creating new software program is not any easy process—neither is it a simple supply of expenditure. The next picture offers you a good suggestion of the sorts of estimates to incorporate below software program growth prices:

Picture sourced from praxent.com

As these prices can fluctuate, you’ll wish to take this as a information slightly than a set supply of reality. For instance, you would possibly have to spend extra money and time on consumer interface for a brand-new product.

Capitalized software program growth prices

This covers the overhead prices which might be capitalized in your firm’s stability sheet, together with software program tester charges and developer salaries.

Software program prices can’t be capitalized at random. It is because capitalized prices don’t rely as incurred prices, which means the principles surrounding them are completely different.

Relating to guidelines, your organization can solely capitalize prices if one in all two situations is met. Firstly, the app has to nonetheless be in growth if it’s going for use internally inside your personal firm. In any other case, it’s obtained to be fully possible on your app to be bought to the general public for capitalization to happen.

Amortization of capitalized software program growth prices

For those who’ve heard of depreciation, the method of an asset dropping worth over time, then you definately’re accustomed to the fundamentals of amortization. The latter all the time refers to an intangible asset—like your SaaS software program, for instance.

Amortization isn’t essentially a nasty factor. That’s as a result of it’s not real looking to anticipate your items—tangible or in any other case—to retain the identical worth perpetually. Amortization helps you get a sensible concept of how the worth of a bit of software program modifications over time.

That is very useful for any SaaS enterprise house owners planning to promote their software program within the future. It’s additionally helpful for planning-savvy SaaS accountants who wish to ensure they’re utilizing the right enterprise worth estimates of their calculations.

That’s why amortization of not simply your software program however your capitalized prices is a significant component to contemplate on the subject of SaaS accounting.

Choosing the proper software program on your SaaS firm

A very powerful tip to remember is that this: there’s no common “proper answer” that works for completely each firm.

That’s as a result of every firm is distinctive. Some are significantly giant, whereas others are very small; some have operated for years, with others having began simply weeks in the past. These components, amongst many others, decide which software program is the perfect for a corporation.

That stated, one possibility to contemplate is a cloud ERP system. This all-in-one answer will be tailor-made to your organization’s particular wants and can unite all your corporation processes on a single platform. It offers you elevated entry to information throughout your total firm, so you possibly can extract real-time insights on the go and enhance collaboration between your groups.

This not solely helps your accounting crew, however your entire departments as they will develop environment friendly, versatile processes whereas working from a single unified database.

When choosing the proper software program on your firm there are some key tips that may assist.

Firstly, all the time examine what accounting characteristics it has. If a bit of software program could be very feature-rich, you can probably customise it to swimsuit you completely. Some can have particular instruments for SaaS firms which can make issues a lot simpler.

There’s additionally ease of use and UI structure. An answer that may do every thing you need, however is clunky to make use of, goes to weigh you down over time.

Lastly, there’s pricing. Cheaper isn’t all the time higher—nor dearer—so it is best to all the time think about whether or not you’re getting the fitting worth for cash. An answer that prices just a little extra to provide you one thing good is best than an inexpensive one which leaves you wanting.

Use SaaS accounting to remain forward of the competitors

SaaS accounting helps you keep on prime of any and all developments in your SaaS firm. By providing you with correct, data-based insights into your organization’s monetary well being, SaaS accounting additionally creates alternatives to spice up your backside line with out rising your spending an excessive amount of.

You’ll want the fitting software program, in addition to skilled specialists, to get essentially the most out of your SaaS accounting expertise.

Once you use SaaS accounting to your benefit, you possibly can extra simply acquire benefits over your rivals. Additionally, you can also make positive your organization is ready for any sudden occasions or modifications within the fast-paced world of SaaS enterprise.