Up to date June 2023

Because the world is evolving, so is the digital atmosphere. Consequently, velocity has change into a relentless within the common buyer’s life, particularly when hitting the checkout web page.

Being in control on the on-line cost strategies is a compulsory observe for your enterprise, as 4.11 billion individuals bought items on-line in 2022.

There are numerous methods by which on-line funds will be processed, their recognition is determined by particular person zones across the globe and so retailers should adapt to present tendencies and specifics.

Positive, it’s possible you’ll concentrate on playing cards’ and PayPal’s recognition, however is your enterprise actually catering to the preferences of all audiences you’re focusing on?

Let’s go over the greatest cost strategies on-line and see if there are any you might be omitting.

International eCommerce cost strategies

Whether or not they’re buying from a desktop browser or out of your cell app, shoppers these days count on completely different cost strategies to be featured in on-line shops, to allow them to select the one which fits that particular want. With a view to be related to the widest viewers it’s essential to guarantee your web site has capabilities to help these cost means that are hottest on-line.

Contemplating this, it’s essential for companies to grasp the most well-liked on-line cost strategies out there out there. By doing so, they will be sure that their prospects have entry to a seamless and safe checkout course of.

Bonus: See how straightforward it’s to go world and different advantages of going past funds.

Credit score & debit playing cards

Bank cards stay probably the most in style decisions globally for on-line purchases, though their market share has been dented in recent times by eWallets. Bank card transactions elevated roughly six % between 2020 and 2019. Then again, debit playing cards have prolonged their lead as probably the most used card product, with 94 transactions per capita globally, versus 49 between 2020 and 2021.

Playing cards’ recognition as on-line cost strategies was constructed on the safety options provided – card transactions have been regulated for a few years by world or regional compliance requirements and likewise by shopper protections issued by cost processors, akin to these upheld by American Categorical, Mastercard and Visa.

Bank cards have a barely extra marked desire in Western markets vs debit playing cards, given a few of their extra options. For instance, some customers are incentivized to make use of bank cards to have entry to the financial institution’s reward packages. Within the US, extra so, bank card spending impacts the person’s credit score scoring and serves as an additional motivation to go for it as an internet cost technique.

Bank cards have a barely extra marked desire in Western markets vs debit playing cards, given a few of their extra options. For instance, some customers are incentivized to make use of bank cards to have entry to the financial institution’s reward packages. Within the US, extra so, bank card spending impacts the person’s credit score scoring and serves as an additional motivation to go for it as an internet cost technique.

For a few years, card funds have been thought-about the best choice for shoppers in terms of making on-line purchases. Nonetheless, in latest instances, their declare to the primary spot has been fiercely contested.

As we transfer ahead, it’s clear that the panorama of on-line cost strategies is consistently evolving, with new and revolutionary choices rising repeatedly. Shoppers have gotten more and more tech-savvy and demand extra handy and safe cost choices.

Within the face of this shifting atmosphere, cost playing cards are dealing with stiff competitors from different cost strategies akin to e-wallets, cell funds, and cryptocurrency.

eWallets

Often known as digital wallets, eWallets are one of many quickest rising on-line cost strategies in B2C eCommerce everywhere in the world, Juniper Analysis raveling that digital and cell pockets funds accounted for 3.4 billion customers in 2022, projecting to exceed 5.2 billion globally in 2026. On-line wallets had the best market share within the Asia-Pacific Area with roughly 69 % of eCommerce funds. Center East, Africa, and Latin America are forecasted to have the best improve in cell wallets market share on-line by 2024.

This various cost technique works like a pay as you go credit score account, and shops the shopper’s private information and funds. When utilizing an eWallet, the person not has to enter his checking account particulars to finish the acquisition, being redirected from the checkout to the eWallet’s web page the place they merely must log in with their username and password to conclude a purchase order.

The preferred digital wallets embody PayPal (predominantly within the Western world), AliPay (in style in Asia Pacific), ApplePay, GooglePay, WeChat or Venmo. eWallets additionally work together with cell wallets, using a smartphone’s biometric choices, which assist the shopper authenticate sooner thus ending their funds sooner.

A brand new examine from Juniper Analysis projected QR code funds as the most well-liked digital pockets transaction kind in 2026 accounting for 380 billion transactions globally, and for over 40% of all transactions by quantity.

Financial institution transfers

This on-line cost technique includes the shopper paying from their banking account with their very own funds. It’s perceived as having an additional layer of safety, as transactions require authentication by means of the shopper’s financial institution. Principally, when chosen as cost technique throughout checkout, a financial institution switch redirects the person to their web banking portal, the place they must log in and authorize the transaction.

Financial institution transfers accounted for 9% of worldwide eCommerce transaction volumes in 2019, chosen primarily in Europe. In 2021 they elevated by 8.6% to 2.5 billion, accounting for 22% of the full variety of transactions.

Purchase now, pay later

A web-based cost technique that has gathered consideration currently and which registered final 12 months an estimate of 360 million individuals worldwide utilizing BNPL providers is Purchase Now, Pay Later. It is a type of prompt lending which an increasing number of younger shoppers are turning to, as Teen Vogue additionally stories.

The rationale for its rising recognition is that BNPL provides a handy approach to make purchases with out having to pay the total quantity upfront. This feature permits shoppers to unfold their funds over a time frame, with out having to open up a bank card account. With BNPL, customers can defer funds for a number of weeks and even months, relying on the phrases of the service. Availability of this selection throughout checkout has been reported to persuading 30% further consumers to finalize a purchase order they wouldn’t have in any other case.

This various cost technique is experiencing accelerated progress, reaching an estimate of $179.5 billion market worth in 2022, and by 2025, this determine is predicted to nearly triple.

Among the choices for this cost technique embody Klarna, AfterPay, and Bread.

Pay as you go playing cards

One other various on-line cost technique is pay as you go playing cards, chosen primarily by unbanked customers or minors. Clients go for a pay as you go card from a set of predefined out there values after which they use the small print on that card for on-line transactions.

Market penetration of pay as you go playing cards has accounted 1.6 market share in 2020, among the hottest playing cards chosen by customers together with Paysafecard or Mint.

Utilization of this cost technique is extra marked within the gaming business, pushed probably by viewers demographics.

One of many largest benefits of pay as you go playing cards is that they may help shoppers handle their spending and keep inside their funds. Since pay as you go playing cards have a pre-loaded stability, customers are unable to spend greater than what they’ve on the cardboard, thereby avoiding the chance of overdrafts and accruing debt. Pay as you go playing cards additionally supply customers the power to observe their spending simply, because of on-line account administration instruments that enable them to trace their stability and transactions in real-time.

As pay as you go playing cards proceed to realize recognition, we will count on to see much more innovation and new options on this quickly evolving market. As an illustration, some pay as you go playing cards now supply rewards packages that enable customers to earn cashback, factors, or reductions for sure purchases.

Digital checks

E-checks are a type of on-line cost which can be regulated by the Automated Clearing Home (ACH) and contain drawing cash immediately from a checking account. With e-checks, the person authorizes the cost immediately from their web banking account, and the processing is just like that of conventional paper checks, however a lot sooner.

One of many benefits of utilizing e-checks is that they provide a safe and dependable cost possibility for each people and companies. This cost technique is especially helpful for recurring funds, akin to hire or utility payments, as customers can arrange computerized funds to be deducted from their checking account at common intervals.

Digital checks are in style amongst American retailers with massive gross sales volumes and a excessive common quantity and they’re perceived as an inexpensive on-line cost technique. Apparently, e-checks have been the primary Web based mostly cost utilized by the US Treasury for making massive on-line funds, which may clarify their recognition on this class of customers.

30% of B2B funds within the U.S. and Canada proceed to be made by checokay and at a world degree, funds made by test account for less than 31 % of B2B funds.

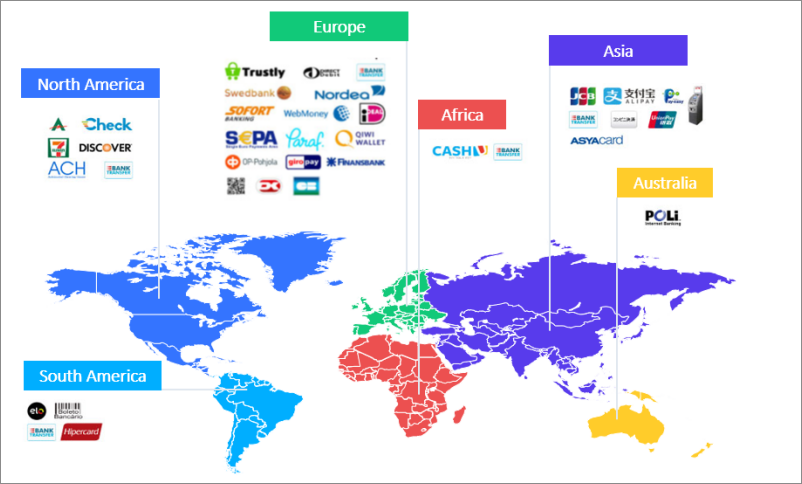

Native eCommerce cost strategies

Whereas understanding greatest cost strategies for on-line companies focusing on world markets is crucial, in an effort to enter some native markets, it’s important to perceive how preferences differ in every area. Some markets, for instance, have a stronger desire for playing cards, whereas in others the eWallet is king.

And, past the cost strategies detailed above, sure markets additionally make use of on-line strategies developed particularly for residents in that jurisdiction.

Native cost strategies can vary anyplace between 10% to 50% in adoption in a rustic, so make sure to take into account native flavors when organising an eShop there.

For instance, in China, there is a prevalent utilization of Peer–to–Peer cost apps (P2P), the place you may switch cash to household members or mates for small bills. Some of the most used cost suppliers are WeChat, Venmo and PayPal.

Europe

General, most European shoppers go for playing cards or eWallets for his or her on-line buying, with some marked desire for various on-line cost strategies in several markets.

In Germany, PayPal is utilized by for on-line shoppping with a 95 % price as of 2021, whereas simply 16% of French go for it. SEPA Direct debit can also be a well-liked possibility amongst Germans, used for one time and for recurring funds as effectively.

Within the Netherlands, the most well-liked cost technique is iDEAL, with 66% of customers selecting in response to Statista. On a market with a excessive adoption price for web banking, it comes naturally that customers desire iDEAL, a standardized on-line banking-based cost technique.

In France, a market with a excessive banking penetration price, customers could go for their playing cards, however as a service provider you continue to must know their preferences. 2Checkout’s benchmark examine discovered that 14% of customers right here favor their Cart Bancaire, an area cost technique out there solely on this market.

Over in Turkey, 17% of customers additionally desire native playing cards, nonetheless, they achieve this as a result of these native playing cards include installment options. 80% of card transactions listed here are recorded by means of installment playing cards akin to Most or Bonus Card.

As reported in latest analysis, in Spain, debit and bank cards are the preffered cost technique, with digital wallets coming in second place. In 2023 is forecasted that playing cards can be used much less and fewer, with digital wallets and financial institution transfers beginning to take over.

North America and Latin America

Bank cards and debit playing cards stay the most well-liked on-line cost strategies within the Americas, with greater than 50% of market share in every area, however, past playing cards, preferences diverge.

The place North Individuals usually tend to go for their PayPal or different most popular digital pockets, South Individuals are extra probably to make use of an area bank card with installments. In 2022, bank cards have been estimated at greater than half of all e-commerce funds in Brazil and Chile, though, in Mexico, they’d make up 4 out of each ten of these transactions. Coming second place in recognition is the moment cost platform Pix amongst Brazilian internet buyers, with debit playing cards rating second amongst Chileans.

11.5% of the full quantity of eCommerce purchases throughout the Latam area are e-wallets transactions because the web penetration price has reached 68.8%.

Asia Pacific

Asia-Pacific leads world preferences for cell/ digital wallets, with greater than 50% of this area’s on-line transactions being pockets based mostly.

Chinese language shoppers are the most important followers of this on-line cost technique, on a market dominated by AliPay and WeChat Pay. 42%, nearly half of all on-line transactions in China are paid by way of AliPay. Playing cards come second in desire in Asia Pacific, adopted by financial institution transfers.

On the subject of digital funds, China is the most important market, It has been reported that on the finish of 2020, 1.22 billion individuals subscribed to cell providers in China, similar to 83% of the area’s inhabitants.

By way of native preferences, about 5% of Japanese go for Konbini, an area cash-based cost technique in that nation, which permits customers to order on-line after which pay in a comfort retailer. Given Japanese individuals’s propensity to go to comfort shops typically, ATM funds at these shops turned fairly in style for customers right here. JCB card funds are additionally a consumer favourite in Japan, given the very fact there are 146 million card holders in Japan and just lately JCB has additionally launched an app.

Africa

Cell funds are gaining recognition in African American on-line buying markets as a result of lack of entry to conventional banking providers for almost all of African American shoppers. This has created a necessity for various cost choices, akin to cell funds, which can be accessible and handy for these shoppers. Cell funds enable shoppers to hyperlink their cell phone quantity to their cost account, enabling them to make purchases immediately from their cell system.

Shoppers who purchase on-line in Africa will be apt to pay by money as of 2022, although in international locations akin to Morocco card-based funds and financial institution transfers are prevalent

On this space, money continues to be the most well-liked cost technique, accounting for a 60 % of the full transactions in 2022. Moreover, in Kenya, 44% of transactions have been by card and 19% by financial institution switch.

In a majorly digitalized world the place velocity is the brand new norm, security is a variable all shoppers take into accout when attempting to keep away from cost fraud. So, what are the most secure on-line cost strategies?

Bank cards use encryption and fraud monitoring to maintain the delicate information and accounts safe, and they’re the most secure cost technique.

ACH costs are processed to a community (Automated Clearing Home involving a sequence of security measures like encryption and the implementation of entry controls.

No matter whether or not you’re a enterprise proprietor or a consumer, it’s essential to conduct thorough analysis to make sure monetary security. Select cost strategies which can be respected, safe, and have a confirmed monitor document of defending shoppers towards fraud. By taking these precautions, you may benefit from the comfort of on-line buying with peace of thoughts.

In the event you’ve made it this far, you now have a a lot stronger grip on what are the most well-liked cost strategies on-line and you’ve got a great begin on the best way to method every market. Attending to know the completely different on-line cost strategies will enable you to adapt domestically, which in time will result in higher conversion charges in your web site. Preserve cultural preferences in thoughts whereas tailoring native methods and select these digital instruments that can ease your entry into new eCommerce markets.

If you wish to study extra about eCommerce in particular international locations all world wide and the best way to attain new audiences with the 2Checkout assist, learn our ‘Enter New eCommerce Markets with 2Checkout Steerage’ sequence.