The Stratasys and Desktop Steel merger has change into a tabloid saga, with Nano Dimension searching for to thwart the enterprise mixture and peppering a convention name with plenty of selection phrases.

Through the course of an hour, Nano Dimension CEO Yoav Stern made quite a few statements in regards to the Stratasys and Desktop Steel deal, together with why he believes long-term worth creation by way of a Nano Dimension takeover of Stratasys is healthier for shareholders, and gave an evaluation of a stalled try by Nano Dimension to takeover Desktop Steel.

Nano Dimension makes an attempt to purchase Desktop Steel

On the decision, Stern mentioned that Desktop Steel and Nano Dimension have been speaking since November 2022, and each corporations had visited one another as a part of the due diligence course of. Stern has mentioned that Desktop Steel requested a purchase order value of $800 million, a determine he thought of overvalued the corporate. Stern pointed to his calculations that Desktop Steel has a gross margin of adverse 3% and his perception that Desktop Steel has destroyed over $2 billion of shareholder worth. Stern characterised the Stratasys and Desktop Steel merger as a “bail-out.” “They’re operating out of money,” mentioned the Nano Dimension CEO.

Stern mentioned that the restricted period rights shareholder rights plan (aka the ‘poison tablet’) introduced by Desktop Steel on Could thirtieth isn’t authorized, and he expects it to be overturned by a courtroom.

“We consider the courtroom will decide that this poison tablet isn’t authorized, that can instantly get rid of it, and we’ll shut the transaction on the twenty sixth of June,” offered Nano Dimension can persuade ample shareholders as to the deserves of their proposal.

Nano Dimension itself put in a shareholder’s rights plan that runs from February 6, 2023, to January 27, 2024, this was characterised as a poison tablet by its largest shareholder. In an open letter Murchinson wrote, “poison drugs are typically considered one of the vital egregious anti-shareholder measures an organization can take,” concerning the transfer.

Desktop Steel has been approached for remark.

“SPAC refugees” and historical past repeating itself?

Stern defined that in the course of the previous two years, Nano Dimension has thought of at the very least 350 corporations as potential targets for acquisition. This pool was whittled right down to 50 corporations the place Nano Dimension started discussions. The Nano Dimension CEO described Desktop Steel as a “SPAC refugee.” “There are about 5 SPAC refugees within the [3D printing] trade, we spoke with all of them,” he added. Within the 3D printing trade over $11 billion was invested utilizing SPACs.

As a sidebar, it’s attention-grabbing to notice the parallels between the 2020/2021 SPAC increase and the reverse merger increase of 2010-2012. Reverse mergers, or reverse takeovers (RTO) are a fast-track method to itemizing on an change. Whereas SPAC offers create a brand new entity, free from previous buying and selling historical past or liabilities, an RTO makes use of a dormant, but nonetheless listed, shell firm. Each strategies of going public sidestep the normal funding financial institution backed roadshow. SPACs are considered as a extra speedy and cost-efficient strategy to go public. Launching its bid to go public in 2020, Desktop Steel is perceived as kicking off the 3D printing trade SPAC wave. Nevertheless, Nano Dimension used a reverse merger to change into listed in 2014, an method 3D Printing Trade described as “arduous and comparatively uncommon” on this interview with Nano Dimension co-founder from 2016.

Stern insisted that his remarks on the decision had been firmly directed at two main shareholder teams: Stratasys shareholders and Nano Dimension shareholders, each of that are critically concerned within the merger proposal. The chairman defined that Nano Dimension had made a number of escalating affords for Stratasys shares, beginning at $18 per share and ending at $20 per share. Stern voiced his bewilderment at Stratasys’s refusal to just accept the upper supply, regardless of Stratasys’s share value falling to $14-$15.

Stern expressed explicit indignation at Stratasys’s dedication to a breakup price, which is his characterization of the Desktop Steel poison tablet. He emphasised that the imposition of a $32 million price by Stratasys, which might be as a result of Desktop Steel if Stratasys is purchased by one other entity, successfully reduces the worth of Stratasys shares by half a greenback every.

Stern appealed to the shareholders by mentioning the all-cash premium that Nano Dimension was providing. He contended that Nano’s all-cash supply, which was a 39% premium to the weighted common value as of early March, was much more advantageous to shareholders than the dilution and lack of worth implied by the Stratasys-Desktop Steel transaction.

Stern went on to spotlight the monetary discrepancies between the 2 corporations, mentioning that Stratasys, regardless of having a bigger income and gross margin, will primarily be absorbing an organization that has proven constant losses.

“Mr. Stratasys, you’re paying for an organization that’s lower than a 3rd of your dimension. It’s shedding a whole lot of tens of millions of {dollars} a 12 months projected or at the very least multiplied this quarter by 4. You’re mainly mortgaging your future. It’s not your future you’re mortgaging your shareholders’ future.”

Stern portrayed Desktop Steel as an enterprise with ongoing monetary points, together with adverse gross margin, ongoing money losses, and the necessity for continuous infusions of money that might carry down Stratasys’ personal profitability. The Nano Dimension CEO argued that the merger wouldn’t handle the underlying points with Desktop Steel’s enterprise mannequin, making this an unwise transfer for Stratasys.

“[Desktop Metal and Stratasys] collectively is nearly minus $50 million of money movement. And the mixed web money that they’ve, web of debt, that Desktop Steel has is about $320 million. Shedding about $50 million 1 / 4. In 4 quarters, that’s $200 million {dollars}, guys, this firm won’t ever do any acquisitions. And we’ll spend the cash making an attempt to run itself to the bottom.”

Stern went on to argue that neither Stratasys nor Desktop Steel has been in a position to meet its personal income projections, indicating that there are bigger points with their enterprise fashions and elevating issues in regards to the knowledge of the merger.

“Stratasys introduced in 2015 there’ll be a billion {dollars}, which was primarily based on This autumn 2014. Outcomes. In This autumn 2022, they introduced to be a billion {dollars} in 2026. And now, a month later, after they spoke with Desktop Steel, effectively, there’ll be $1.1 billion in 2025. Guys, the market has modified. This isn’t the place we had been in 2021, the market is transferring again into profitability return on funding.”

“The market now needs us to be along with you,” mentioned Stern.

Traders query Nano Dimension on its bid for Stratasys

Richard Smith of Smith Capital queried the expiration date of the tender supply, which, in keeping with Yoav Stern, is the sixth of June. Dan Reich from SAB requested in regards to the worth for long-term Stratasys shareholders offered by the proposed mixture. Stern offered a method involving shopping for shares again at a lower cost.

Ryuta Makino from Gabelli Funds requested about income and price synergies between Nano Dimension and Stratasys and about EBITDA and gross margin targets for 2025. Stern defined that synergies can solely be realized after a whole merger, which isn’t presently potential. He hinted at a projected EBITDA of round $170 million by 2025 underneath the idea of a full merger. Makino additionally requested in regards to the determination to take management of 53 to 55% of the corporate, which Stern defined was to make sure majority possession even when accounting for potential dilution from workers exercising their choices.

A non-public investor requested for clarification on Desktop Steel’s monetary scenario, with Stern presenting information suggesting the corporate is in a precarious monetary place, operating low on money reserve.

In his closing remarks, Stern inspired shareholders to proceed reaching out with their queries. “During the last six months, I’m personally responding to questions of shareholders… we’re devoting lots of time to talk with shareholders and we’ll be glad to reply extra questions as they arrive.”

Questions, and extra statements, are undoubtedly incoming. But to touch upon the previous week’s exercise, which included an in depth timeline of Stratasys and Desktop Steel merger and the announcement of the takeover bid by Stratasys, is Murchinson.

3D Printing Trade will, in fact, have the newest information, subscribe to our free e-newsletter to remain updated.

What does the way forward for 3D printing maintain?

What engineering challenges will have to be tackled within the additive manufacturing sector within the coming decade?

You may also observe us on Twitter, or like our web page on Fb.

When you’re right here, why not subscribe to our Youtube channel? That includes dialogue, debriefs, video shorts, and webinar replays. Are you searching for a job within the additive manufacturing trade? Go to 3D Printing Jobs for a collection of roles within the trade.

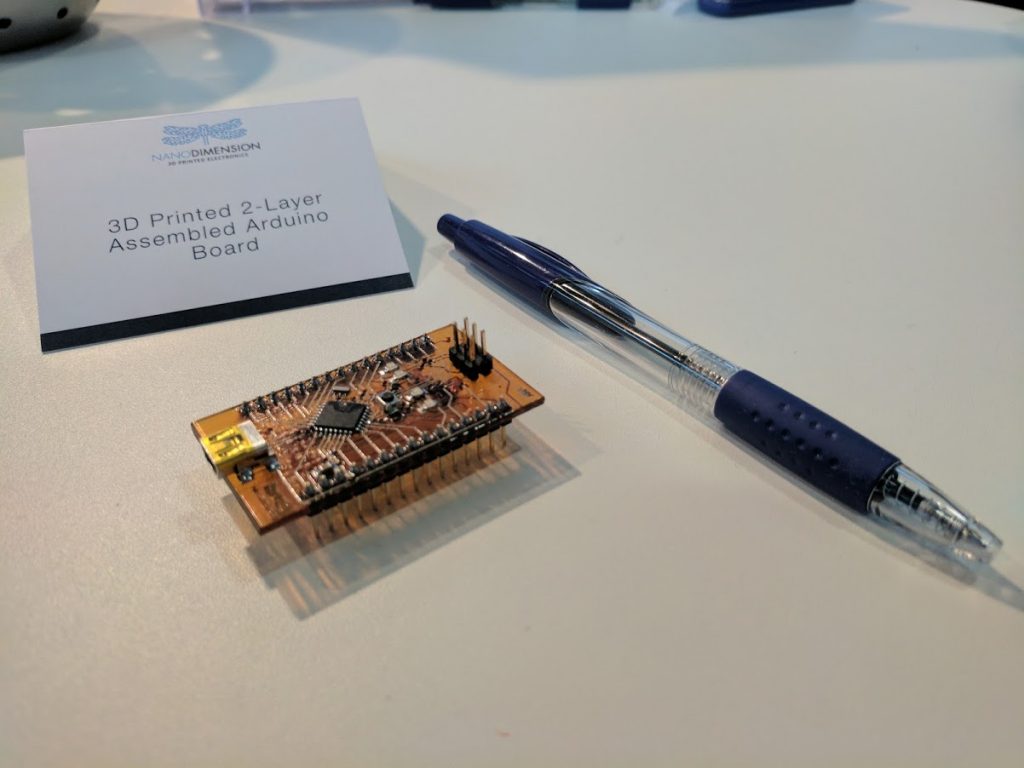

Featured picture reveals Nano Dimension 3D printed electronics. Photograph by Michael Petch.