Three Issues To Think about When Contemplating Whether or not To Be Bullish or Bearish on the SPY.

Shares proceed to climb greater on the again of earnings which have overwhelmed expectations up to now (albeit lowered expectations). The NASDAQ 100 simply closed on the highest degree since final August. The S&P 500 (SPY) is getting ready to a breakout above $4200. The VIX simply closed under 16 for the primary time in effectively over a yr.

Whether or not or not inventory markets rip even greater stays to be seen. Momentum can definitely take costs past affordable ranges and to extremes.

To cite Keynes- “Markets can stay irrational longer than buyers can stay solvent”. Within the quick run, markets can and can do virtually something.

Over a bit of longer-term horizon, nevertheless, three issues are value contemplating earlier than you contemplate getting lengthy shares at these ranges. Let’s look again to a couple of yr in the past (11 months) when the S&P 500 was at an analogous worth to see what has modified in that timeframe.

Implied Volatility

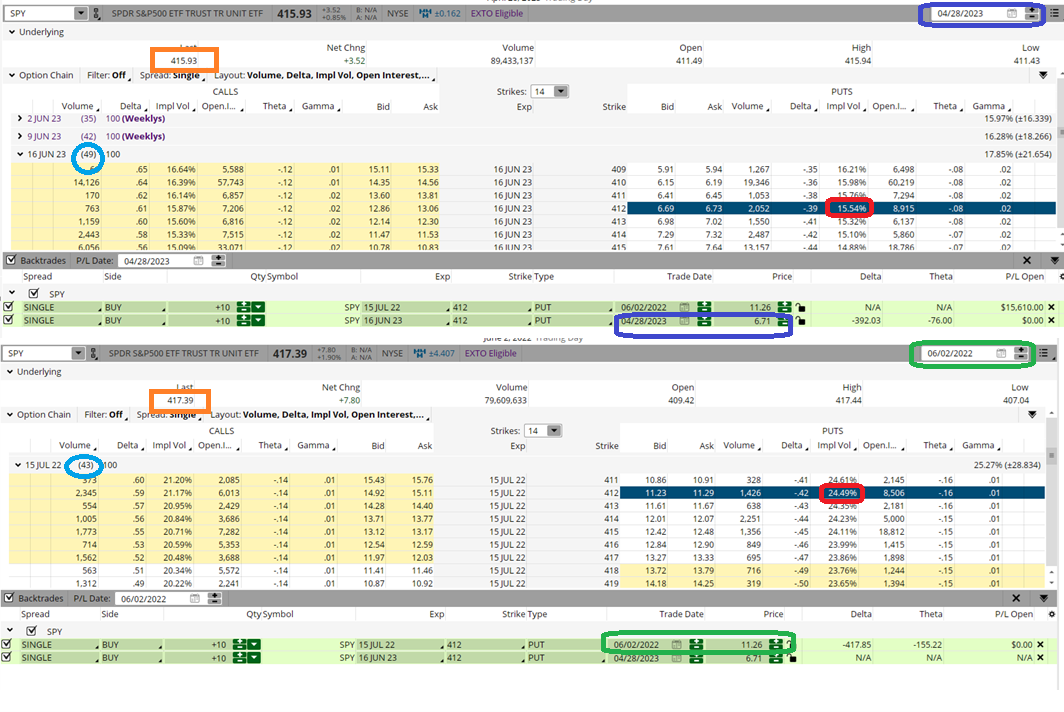

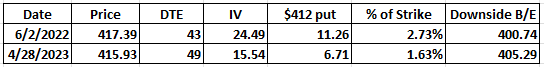

The 2 possibility montages under present possibility costs from Friday’s shut and from the shut on June 2, 2022.

Again on June 2, 2002, the SPY closed at $417.39. Friday it completed at $415.93, so just about the identical worth as Friday, only a contact decrease (0.35%) now.

The June 16, 2023, choices have 49 days to expiration (DTE). The July 15, 2022, choices have 43 DTE. So, a bit of longer (6 days) for the 2023 choices now.

Usually, places which can be nearer to the cash with extra time to expiration are costlier. However as a result of the VIX -or implied volatility (IV) – is at lows, the places now are literally a lot cheaper ($6.71 now versus $11.26 then).

All due to the massive drop in IV from 24.49 to fifteen.54. The desk under places the comparability collectively, together with a % of strike (possibility worth /$412 strike worth) and draw back breakeven ($412 strike worth -option worth).

So, a a lot decrease price for a lot better safety. Sort of like paying much less insurance coverage premium for a decrease deductible with the very same protection.

Curiosity Charges

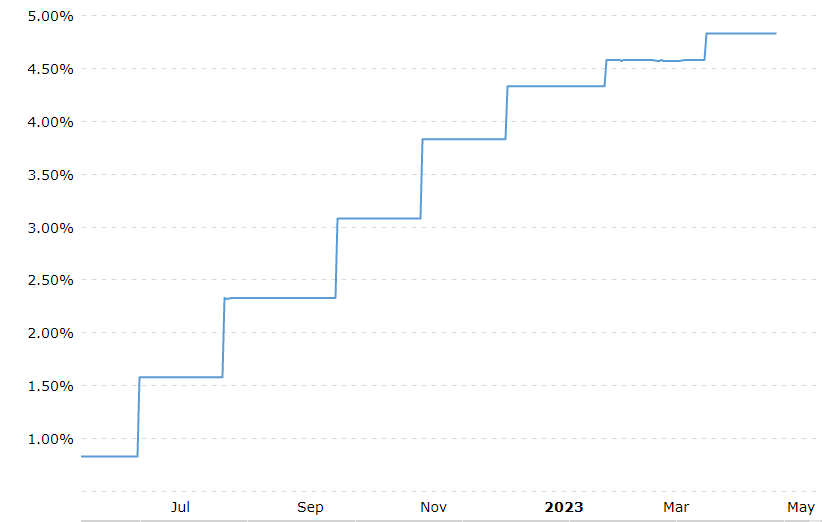

10-year Treasury yield was 2.913% on June 2, 2022. Friday it closed at 3.452%.

Fed Funds charge was underneath 1% again then, approaching 5% now.

Little doubt rates of interest have risen sharply over the previous 11 months.

Valuations

P/E was 21.51 June 2, 2022. P/E at the moment is 24.14.-and nearing the richest a number of since December 2021. The final time it was above 24 was February 2 of this yr which coincided with a major high within the S&P 500.

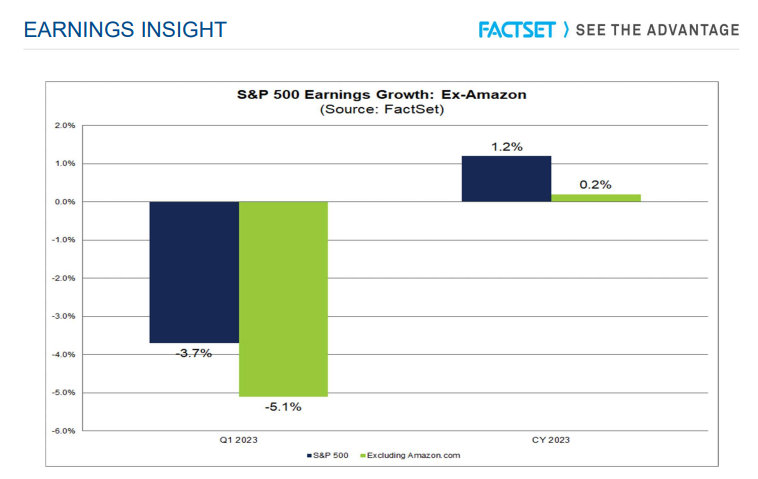

FactSet talked about that it’s fascinating to notice that Amazon.com can also be the biggest contributor to earnings progress for your entire S&P 500 for Q1 and 2023. If this firm have been excluded, the (blended) earnings decline for the S&P 500 for Q1 2023 would improve to -5.1% from -3.7%, whereas the estimated earnings progress charge for the S&P 500 for CY 2023 would fall to 0.2% from 1.2%. Both means, earnings are nonetheless receding and do not look to see a lot progress over the subsequent few quarters.

Elevated rates of interest and decrease earnings ought to result in decrease valuation multiples-and decrease inventory costs. As an alternative, inventory markets are again approaching contemporary new multi-year highs on valuation and all-time highs on worth.

The assumption within the Fed to begin decreasing charges prior to projected and earnings to begin bettering extra shortly than anticipated requires a fairly good leap of religion.

Merchants and buyers alike could wish to hedge that religion a bit of. Shopping for some draw back safety with places which can be the most cost effective they’ve been in a very long time makes numerous sense – all the pieces thought of.

POWR Choices

What To Do Subsequent?

Should you’re in search of one of the best choices trades for at the moment’s market, you must try our newest presentation How you can Commerce Choices with the POWR Rankings. Right here we present you easy methods to constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to study extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

How you can Commerce Choices with the POWR Rankings

All of the Finest!

Tim Biggam

Editor, POWR Choices Publication

SPY shares closed at $415.93 on Friday, up $3.52 (+0.85%). 12 months-to-date, SPY has gained 9.17%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit Are Shares A Good Purchase Now – Or A Good Bye ?? appeared first on StockNews.com