Industrial 3D printing giants Stratasys and Desktop Steel have supplied further element on their “landmark” intention to merge. On a name with traders, CEO’s Yoav Zeif and Ric Fulop supplied further perception into why the merger of Desktop Steel and Stratasys will create worth. The mixed entity is anticipated to offer a complete portfolio of 3D printing applied sciences and providers spanning from polymer to steel, sand, and ceramic options, catering to a various vary of business verticals.

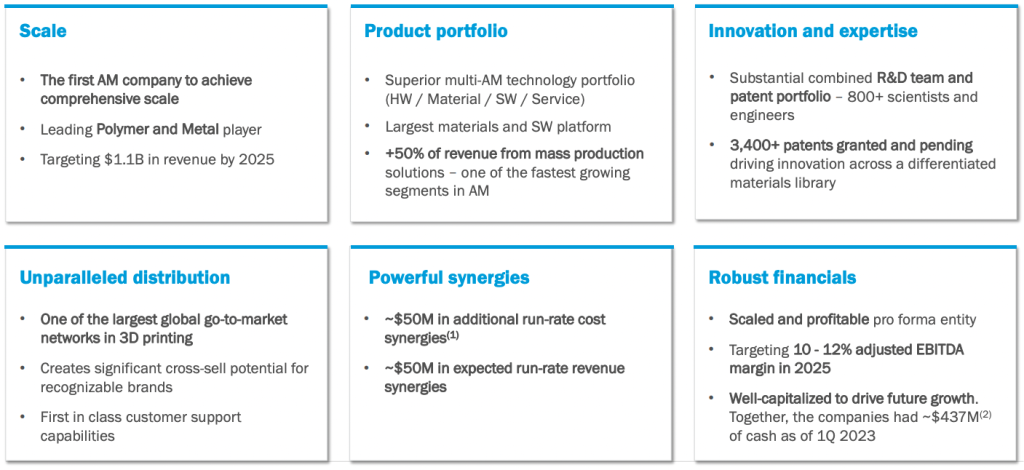

“The mix of our firms would considerably speed up our development trajectories, making a uniquely scaled industrial additive manufacturing firm,” introduced Dr. Yoav Zeif, CEO of Stratasys. He highlighted the synergies and worth proposition of the merger, stating that “collectively, we may have a diversified and healthful product portfolio and one of many largest world go-to-market networks in 3D printing.”

Zief said the merger guarantees a mixing of strengths, experience, and complementary applied sciences, with Stratasys, a pacesetter in polymer 3D printing, bringing its distinctive affect within the aerospace, automotive, client merchandise, healthcare, and dental verticals. Desktop Steel, recognized for its management within the mass manufacturing of steel, sand, ceramic, and restorative dental 3D printing options, enhances Stratasys.

Along with the technological benefits, the deal can be anticipated to deliver substantial monetary advantages, driving development and delivering important worth for shareholders. This mix is estimated to unlock a possibility to understand roughly $50 million in annual run-rate price synergies and roughly $50 million in annual run-rate income synergies throughout the enterprise by 2025. Consequently, Zeif predicts, “Mixed, we anticipate to ship roughly 10% to 12% of adjusted EBITDA margin in 2025.”

The merging of Stratasys and Desktop Steel is hoped to be a rigorously calculated fusion of two forces in additive manufacturing. It’s a pairing that guarantees to generate a robust, dynamic, and influential business entity that would rework the face of 3D printing on a worldwide scale.

The merger, structured as a stock-for-stock transaction valued at roughly $1.8 billion, will end in Stratasys shareholders proudly owning roughly 59% of the mixed firm and Desktop Steel stockholders proudly owning about 41% on a completely diluted foundation. Some extra vocal customers of inventory message boards have expressed dissatisfaction with the merger, expressing the view that Desktop Steel might obtain better returns by persevering with on its solo path.

After the shut of the transaction, anticipated to happen in This autumn 2023, Zeif will proceed to function the CEO of the mixed firm, whereas Ric Fulop, Chairman and CEO of Desktop Steel, will function the chairman of the board. As Zeif identified, “this mix will allow us to increase use instances, develop income, and improve profitability.”

A Seismic Shift within the Industrial Additive Manufacturing Market Panorama

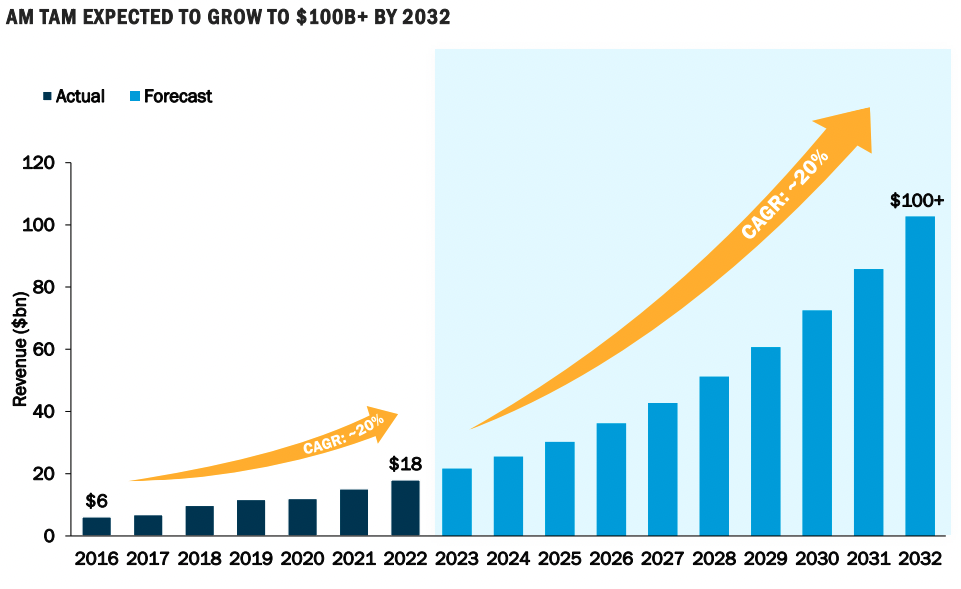

Ric Fulop, CEO of Desktop Steel, underscored the enormity of the chance through the convention name. The merger of Stratasys and Desktop Steel is forecasted to handle a swiftly increasing market that’s projected to exceed $100 billion by 2032. The mixed entity will serve your entire manufacturing lifecycle – a feat corresponding to a Swiss Military knife with a device for each job, from designing to prototyping, tooling to mass manufacturing, and aftermarket operations.

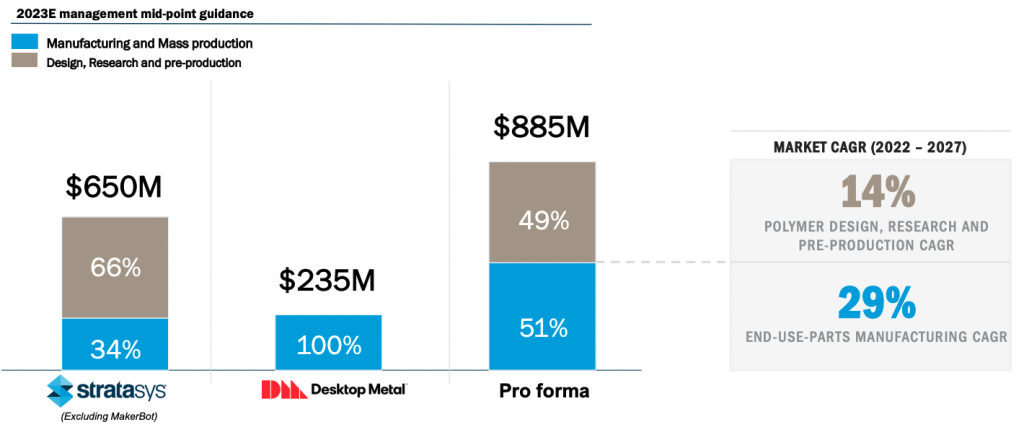

The income mixture of the mixed entity is anticipated to shift in the direction of high-growth verticals throughout a broad product portfolio, promising over half of the professional forma mixed firm’s income to stem from end-use elements manufacturing and mass manufacturing. This section is a powerhouse within the additive manufacturing area, anticipated to boast a compound annual development charge (CAGR) of greater than 29% by 2027.

Within the phrases of Fulop, “We’re going to construct an much more resilient providing with a diversified buyer base throughout industries and functions to drive long-term sustainable development.” This dedication, akin to setting up a resilient fortress able to withstanding the challenges and fluctuations of market dynamics, signifies a constructive future for the stakeholders of each firms, in response to Fulop.

The amalgamation of those two business titans guarantees to create an expansive and complementary suite of choices that may make waves within the additive manufacturing panorama. With Desktop Steel’s enlargement into mass manufacturing throughout a variety of supplies – together with metals, polymers, ceramics, sand, carbon fiber, and wooden – the brand new entity will place itself on the forefront of innovation.

Fulop additionally highlighted the potential for development in dental restorative mass manufacturing, emphasizing the corporate’s strategic partnerships, main supplies, and world-class group. Given the $35 billion development alternative in dental mass manufacturing, it is a promising discipline.

Important alternatives additionally lie in steel, carbides, and ceramics. “We now have the business’s main world place in binder jet. That’s the quickest 3D printing course of for supplies like metals, technical ceramics, and carbides, and now we have the most important and rising buyer base on this section, with over 1,200 prospects,” Fulop added. This standing places the corporate on the helm of high-volume mass manufacturing within the steel additive manufacturing area.

The mixed entity’s capabilities aren’t restricted to manufacturing; they prolong to distribution as effectively. Stratasys and Desktop Steel’s union will supply important advantages for stakeholders, thanks to an intensive world go-to-market community, enhanced market entry, and globally acknowledged manufacturers. This worldwide footprint is supported by greater than 400 help personnel and utility engineers, guaranteeing a strong buyer help construction.

Fulop famous the highly effective mixed R&D engine driving innovation, stating, “Collectively, our firms invested practically half a billion {dollars} in cumulative R&D spend up to now 4 years. That’s a big funding for innovation, and it’s going to stay a key space for us going ahead.”

He concluded, “As a mixed firm, we’re going to have one of many largest and most skilled R&D and engineering groups on this whole business,” setting the stage for an period of speedy innovation and potential market disruption within the additive manufacturing business.

Yoav Zeif, the CEO of Stratasys, and Ric Fulop, the CEO of Desktop Steel, outlined the anticipated monetary advantages of the merger between their two firms. They projected $50 million in annual run charge price synergies by 2025, achievable by optimized sourcing methods, improved know-how infrastructure, and the consolidation of shared inner infrastructures.

The CEOs additionally introduced a promising monetary outlook, anticipating the mixed firm to generate $1.1 billion in 2025 income with a ten% to 12% adjusted EBITDA margin. This amalgamation has the potential to create a financially sturdy enterprise geared up with important money sources, enhancing its means to gas future development.

Because the dialog continued, each leaders expressed their confidence that the merger could be advantageous for his or her shareholders, workers, and prospects. This merger is seen as a technique to seize the worth of additive manufacturing (AM) for mass manufacturing, foster price, and income synergies, and set up a gorgeous monetary profile.

When requested in regards to the broader affect of the merger on the additive business, Zeif emphasised that this merger is about “transformation” and “reshaping the business.” He argued that the present additive manufacturing business lacks the power to ship high quality, cost-effective elements, and actual workflow. Nonetheless, with the merger, the strengths of Stratasys and Desktop Steel could be mixed to handle these points.

The CEOs had been additionally assured in regards to the alternatives for know-how sharing and collaboration throughout their groups. They highlighted the potential for advancing materials applied sciences and software program synergies. They ended the decision by reinforcing their enthusiasm for the merger, seeing it as a possibility for accelerated innovation and improved go-to-market methods.

The approaching merger between Stratasys and Desktop Steel is anticipated to yield substantial advantages, not only for the 2 firms but additionally for the broader additive manufacturing business. The merging of sources and capabilities guarantees to handle business shortcomings, promote innovation, and drive important development within the years to come back. Because the plans for this merger progress, all eyes will undoubtedly be on this transformative transfer within the additive manufacturing sector.

What does the way forward for 3D printing maintain?

What engineering challenges will have to be tackled within the additive manufacturing sector within the coming decade?

To remain updated with the newest 3D printing information, don’t overlook to subscribe to the 3D Printing Business publication or observe us on Twitter, or like our web page on Fb.

Whilst you’re right here, why not subscribe to our Youtube channel? That includes dialogue, debriefs, video shorts, and webinar replays.Are you on the lookout for a job within the additive manufacturing business? Go to 3D Printing Jobs for a number of roles within the business.