Excellent bills discuss with these bills which relate to the present accounting interval however haven’t been paid up to now. These bills result in a rise in legal responsibility for a agency. A few of the kinds of these bills are Excellent wages, Excellent salaries, Excellent Curiosity on mortgage, and so forth. All these bills should be taken under consideration for computing the present Revenue/Lack of a agency. These are debited to Revenue and Loss A/c underneath their respective accounts.

Adjustment:

A. If Excellent Expense is given outdoors the trial steadiness: In such case, two entries will likely be handed:

- Can be added within the involved merchandise (expense) on the Dr. aspect of Buying and selling A/c or Revenue & Loss A/c.

- Can be proven on the liabilities aspect of the steadiness sheet.

B. If Excellent Expense is given contained in the trial steadiness: It will likely be solely proven on the liabilities aspect of the Steadiness Sheet. (As a result of it’s a Consultant Private A/c, which has a Cr. steadiness)

Illustration:

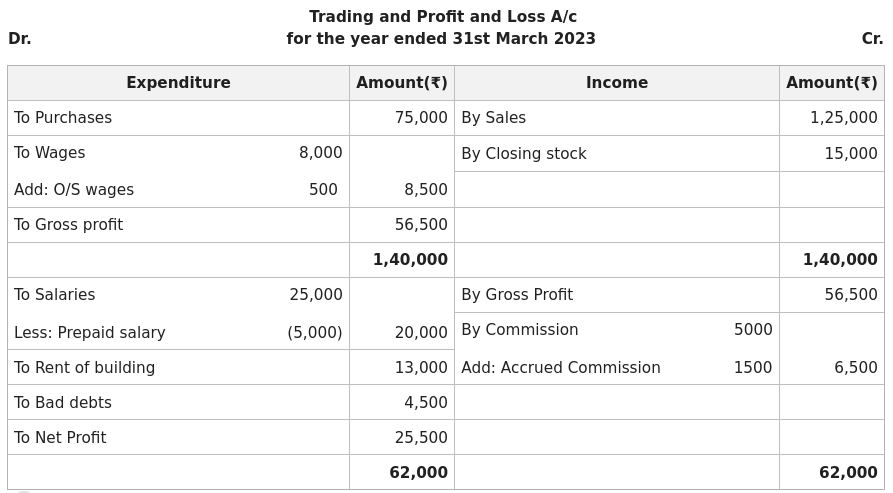

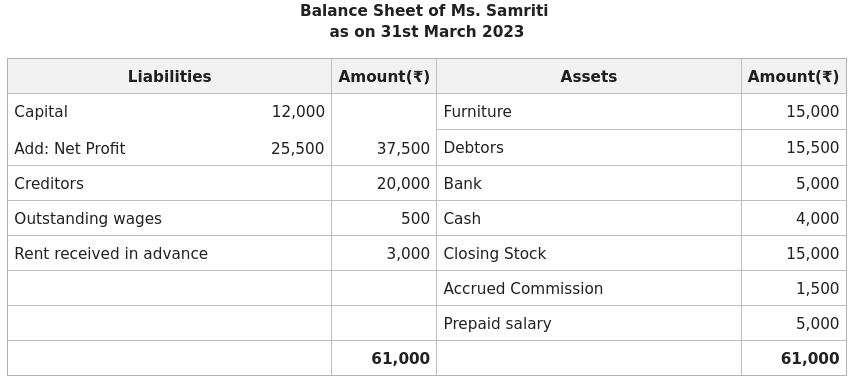

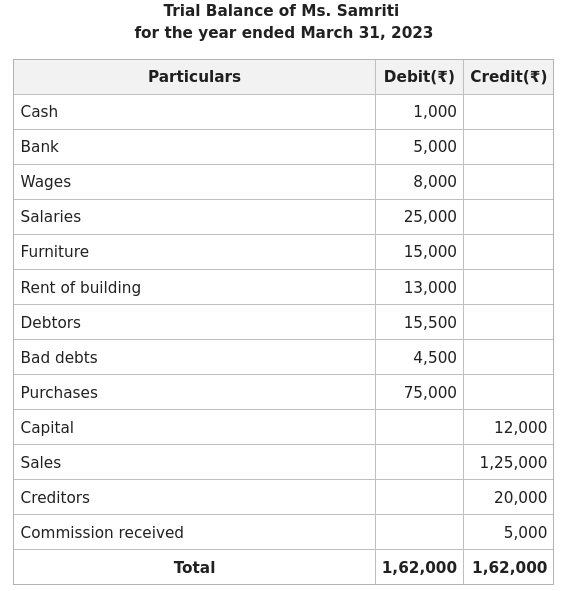

The Trial Steadiness of Ms. Samriti for the 12 months ended March 31 2023, seems as follows:

The next changes have been famous on that date:

1. Excellent wages amounting to ₹500.

2. Quantity of Closing inventory on thirty first March 2022 was ₹15,000.

3. Wage paid upfront amounting to ₹5,000.

4. Fee amounting to ₹1,500 remains to be to be acquired.

5. Lease acquired upfront quantities to ₹3,000.

Put together Buying and selling and Revenue and Loss A/c and steadiness sheet after taking the next changes into consideration.

Answer: